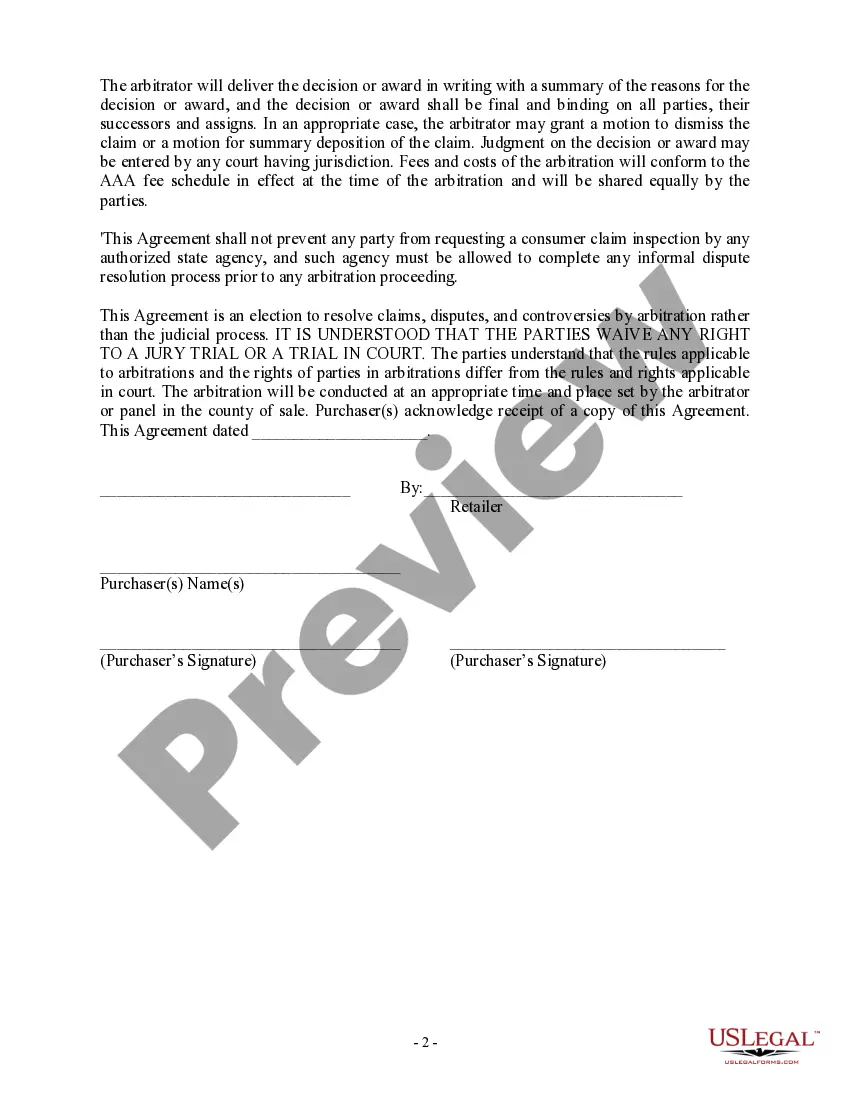

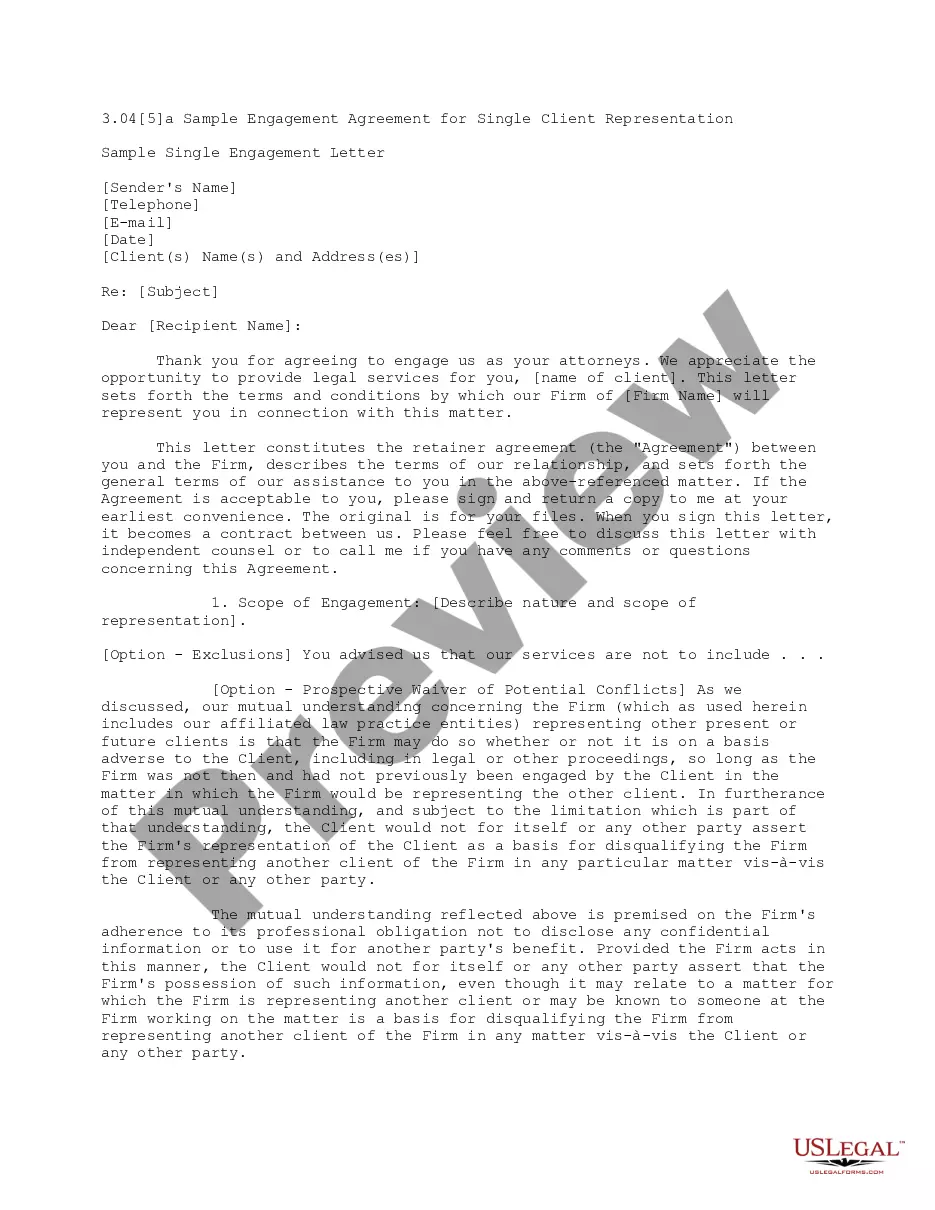

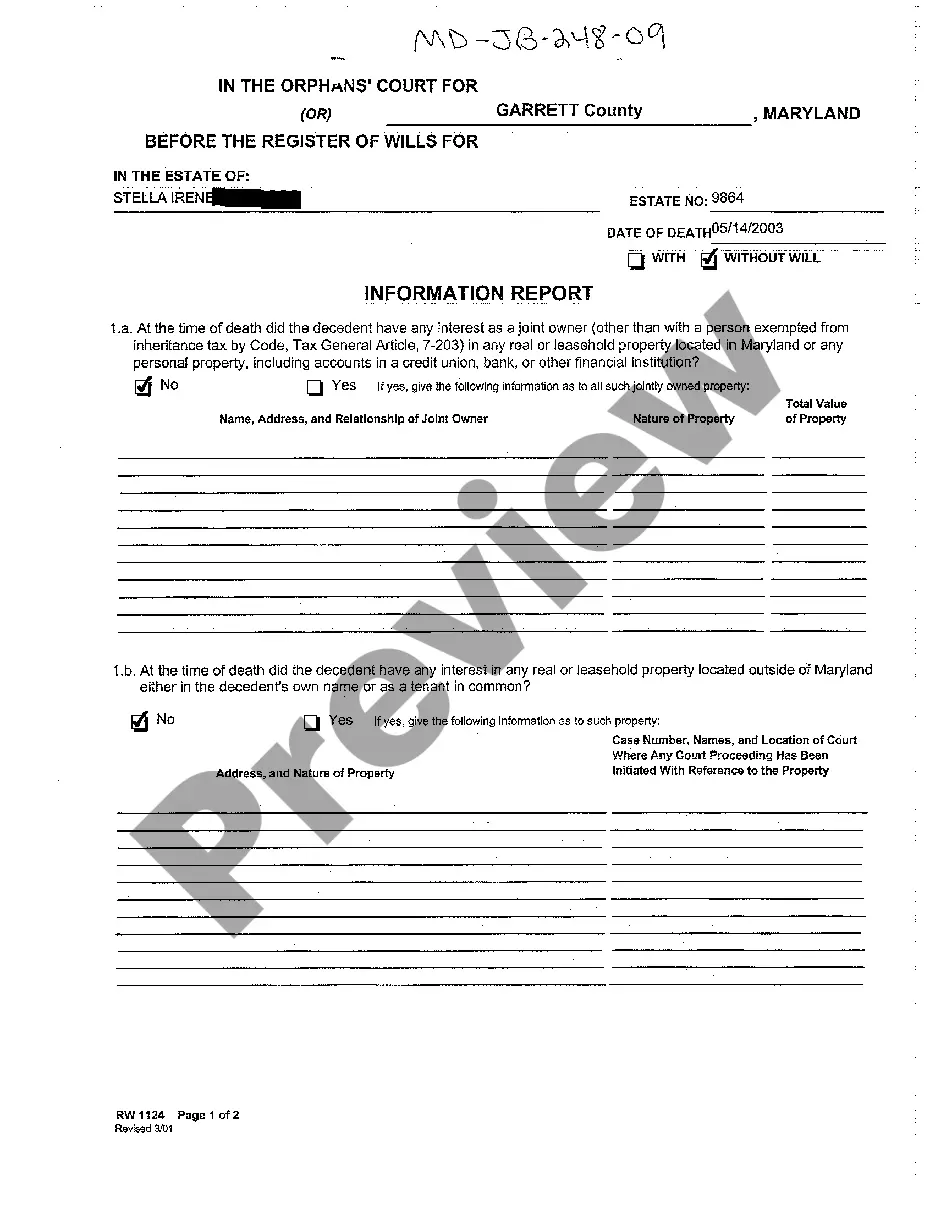

Montgomery, Maryland Arbitration Agreement for Insurance: Explained Montgomery, Maryland is a jurisdiction where an arbitration agreement for insurance can be utilized in resolving disputes between policyholders and insurance companies. An arbitration agreement is a contract provision that outlines the parties' consent to resolve conflicts through arbitration, an alternative dispute resolution process outside traditional court litigation. In Montgomery, Maryland, this agreement specifically pertains to insurance-related disputes and seeks to provide a fair and efficient method of resolving conflicts. Some commonly observed types of Montgomery, Maryland Arbitration Agreements for Insurance include: 1. Auto Insurance Arbitration Agreement: This type of agreement is designed to address disputes arising from automobile insurance policies. It covers issues such as coverage denials, claim settlements, liability determinations, and premium disputes related to auto insurance policies. 