Middlesex Massachusetts Arbitration Agreement for Insurance is a legally binding document that outlines the terms and conditions under which disputes between insurance companies and policyholders located in Middlesex County, Massachusetts will be resolved through arbitration rather than through litigation in court. This agreement provides a fair and efficient alternative to the traditional legal system for settling insurance-related disputes. Arbitration is a process where a neutral third party, known as an arbitrator, is chosen by both parties to hear the case and make a final decision. This method offers a more streamlined and cost-effective approach to resolving conflicts, as it generally avoids lengthy court battles and expensive legal fees associated with traditional litigation. The Middlesex Massachusetts Arbitration Agreement for Insurance applies to various types of insurance policies, including but not limited to automobile insurance, homeowner's insurance, commercial insurance, liability insurance, and other types of coverage commonly provided by insurance companies operating in Middlesex County. Some specific types of Middlesex Massachusetts Arbitration Agreements for Insurance may include: 1. Automobile Insurance Arbitration Agreement: This agreement specifically pertains to disputes related to automobile insurance, covering issues such as property damage, personal injury claims, uninsured motorist claims, and more. 2. Homeowner's Insurance Arbitration Agreement: This agreement focuses on resolving disputes arising from homeowner's insurance policies, addressing matters such as property damage, liability claims, and even disputes between homeowners and their insurance company. 3. Commercial Insurance Arbitration Agreement: Catering to businesses and commercial entities, this agreement deals with disputes related to commercial insurance policies, including but not limited to coverage for property damage, general liability claims, workers' compensation claims, and more. 4. Health Insurance Arbitration Agreement: This agreement focuses specifically on resolving disputes related to health insurance policies, including coverage denials, claim reimbursement issues, disputes over medical procedures, and more. It is important to carefully review the Middlesex Massachusetts Arbitration Agreement for Insurance before signing, as it serves as a binding contract that outlines the process and rules for resolving future disputes. Both the insurance company and the policyholder should thoroughly understand their rights and obligations under the agreement. By choosing arbitration as the preferred method of dispute resolution, parties involved in insurance-related conflicts within Middlesex County can benefit from a faster, less formal, and often more cost-effective way of resolving disagreements.

Middlesex Massachusetts Arbitration Agreement for Insurance

Description

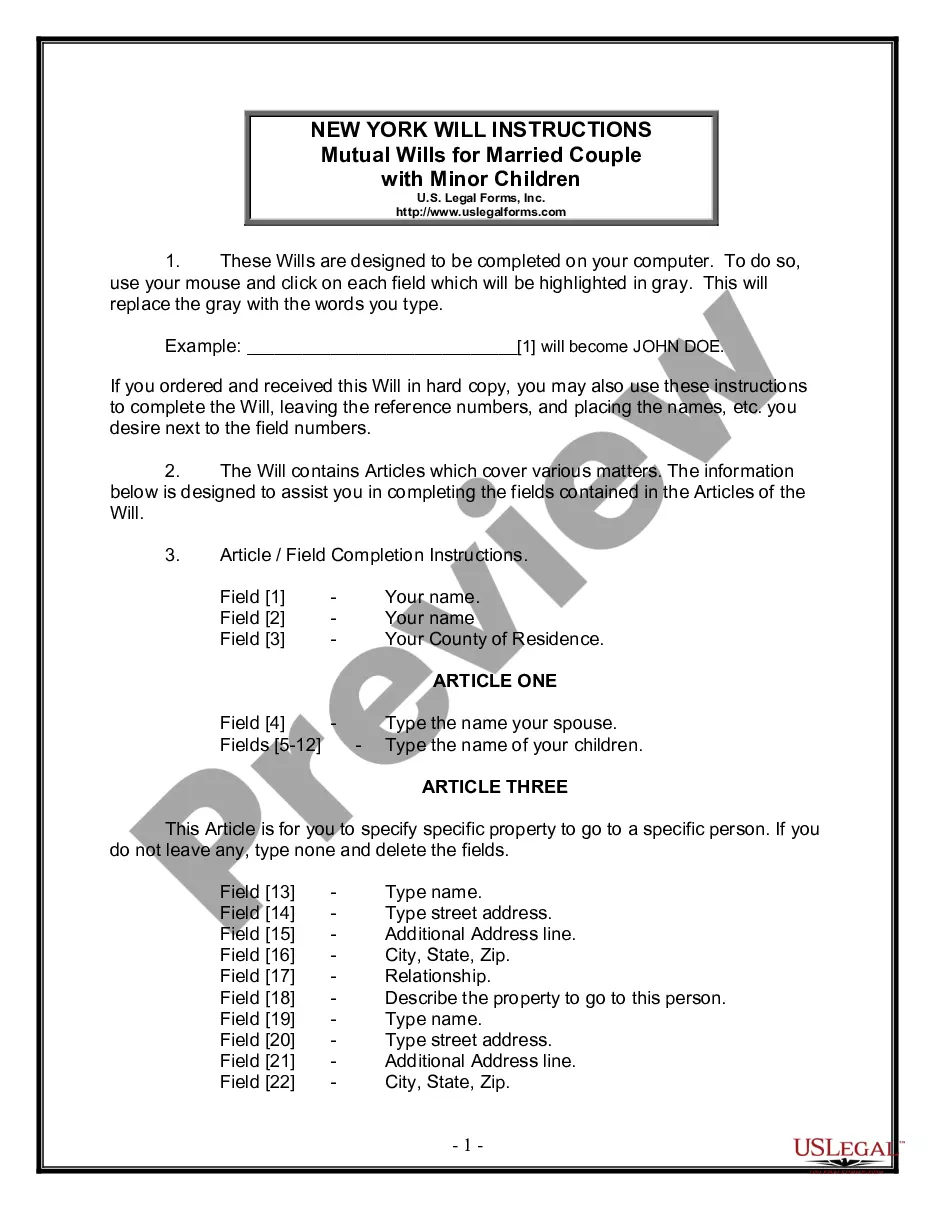

How to fill out Middlesex Massachusetts Arbitration Agreement For Insurance?

If you need to get a trustworthy legal form provider to find the Middlesex Arbitration Agreement for Insurance, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Middlesex Arbitration Agreement for Insurance, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Middlesex Arbitration Agreement for Insurance template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or execute the Middlesex Arbitration Agreement for Insurance - all from the comfort of your home.

Join US Legal Forms now!