Travis Texas Accounts Receivable — Contract to Sale is a financial transaction process commonly used by businesses in Travis County, Texas, for managing their accounts receivable. This process involves the conversion of outstanding invoices into immediate cash flow by selling them to a third-party company. The Accounts Receivable — Contract to Sale is ideal for companies facing cash flow constraints or seeking to reduce their credit risk. By converting their outstanding invoices into immediate funds, businesses can meet their ongoing financial obligations, invest in growth opportunities, and effectively manage their working capital. This financial tool is particularly beneficial for small and medium-sized enterprises (SMEs) operating in Travis County, Texas. The Travis Texas Accounts Receivable — Contract to Sale offers several advantages to businesses, including simplified cash flow management, reduced credit risk, and improved financial stability. By partnering with a trusted finance company, businesses can unlock the value of their accounts receivable and free up capital that would otherwise be tied up in unpaid invoices. There are different types of Travis Texas Accounts Receivable — Contract to Sale options available to suit the specific needs of different businesses. These may include: 1. Non-recourse Factoring: This type of arrangement shifts the credit risk associated with the accounts receivable to the finance company. If the customer fails to pay the invoice, the business is not held liable. This type of factoring provides increased protection against bad debts. 2. Recourse Factoring: With recourse factoring, the business remains liable for any unpaid invoices. If the customer fails to pay, the finance company can seek reimbursement from the business. This option usually offers lower fees but carries a higher credit risk for the business. 3. Spot Factoring: Spot factoring allows businesses to choose specific invoices to sell, rather than selling their entire accounts receivable. This flexibility gives businesses more control over their cash flow management and allows them to choose invoices with higher credit risks or longer payment terms. In conclusion, Travis Texas Accounts Receivable — Contract to Sale is a financial tool that enables businesses in Travis County, Texas, to turn their outstanding invoices into immediate cash flow. With different types of factoring options available, businesses can choose the most suitable arrangement based on their credit risk tolerance and cash flow requirements. This process offers numerous benefits, including improved financial stability and simplified cash flow management for companies operating in Travis County, Texas.

