Queens New York Direct Deposit Form for Stimulus Check is a document that allows eligible residents of Queens, New York, to receive their stimulus payment directly into their bank account. Direct deposit is a convenient and secure method of receiving the stimulus check, as it eliminates the need for physical checks and potential delays in mail delivery. With the Queens New York Direct Deposit Form for Stimulus Check, individuals can ensure that their stimulus payment is deposited directly into their bank account without any hassle. This form is specifically designed for residents of Queens, New York, to facilitate a smooth and efficient process during the distribution of stimulus funds. Keywords: Queens New York, Direct Deposit Form, Stimulus Check, residents, bank account, convenient, secure, physical checks, mail delivery, stimulus payment, efficient process. Different types of Queens New York Direct Deposit Forms for Stimulus Check may include: 1. Individual Form: This form is for individuals who want their stimulus payment deposited directly into their personal bank account. It requires personal information, such as Social Security Number, full name, address, and bank account details. 2. Joint Form: Joint form is for married couples or individuals who share a joint bank account and wish to receive their stimulus payment directly into that account. It may require both individuals' personal information and signature. 3. Business Form: This form is specifically designed for Queens-based businesses that want their stimulus payment deposited directly into their business account. It may require business information, Taxpayer Identification Number (TIN), bank account details, and authorized signatures. 4. Non-profit Organization Form: Non-profit organizations in Queens, New York, may have their own direct deposit form to receive the stimulus payment into their designated bank account. This form would require the organization's information, Tax Identification Number (TIN), bank account details, and authorized signatures. These different types of Queens New York Direct Deposit Forms for Stimulus Check cater to the specific needs of individuals, couples, businesses, and non-profit organizations in Queens, New York, ensuring that they can conveniently receive their stimulus payment directly into their preferred bank account.

Queens New York Direct Deposit Form for Stimulus Check

Description

How to fill out Queens New York Direct Deposit Form For Stimulus Check?

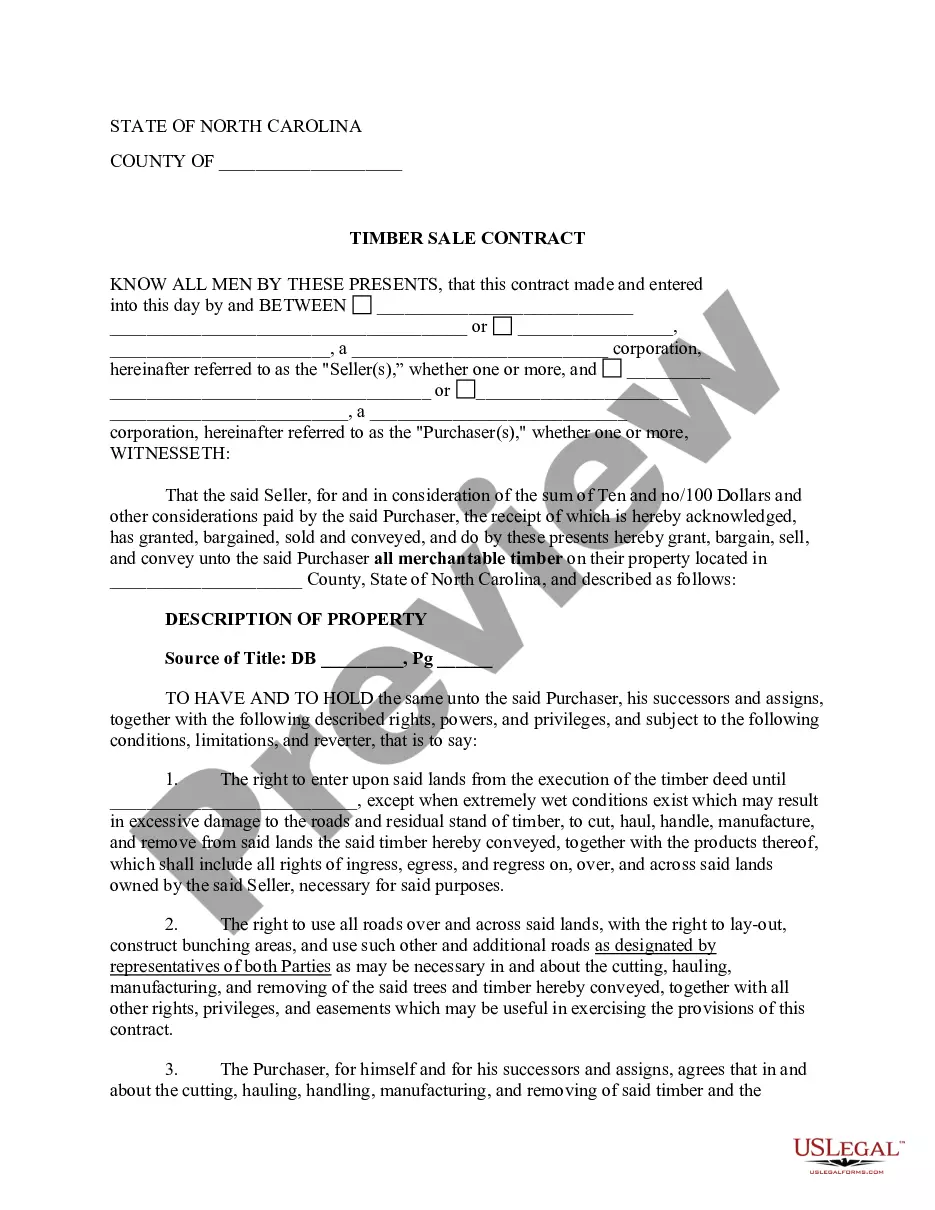

Are you looking to quickly create a legally-binding Queens Direct Deposit Form for Stimulus Check or maybe any other document to take control of your personal or corporate affairs? You can go with two options: contact a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Queens Direct Deposit Form for Stimulus Check and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Queens Direct Deposit Form for Stimulus Check is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Queens Direct Deposit Form for Stimulus Check template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!