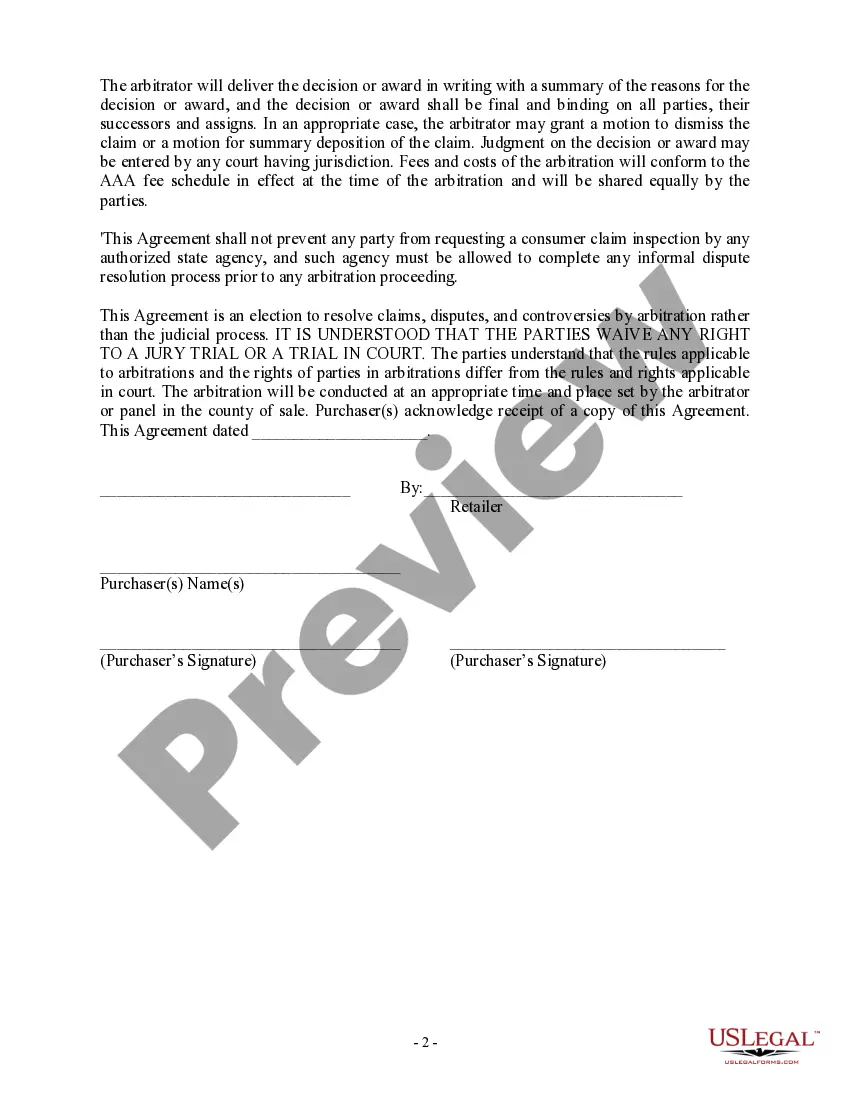

San Jose California Arbitration Agreement for Insurance: A Comprehensive Overview An arbitration agreement, in the context of insurance, refers to a legally binding contract between an insured individual or entity and an insurance company situated in San Jose, California. This agreement is designed to resolve any disputes or conflicts that may arise between the policyholder and the insurer through the process of arbitration, rather than resorting to traditional litigation in court. This description will provide a detailed explanation of San Jose California Arbitration Agreement for Insurance, highlighting its purpose, benefits, and different types, if applicable. In San Jose, California, an arbitration agreement for insurance plays a crucial role in streamlining and expediting the resolution process for insurance-related disputes. As an alternative to litigation, arbitration offers a confidential, cost-effective, and relatively quicker way of settling disagreements. However, it is important to note that arbitration is a binding process, and once the agreement is signed, the parties involved must adhere to the final decision of the arbitrator(s). One of the primary advantages of opting for an arbitration agreement in San Jose, California, is the flexibility it provides. Parties have the freedom to choose their arbitrators and the rules under which the arbitration will be conducted. This allows for a tailored approach to dispute resolution, ensuring that the unique circumstances and complexities of insurance-related matters are appropriately addressed. When it comes to different types of San Jose, California, Arbitration Agreements for Insurance, specific focus must be given to the insurance sector in question. Various types of insurance, such as auto insurance, health insurance, property insurance, and liability insurance, may have their own unique arbitration agreements or clauses. These agreements are often crafted to address the specifics of each insurance type, taking into consideration relevant regulations and legal requirements. For instance, a San Jose California Arbitration Agreement for Auto Insurance may cover disputes related to coverage denials, uninsured/under insured motorist claims, or disputes arising from an auto accident. On the other hand, a San Jose California Arbitration Agreement for Health Insurance might specifically address conflicts regarding claim denials, medical necessity, or coverage limitations. These agreements are formulated to comply with both state regulations specific to San Jose and California, as well as industry standards applicable to the insurance sector. In conclusion, a San Jose California Arbitration Agreement for Insurance is a contractual agreement aimed at resolving disputes between insurers and policyholders in a cost-effective, efficient, and tailored manner. With its ability to provide a platform for fair resolution while maintaining confidentiality, arbitration is becoming increasingly popular in San Jose's insurance industry. Different insurance types, such as auto insurance and health insurance, may have their own variations of arbitration agreements, ensuring that any disputes specific to a particular insurance sector can be addressed effectively through this alternative dispute resolution method.