Travis Texas Accounts Receivable - Contract to Sale

Description

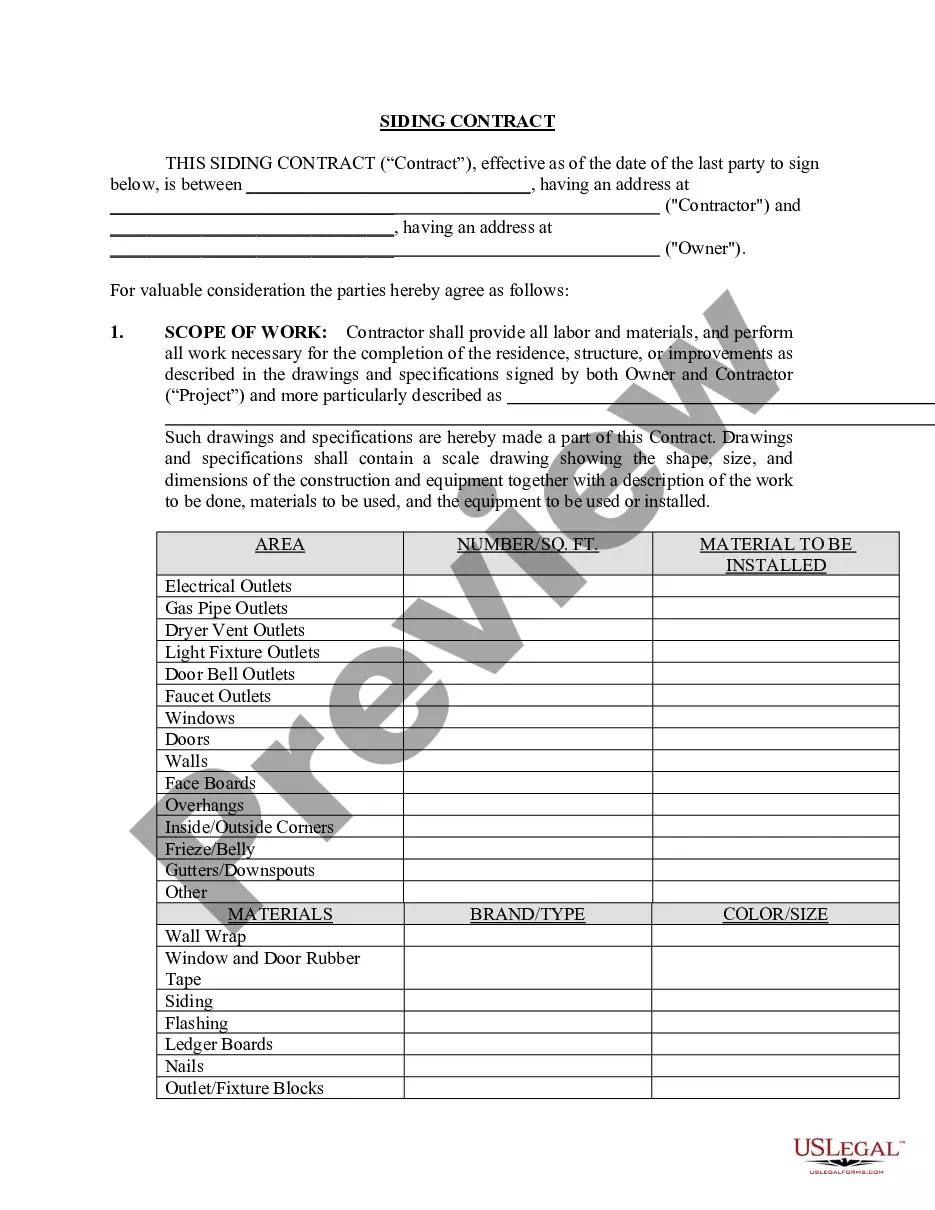

How to fill out Travis Texas Accounts Receivable - Contract To Sale?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Travis Accounts Receivable - Contract to Sale, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the current version of the Travis Accounts Receivable - Contract to Sale, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Accounts Receivable - Contract to Sale:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Travis Accounts Receivable - Contract to Sale and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Companies will sometimes sell their accounts receivable if they need to make cash quickly, improve cash flow or pay off debts. Sometimes selling these accounts which are assets of the company because they represent money that is owed to the company for a product or service sold makes financial sense.

Factoring works like this: You sell your account receivables to a commercial finance company called a factor at a discount.

Selling receivables improves cash flowCompanies can improve their cash flow by selling their invoices to a factoring company. This sale provides your company with quick access to funds while the factor waits to get paid. The process of financing receivables is called factoring.

