Maricopa Arizona Direct Deposit Form for IRS is a document used by taxpayers in Maricopa, Arizona, to securely and conveniently receive their tax refunds or make electronic payments to the Internal Revenue Service (IRS). This form enables individuals or businesses to provide their banking information, such as account number and routing number, to the IRS, ensuring a smooth and efficient transfer of funds. The Maricopa Arizona Direct Deposit Form for IRS comes in various types, each catering to different taxpayers' needs. Some common types of these forms include: 1. Individual Taxpayer Direct Deposit Form for IRS: This form is primarily used by individuals who want to receive their tax refunds directly into their bank accounts. By providing their banking details, taxpayers can avoid the hassle of waiting for paper checks and have their refunds deposited quickly and securely. 2. Business Taxpayer Direct Deposit Form for IRS: This form is specifically designed for businesses, allowing them to electronically pay their taxes directly from their business accounts. By submitting this form, businesses can ensure timely tax payments while reducing the risk of errors or delays associated with traditional payment methods. 3. Partnership/ Corporation Direct Deposit Form for IRS: This form is utilized by partnerships or corporations in Maricopa, Arizona, to authorize the direct deposit of tax refunds or payments into their designated business accounts. By opting for direct deposit, partnerships and corporations can streamline their financial operations and avoid any potential mailing issues or delays. 4. Estate or Trust Direct Deposit Form for IRS: This form is intended for individuals acting as executors of estates or trustees of trusts. It enables them to receive any tax refunds or make payments to the IRS through direct deposit, enhancing convenience and efficiency in managing the financial affairs of the estate or trust. Completing the Maricopa Arizona Direct Deposit Form for IRS accurately is crucial, as providing incorrect or incomplete information may result in delayed or rejected transactions. It is recommended to consult the IRS guidelines and instructions while filling out the form to ensure compliance with all necessary procedures. By utilizing the Maricopa Arizona Direct Deposit Form for IRS, taxpayers and businesses in Maricopa can simplify their tax-related financial transactions, save time, and have greater control over their funds with the assurance of secure electronic transfers.

Maricopa Arizona Direct Deposit Form for IRS

Description

How to fill out Maricopa Arizona Direct Deposit Form For IRS?

Drafting papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Maricopa Direct Deposit Form for IRS without expert help.

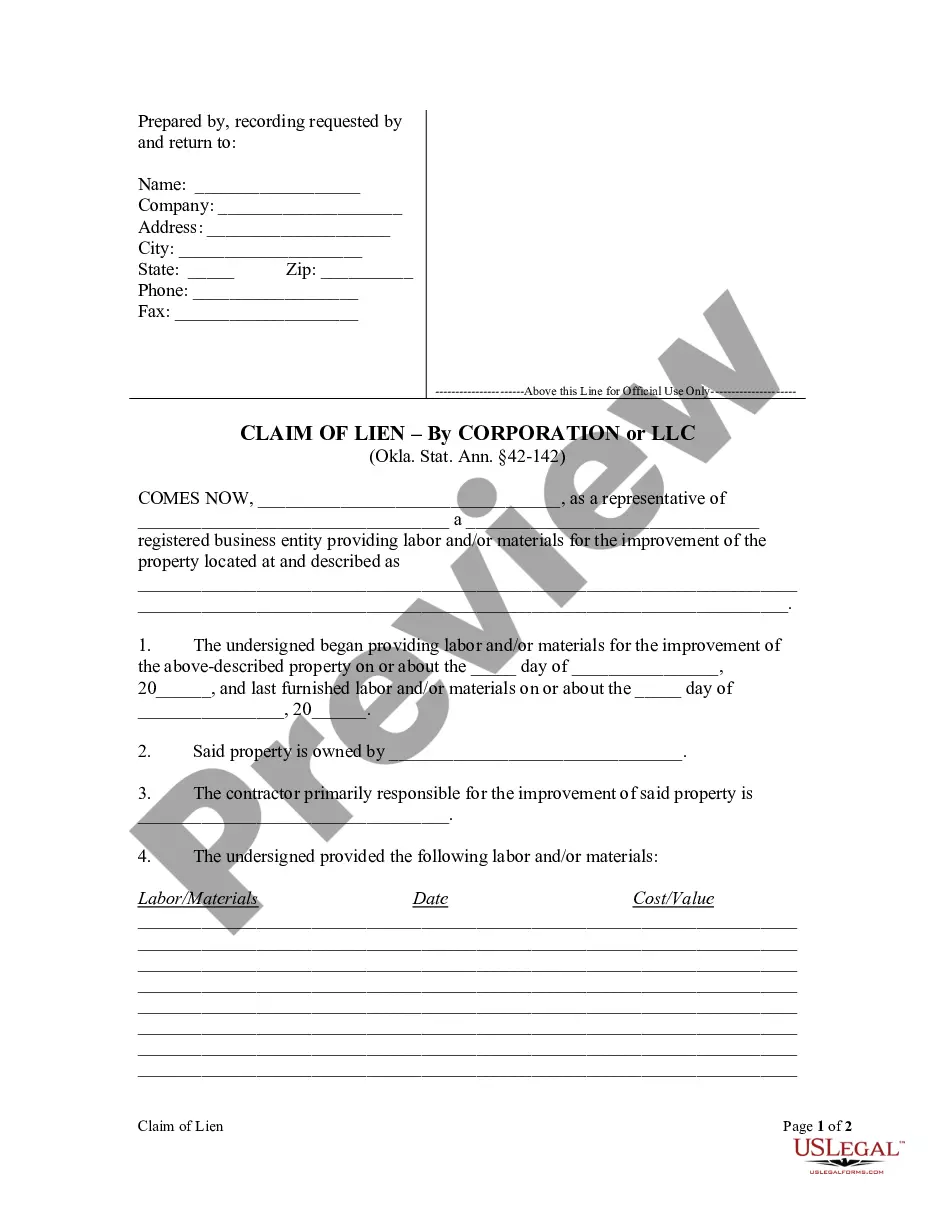

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Maricopa Direct Deposit Form for IRS by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Maricopa Direct Deposit Form for IRS:

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

There's no way to change your bank information once the IRS has accepted your e-filed tax return. You can check the status of your refund by using the IRS's Where's My Refund? tool.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

To set up a direct deposit payment via the IRS Direct Pay system, log into your IRS account and go to the Account Home tab on your dashboard. Select the Go To Payment Options button. Scroll down the page and select Go To IRS Direct Pay under the Pay by Bank Account section.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.