Sacramento California Direct Deposit Form for IRS is a document that allows taxpayers in Sacramento, California, to authorize the Internal Revenue Service (IRS) to directly deposit their federal tax refunds or other payments directly into their bank accounts. This eliminates the need for paper checks and ensures convenience, efficiency, and security of funds transfer. The form is specifically designed for Sacramento residents who prefer electronic payment as a means of receiving their tax refunds or any other payments owed by the IRS. By using direct deposit, individuals can avoid the hassle of waiting for traditional paper checks to arrive in the mail and can have funds deposited directly into their designated bank accounts. The Sacramento California Direct Deposit Form for IRS typically requires the taxpayer's personal information such as name, address, Social Security number, and contact details. Additionally, individuals need to provide their banking information, including the bank name, routing number, and account number. It should be noted that the IRS provides different types of direct deposit forms to cater to various entities and situations. Some notable variations of the Sacramento California Direct Deposit Form for IRS include: 1. Form 8888: This is the "Allocation of Refund" form, which enables taxpayers to allocate their refund amount across multiple accounts. This is useful for individuals who wish to allocate portions of their refund to different accounts, such as checking, savings, or individual retirement accounts (IRAs). 2. Form 4868: This form is intended for taxpayers who require an extension to file their federal income tax return. Although it is not a direct deposit form per se, it allows individuals to make a direct deposit of estimated taxes owed or voluntary contributions alongside the request for an extension. 3. Form 1199A: While not specific to Sacramento, this form is widely used for federal payments and is applicable for individuals, businesses, or entities receiving various types of payments from the government, including tax refunds. It authorizes the IRS to directly deposit the funds into the specified bank account. Sacramento's residents are encouraged to consult the IRS website or seek professional assistance to determine which specific direct deposit form is appropriate for their circumstances. By utilizing the Sacramento California Direct Deposit Form for IRS, taxpayers can expedite and streamline the refund process, ensuring prompt and secure payment delivery.

Sacramento California Direct Deposit Form for IRS

Description

How to fill out Sacramento California Direct Deposit Form For IRS?

Drafting documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Sacramento Direct Deposit Form for IRS without expert help.

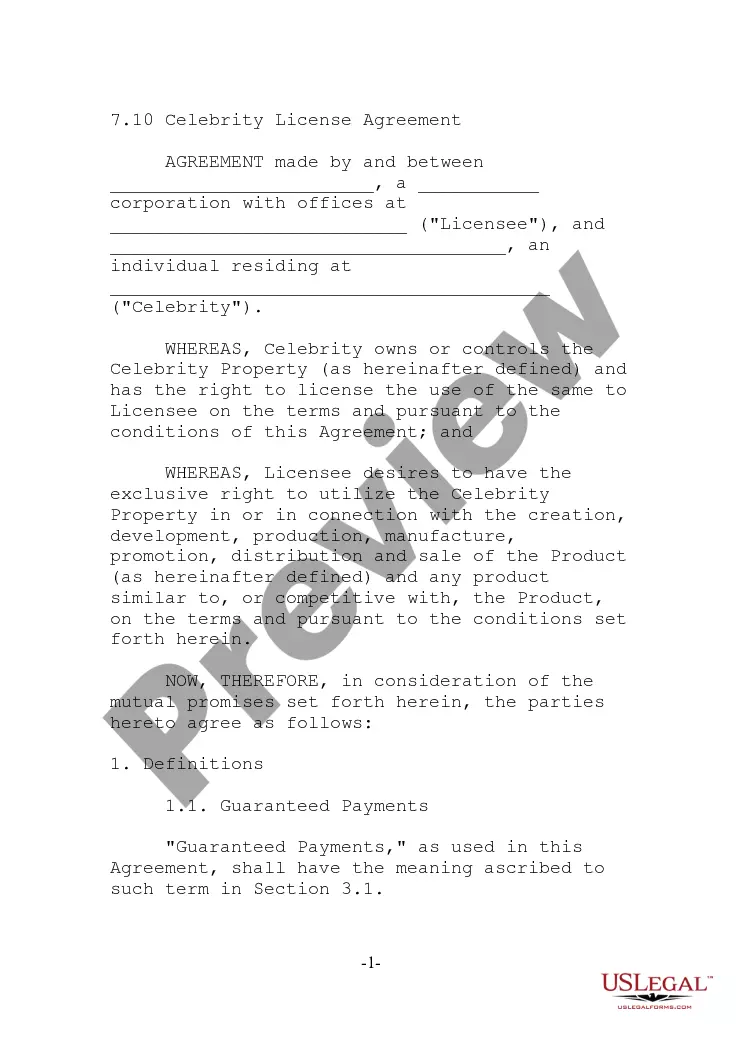

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Sacramento Direct Deposit Form for IRS by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Sacramento Direct Deposit Form for IRS:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!