San Jose California Demand Bond is a type of financial instrument issued by the city of San Jose, California, to fund various infrastructure projects, public services, and improve the overall quality of the city. It is a form of municipal bond that is purchased by investors and provides a fixed income over a specific period and a guaranteed return on investment upon maturity. San Jose California Demand Bond offers investors the flexibility to sell their holdings back to the city at any time and collect the principal amount. This feature differentiates it from traditional bonds with fixed maturities that cannot be redeemed before their maturity date. This flexibility allows investors to access their capital quickly, making it an attractive investment option. Different types of San Jose California Demand Bonds include: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the city, meaning the city guarantees repayment from its general funds. The funds raised through these bonds can be utilized for a variety of purposes, such as city infrastructure development, public safety projects, educational facilities, and parks. 2. Revenue Bonds: These bonds are supported by specific revenue streams, such as fees or charges associated with a particular project or service. For instance, revenue from a public parking facility can be used to repay the bondholders. This type of bond is suitable for projects that generate sufficient revenue to cover the interest and principal payments. 3. Special Assessment Bonds: These bonds are issued to finance infrastructure improvements and are repaid through special assessments levied on the benefited properties. The assessments are typically based on the property value or the benefit received from the infrastructure project. San Jose California Demand Bonds are considered relatively low-risk investments due to the creditworthiness of the city and the assurance of repayment. They offer investors a stable source of income, making them appealing to risk-averse individuals seeking a dependable investment avenue. Additionally, these bonds enable individuals to contribute to the development and growth of San Jose while earning a return on investment. If you are interested in investing in San Jose California Demand Bonds, it is advisable to consult with a financial advisor or broker to understand the specific terms, conditions, and risks associated with each type of bond.

San Jose California Demand Bond

Description

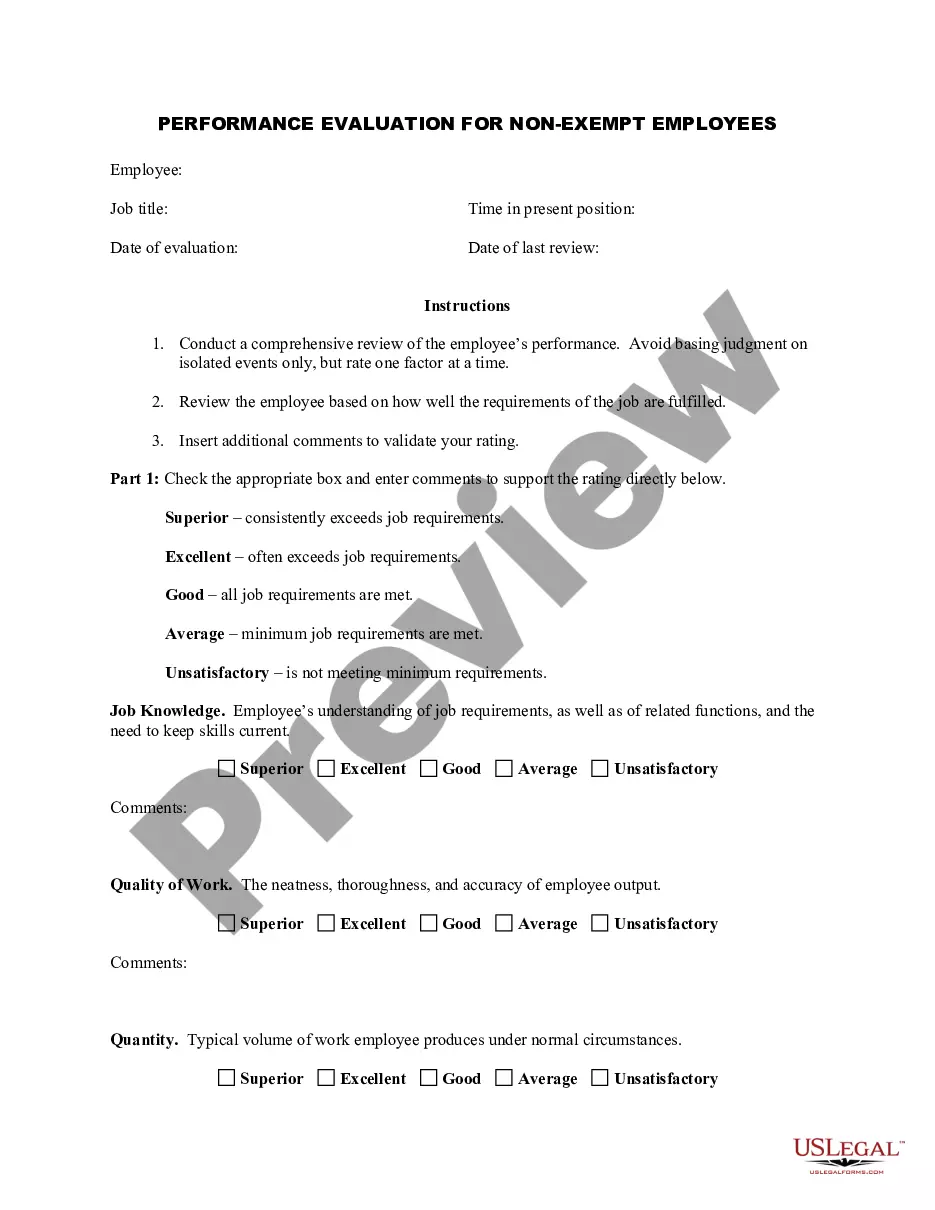

How to fill out San Jose California Demand Bond?

Preparing documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft San Jose Demand Bond without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid San Jose Demand Bond by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the San Jose Demand Bond:

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!