Montgomery Maryland Direct Deposit Form for IRS is a document that enables taxpayers in Montgomery County, Maryland, to receive their tax refunds or make electronic payments securely and conveniently. This form is specifically designed for residents of Montgomery, Maryland, who prefer to have their tax-related funds directly deposited into their bank accounts rather than receiving a paper check. The Montgomery Maryland Direct Deposit Form for IRS serves as an authorization for the Internal Revenue Service (IRS) to transfer funds directly from the taxpayer's account to their designated bank account. By choosing direct deposit, taxpayers can ensure a fast and reliable transfer of funds without the hassle of waiting for checks to arrive in the mail or standing in long lines at the bank. The Montgomery Maryland Direct Deposit Form for IRS requires taxpayers to provide accurate and up-to-date information, including their social security number, bank account number, routing number, and the type of account (checking or savings). It is crucial to double-check these details to avoid any errors that may delay or prevent the successful transfer of funds. Different types of Montgomery Maryland Direct Deposit Forms for IRS: 1. Income Tax Refund: This form is used when taxpayers are expecting a refund from their filed income tax return. It allows them to specify the account in which they want the refund to be deposited. 2. Estimated Tax Payments: Taxpayers who make estimated tax payments throughout the year can use this form to authorize the IRS to directly withdraw the agreed-upon amounts from their bank accounts, ensuring timely submission and elimination of potential penalties. 3. Quarterly Business Taxes: Business owners and self-employed individuals who are required to make quarterly tax payments can utilize this form to authorize the IRS to automatically withdraw the specified amounts from their bank accounts on the designated due dates. 4. Trust Fund Recovery Penalty Payments: This form is used for taxpayers who owe trust fund recovery penalties, typically due to unpaid employment taxes. It allows the IRS to withdraw the full or agreed-upon repayment amount directly from their bank account. 5. Installment Agreement Payments: Taxpayers who have set up an installment agreement with the IRS to pay their tax debts over time can opt for direct deposit using this form. It ensures hassle-free automated payments according to the agreed-upon schedule. By utilizing the Montgomery Maryland Direct Deposit Form for IRS, taxpayers can take advantage of the convenience, security, and efficiency of electronic payment methods. This form streamlines the process and reduces paperwork, making it an excellent choice for Montgomery County residents seeking a quick and reliable way to receive their tax refunds or make payments.

Montgomery Maryland Direct Deposit Form for IRS

Description

How to fill out Montgomery Maryland Direct Deposit Form For IRS?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Montgomery Direct Deposit Form for IRS, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Montgomery Direct Deposit Form for IRS from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Montgomery Direct Deposit Form for IRS:

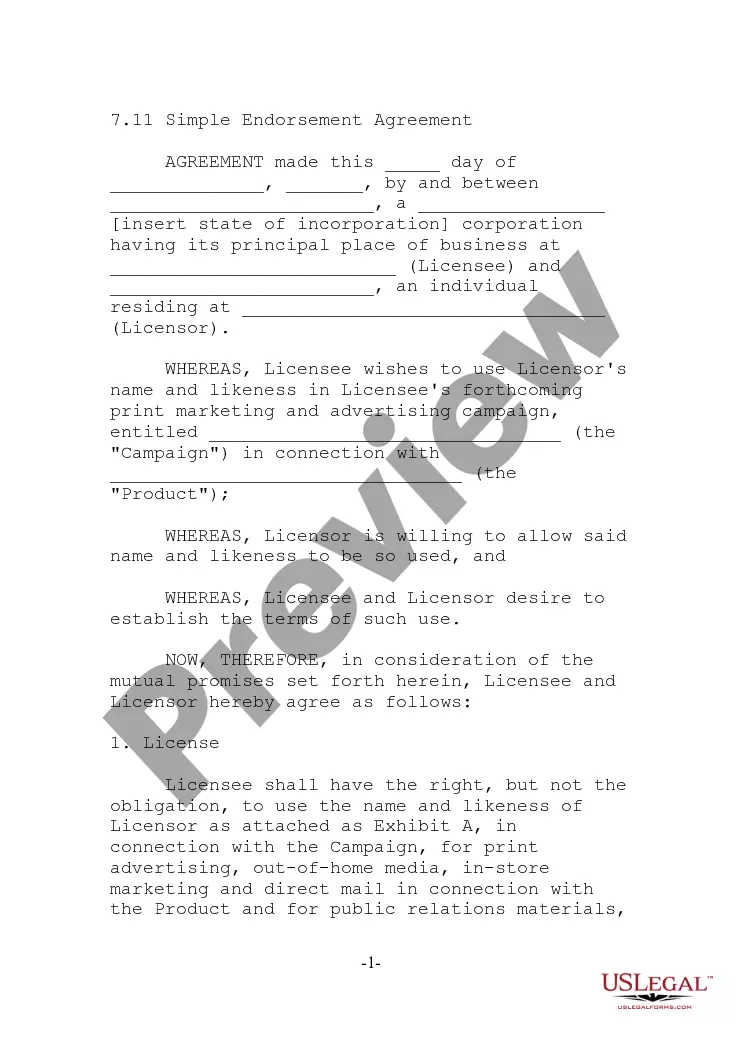

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!