2. Homeowners Insurance Arbitration Agreement: This agreement type focuses on resolving conflicts related to homeowners' insurance policies. Examples of possible disputes covered under this agreement include property damage claims, coverage disputes, liability disputes arising from incidents on the insured property, and disagreements over insurance claim settlements. 3. Health Insurance Arbitration Agreement: Often seen in individual and group health insurance policies, this agreement facilitates the resolution of disputes related to health coverage, medical claims, coverage denials, medical bill disputes, and disagreements over the payment of medical expenses. 4. Commercial Insurance Arbitration Agreement: This type of agreement caters to businesses and addresses disputes that may arise within commercial insurance policies. It covers various areas, including liability claims, property damage claims, business interruption claims, and liability disagreements between insured businesses and insurers. 5. Life Insurance Arbitration Agreement: Life insurance policies may also incorporate specific arbitration agreements. In the event of disputes such as claim denials, beneficiary disputes, policy cancellations, or disagreement over policy provisions, this type of agreement ensures a structured resolution process. The Montgomery, Maryland Arbitration Agreement for Insurance promotes an efficient, cost-effective, and timely resolution of disputes while providing policyholders and insurance companies with an alternative to the time-consuming and expensive court system. It enables both parties to have their disputes determined by an impartial arbitrator or panel, whose decision is generally binding under the terms of the agreement. However, it is important to carefully review and understand the specific terms and conditions of each agreement, as they can vary between insurance policies and providers. Overall, the Montgomery, Maryland Arbitration Agreement for Insurance aims to streamline the dispute resolution process, offering a fair and accessible method for policyholders and insurance companies to resolve conflicts outside the traditional courtroom setting.

Montgomery Maryland Arbitration Agreement for Insurance

Description

How to fill out Montgomery Maryland Arbitration Agreement For Insurance?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Montgomery Arbitration Agreement for Insurance without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Montgomery Arbitration Agreement for Insurance by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Montgomery Arbitration Agreement for Insurance:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!