Nassau New York Demand Bond is a type of municipal bond issued by the government of Nassau County, New York, to raise funds for various public projects and infrastructure developments. It is a debt instrument that offers investors tax-free income, making it an attractive investment option for individuals seeking steady returns with limited risk. These bonds are known as "demand" bonds because they can be redeemed by the bondholder at any time, upon serving a notice to the issuer. This feature provides investors with enhanced liquidity, allowing them to access their invested capital swiftly if needed. The Nassau New York Demand Bonds are generally divided into two main categories based on the source of repayment: General Revenue Demand Bonds and Special Assessment Demand Bonds. 1. General Revenue Demand Bonds: These bonds are backed by the general revenue of the county. The funds raised through these bonds can be used for various purposes, including financing capital projects, improving public infrastructure, and supporting essential services such as education, healthcare, and public safety. 2. Special Assessment Demand Bonds: These bonds are backed by special assessments levied on properties within specific districts or areas. The revenue generated through these assessments is then allocated to repay the bondholders. This type of bond is typically issued to finance specific projects like road construction, street lighting, or sewer systems within a particular region. Investing in Nassau New York Demand Bonds not only provides individuals with a reliable income stream but also contributes to the development and enhancement of the county's infrastructure and public services. The interest earned from these bonds is generally exempt from federal, state, and local income taxes, making them an appealing choice for investors seeking tax advantages. Before considering an investment in Nassau New York Demand Bonds or any municipal bond, it is advisable to thoroughly analyze the issuer's financial standing, credit rating, and the purpose for which the bond proceeds will be used. Seeking advice from a financial advisor or bond specialist can assist in making an informed investment decision based on personal financial goals and risk tolerance.