San Jose California Arbitration Agreement for Insurance

Description

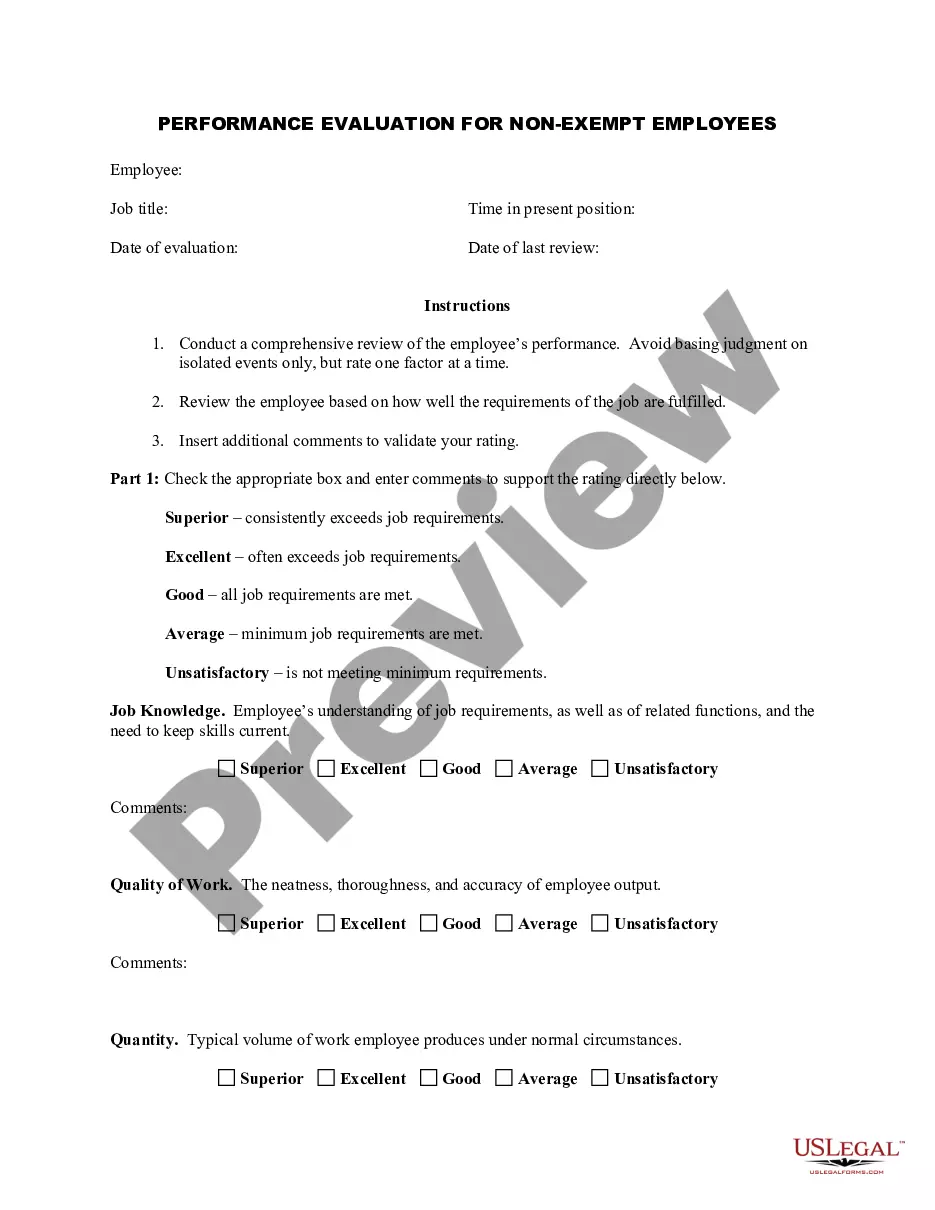

How to fill out San Jose California Arbitration Agreement For Insurance?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a San Jose Arbitration Agreement for Insurance suiting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Apart from the San Jose Arbitration Agreement for Insurance, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your San Jose Arbitration Agreement for Insurance:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Jose Arbitration Agreement for Insurance.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!