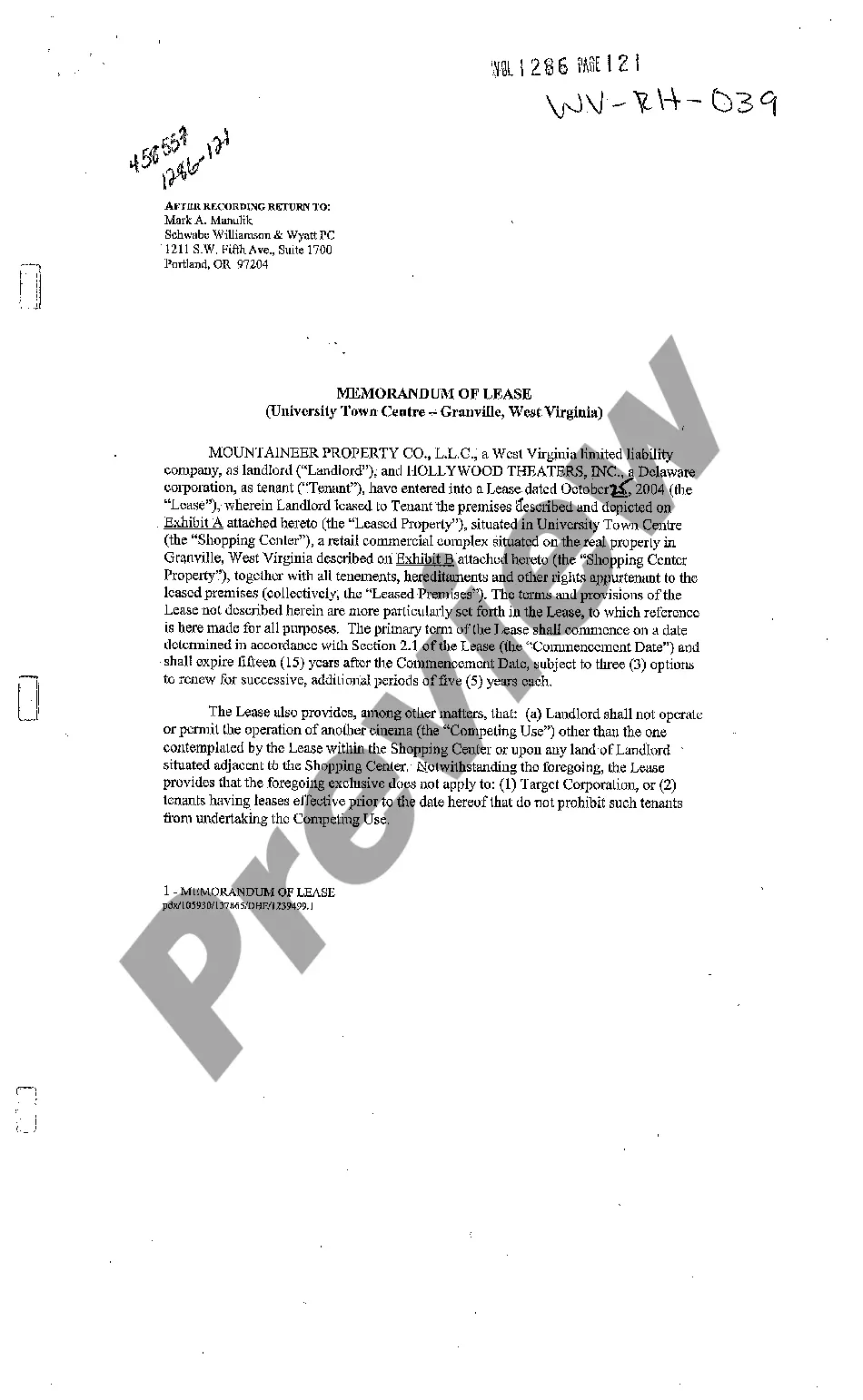

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.

Receivables purchase agreements allow a company to sell off the as-yet-unpaid bills from its customers, or "receivables." The agreement is a contract in which the seller gets cash upfront for the receivables, while the buyer gets the right to collect the receivables.

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

Follow these steps to calculate accounts receivable:Add up all charges. You'll want to add up all the amounts that customers owe the company for products and services that the company has already delivered to the customer.Find the average.Calculate net credit sales.Divide net credit sales by average accounts receivable.

Receivables can be converted to cash though factoring or pledging. Factoring involves selling receivables to a third party, a factor, at a discount. The harder it is to collect the receivables, the lower the price a factor will pay for them. Pledging involves offering the receivables as collateral for a loan.

In most businesses, accounts receivable is executed by generating an invoice and either mailing or electronically delivering it to the customer, who, in turn, must pay it within an established timeframe. Account receivables are classified as current assets assuming that they are due within one year.

You might choose to sell your accounts receivable in order to accelerate cash flow. Doing so is accomplished by selling them to a third party in exchange for cash and a hefty interest charge. This results in an immediate cash receipt, rather than waiting for customers to pay under normal credit terms.