Contra Costa California is a county located in the state of California, United States. It is known for its picturesque landscapes, diverse communities, and thriving economy. Here, businesses often require various corporate resolutions, including the Contra Costa California Issue Capital Stock — Resolution Form. The Contra Costa California Issue Capital Stock — Resolution Form is a crucial legal document used by corporations in the county to authorize the issuance of capital stock. This resolution is typically adopted by the board of directors of a corporation and outlines the specific details regarding the issuance of stock, its class, number of shares, par value (if applicable), and any other relevant provisions. The purpose of this resolution form is to ensure transparency and compliance with state and federal laws governing the issuance of capital stock. By implementing this resolution, corporations can effectively manage their stock offerings and maintain accurate records of their shareholders and ownership structure. The Contra Costa California Issue Capital Stock — Resolution Form plays a vital role in corporate governance, especially during significant events such as mergers, acquisitions, or IPOs (Initial Public Offerings). It enables businesses to raise funds by offering shares to investors, both within and outside the organization. This form helps ensure that the issuance of stock is properly authorized and documented, thus protecting the interests of both the corporation and its shareholders. Additionally, corporations in Contra Costa California may encounter different types of capital stock resolutions, depending on their specific needs and circumstances. Some common variations of Contra Costa California Issue Capital Stock — Resolution Form include: 1. Common Stock Issue Resolution: This type of resolution authorizes the issuance of common stock, which represents regular ownership in the corporation. Common stockholders typically have voting rights and may receive dividends based on company profitability. 2. Preferred Stock Issue Resolution: This resolution form authorizes the issuance of preferred stock, which grants shareholders certain privileges over common stockholders. Preferred stockholders usually receive fixed dividends and have a higher claim on company assets in the event of liquidation. 3. Additional Stock Issue Resolution: This resolution allows corporations to issue additional shares of authorized capital stock beyond what has already been issued. It may be necessary when a company needs to raise more capital or accommodate new investors. 4. Convertible Stock Issue Resolution: This resolution enables the issuance of convertible stock, which can be converted into a different class of stock, typically common stock, at a predetermined conversion ratio. Convertible stock provides flexibility for investors and allows them to possibly benefit from future company growth. By employing the appropriate Contra Costa California Issue Capital Stock — Resolution Form, corporations can confidently manage their capital stock activities, align with legal requirements, and protect the interests of both shareholders and the company itself.

Contra Costa California Issue Capital Stock - Resolution Form - Corporate Resolutions

