Houston Texas Direct Deposit Form for Employees is a critical document utilized by organizations and employers in Houston, Texas, to facilitate seamless salary payments to their employees. This form is specifically designed to authorize the direct deposit of an employee's earnings into their bank account, enabling swift and convenient access to their wages. By eliminating the need for paper checks and physical visits to the bank, direct deposit proves to be a secure and time-efficient method of salary distribution. Keywords: Houston Texas, direct deposit form, employees, salary payments, bank account, wages, paper checks, secure, time-efficient, salary distribution. There are several types of Houston Texas Direct Deposit Forms for Employees, depending on the specific requirements and preferences of the employer: 1. Basic Direct Deposit Form: This form includes essential fields such as the employee's name, employee identification number, bank name, bank account number, and bank routing number. It authorizes the employer to deposit the employee's wages directly into the provided bank account electronically. 2. Additional Bank Account Direct Deposit Form: In circumstances where an employee wishes to distribute their salary across multiple accounts, this form is utilized. It enables the employee to split their earnings between various accounts by providing the necessary details for each bank account, including routing numbers and account numbers. 3. Percentage Allocation Direct Deposit Form: This type of form is useful when an employee wants to allocate a specific percentage of their earnings to different accounts. It allows the employee to determine the percentage of their salary that should be deposited into each designated bank account. 4. Pre-Authorization Direct Deposit Form: This form is utilized to authorize direct deposit payments before an employee's first paycheck. It enables the employer to initiate the direct deposit process immediately, eliminating any delays in salary payments. 5. Cancellation or Modification Direct Deposit Form: When an employee wants to cancel or modify their existing direct deposit information, this form is required. It allows them to update their bank account details, alter the allocation percentages, or terminate direct deposit altogether. Employers in Houston, Texas, are highly encouraged to provide these various types of direct deposit forms to accommodate the diverse needs of their employees and streamline the payment process, ultimately enhancing employee satisfaction and convenience. Keywords: Houston Texas, direct deposit form, employees, salary payments, multiple accounts, percentage allocation, pre-authorization, cancellation, modification, diverse needs, employee satisfaction, convenience.

Houston Texas Direct Deposit Form for Employees

Description

How to fill out Houston Texas Direct Deposit Form For Employees?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Houston Direct Deposit Form for Employees, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any activities associated with paperwork execution simple.

Here's how you can purchase and download Houston Direct Deposit Form for Employees.

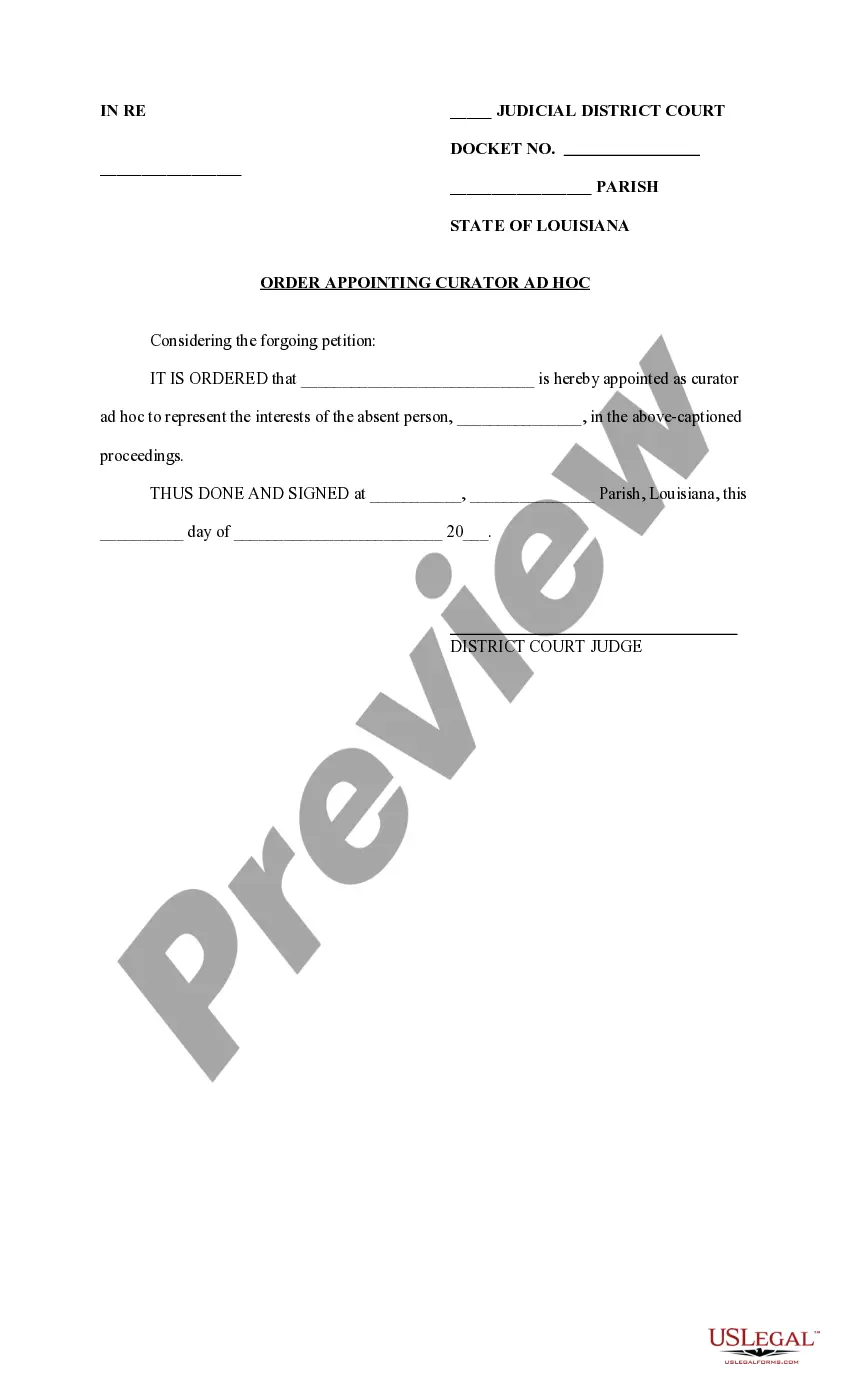

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Houston Direct Deposit Form for Employees.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston Direct Deposit Form for Employees, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to cope with an exceptionally complicated situation, we advise getting a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!