Nassau New York Demand Bond

Description

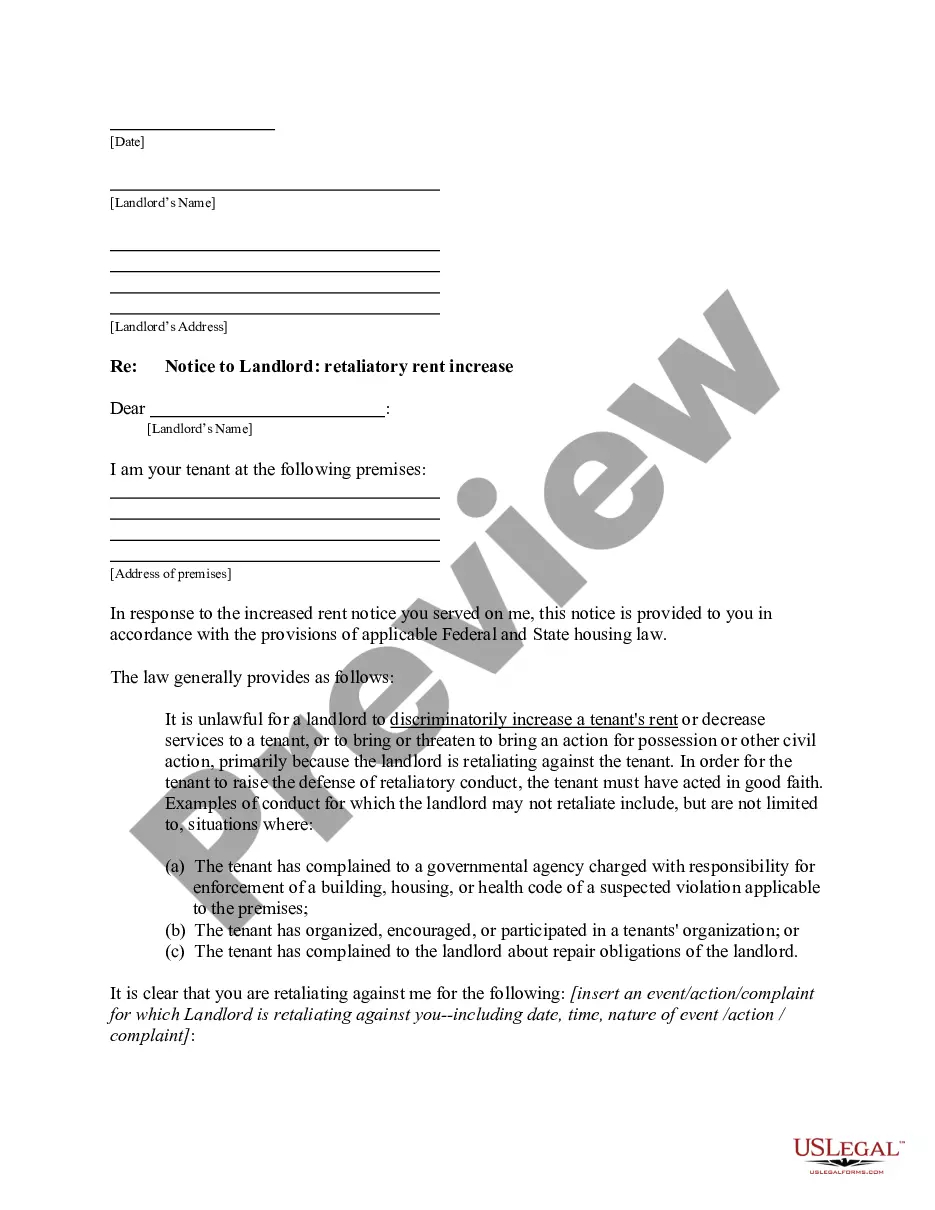

How to fill out Nassau New York Demand Bond?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Nassau Demand Bond is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Nassau Demand Bond. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Demand Bond in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

To commence a special proceeding you need to file the following with the County Clerk's Office: (i) Notice of Petition or Order to Show Cause; (ii) Verified Petition; (iii) Application for Index Number form; and (iv) Request for Judicial Intervention (RJI) form.

In order to become legally separated, you and your spouse would likely enter into a Legal Separation Agreement. This is a binding agreement, signed by both parties in front of a notary, which will address all the same major issues that would be addressed if you were to be granted a divorce.

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

In New York, there are two ways to obtain a legal separation:Amicably resolve differences and memorialize them in a settlement agreement; or.Fle an Action for Separation with the court to get a Judgment of Separation in a contested proceeding.

In New York, there are two ways to become legally separated. The first is by entering into a separation agreement and the second is by asking the court for a separation judgment. Judgments can be granted based on any of the following grounds: Cruel and inhuman treatment.

The 1997 Rules of Civil Procedures define a special proceeding as a remedy by which a party seeks to establish a status, a right, or a particular fact. It is distinct from an ordinary legal action where one party files a suit against another party to seek redress for a wrong or an injury, or to protect his (the

You or someone else may start your case by filling out a Complaint Form (DC-283). The Complaint Form describes your claim to the Court. You may file by mail or you may file in person at one of the District Court courthouses. You will be required to pay a filing fee.

In order to properly bring an article 78 proceeding, a petitioner must have first exhausted their administrative remedies (discussed in detail below). Most importantly, an article 78 proceeding must be brought 4 months, or 120 days after a final agency determination.

A special proceeding is a variety of lawsuit. It is bought on with the simplicity and speed of a motion. The special proceeding may be used only when authorized by law. One kind of special proceeding is the Article 78 proceeding, which seeks to challenge actions of administrative agencies and other government bodies.

Making an Order to Show Cause An Order to Show Cause consists of a top page called an Order to Show Cause (OSC), followed by an Affidavit in Support of the OSC, and copies of any documents that the moving side (movant) thinks would help the Judge make a decision.

Interesting Questions

More info

For information on how to apply for and obtain a Foreign Travel Card or a Permanent Resident Card, please click the link below: Domestic Travel Cards (PDF) Foreign Travel Cards (PDF) Persons with disabilities who need auxiliary aids or services are invited to attend or participate in the Nassau County Public Schools' Family Wellness Orientation program. Please note, however, that attendance at this program is limited. This program will provide an opportunity to discuss specific family needs to assist the school administrators and/or the staff to help the person with a disability in gaining the skills to develop a productive and independent life in the community. Contact the office of the Assistant Superintendent of Special Education and Disability Services for more information, Ext. 111, Monday through Friday, 8 a.m. to 5:30 p.m. All other inquiries will be handled by the Special Education Department at.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.