The Hennepin County, located in Minnesota, offers a convenient Direct Deposit Form specifically designed for the Internal Revenue Service (IRS) purposes. This form allows taxpayers in Hennepin County to electronically receive their tax refunds or other payments directly into their bank accounts. The Hennepin Minnesota Direct Deposit Form for IRS serves as a secure and efficient method for individuals and businesses who want to receive their tax refunds or payments quickly, eliminating the need for paper checks and postal delays. By opting for direct deposit, taxpayers can ensure that their funds are deposited directly into their designated bank account on the scheduled date, providing them with seamless access to their funds. This form requires individuals or businesses to provide essential information, including their full name, address, Social Security number or Employer Identification Number (EIN), bank account number, and bank routing number. It is crucial to ensure the accuracy of the supplied information to avoid any potential issues or delays in receiving the funds. Moreover, it is important to note that Hennepin County may offer different types of Direct Deposit Forms for IRS, depending on the specific tax refund or payment type. Some common types of direct deposit forms include individual tax refunds, corporate tax refunds, payroll tax refunds, and business-related payments. Each form may have its own unique set of instructions and requirements, so it is important to carefully read and follow the instructions provided on the specific form relevant to your situation. To access the Hennepin Minnesota Direct Deposit Form for IRS, individuals can visit the official website of Hennepin County or contact their local IRS office to request a copy. It is recommended to complete the form accurately and legibly, double-checking all entered information for any errors or omissions. Once the form is completed, individuals should submit it following the provided instructions, either through mail or electronically, to initiate the direct deposit process. In conclusion, the Hennepin Minnesota Direct Deposit Form for IRS is a valuable tool that enables taxpayers residing in Hennepin County to receive their tax refunds or payments quickly and securely. By using this form, individuals and businesses can take advantage of the benefits offered by direct deposit, ensuring prompt access to their funds, and eliminating the need for paper checks.

Hennepin Minnesota Direct Deposit Form for IRS

Description

How to fill out Hennepin Minnesota Direct Deposit Form For IRS?

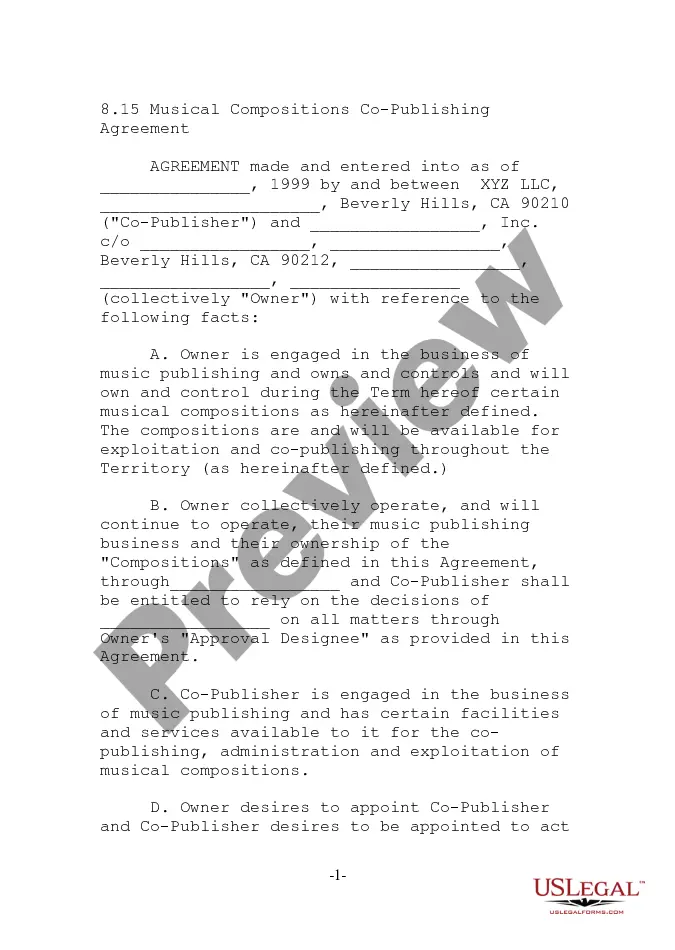

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Direct Deposit Form for IRS, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Hennepin Direct Deposit Form for IRS, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Direct Deposit Form for IRS:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Hennepin Direct Deposit Form for IRS and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!