Description

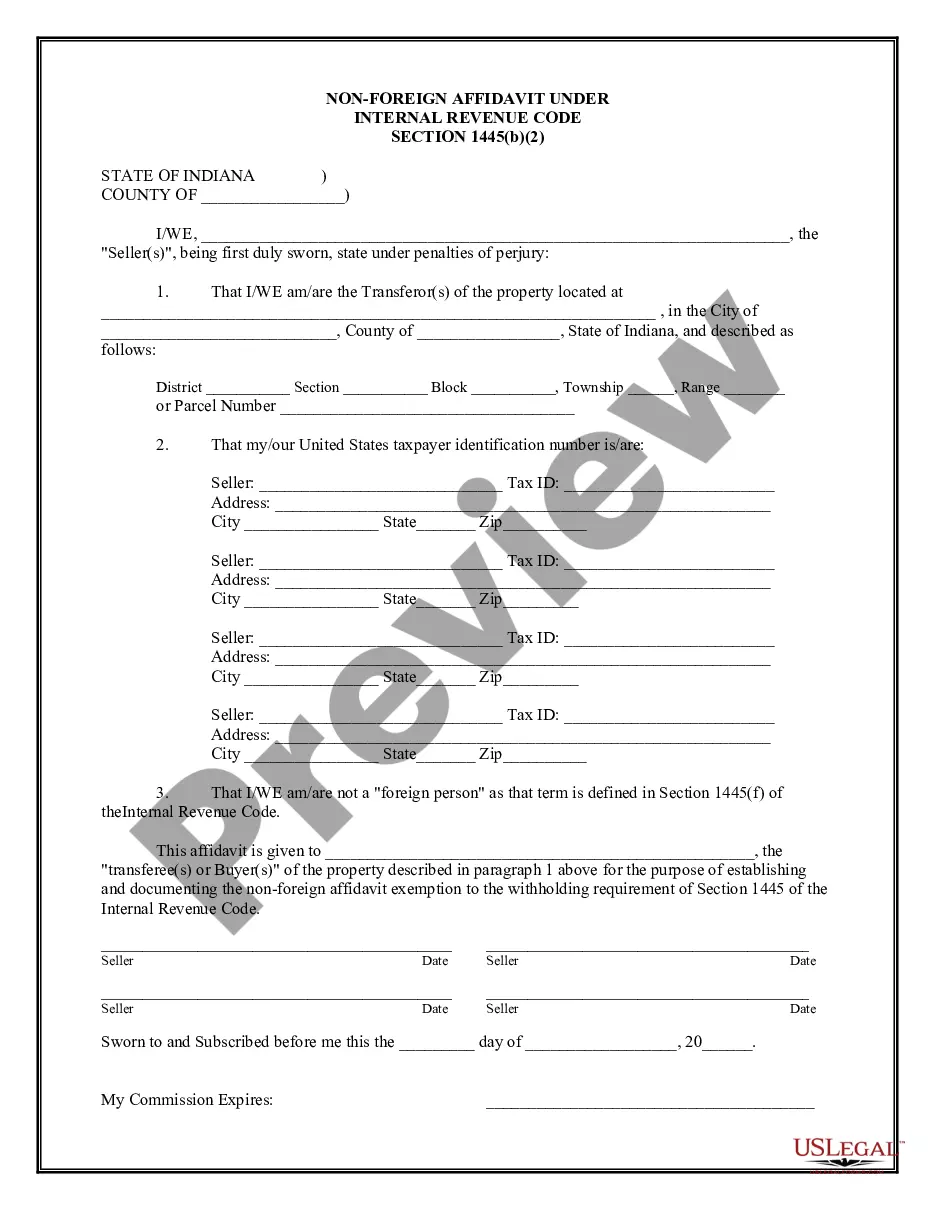

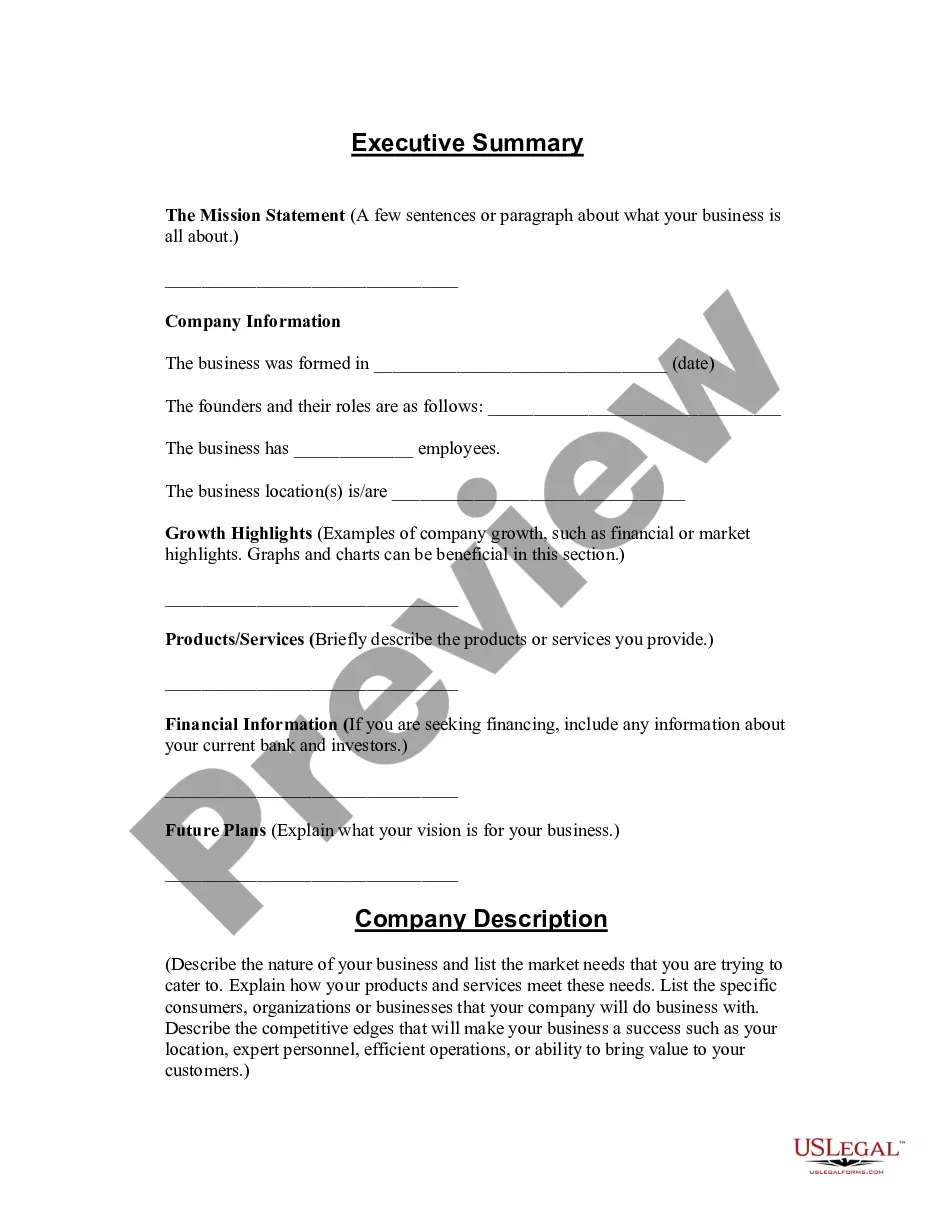

How to fill out Contra Costa California Issue Capital Stock - Resolution Form - Corporate Resolutions?

Are you looking to quickly draft a legally-binding Contra Costa Issue Capital Stock - Resolution Form - Corporate Resolutions or probably any other form to manage your own or corporate affairs? You can go with two options: hire a legal advisor to write a legal paper for you or draft it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Contra Costa Issue Capital Stock - Resolution Form - Corporate Resolutions and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, double-check if the Contra Costa Issue Capital Stock - Resolution Form - Corporate Resolutions is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Contra Costa Issue Capital Stock - Resolution Form - Corporate Resolutions template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the documents we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!