The Allegheny Pennsylvania Deferred Compensation Agreement — Short Form is a contractual agreement between an employer and an employee that outlines the terms and conditions of deferred compensation in the region of Allegheny, Pennsylvania. This agreement allows eligible employees to defer a portion of their compensation until a later date, typically retirement, providing them with financial security and potential tax advantages. The Allegheny Pennsylvania Deferred Compensation Agreement — Short Form is designed to simplify the process of establishing a deferred compensation plan for both employers and employees. It lays out the key provisions concisely, ensuring clarity and ease of understanding. This document covers important aspects such as contribution limits, distribution options, investment choices, and vesting schedules. Key features of the Allegheny Pennsylvania Deferred Compensation Agreement — Short Form typically include the ability for employees to contribute a specified percentage of their salary on a pre-tax basis, thereby reducing their taxable income in the current year. This arrangement allows participants to potentially enjoy tax deferral benefits, as they will only be taxed on the deferred income when it is distributed in the future. Under this agreement, employees also have the flexibility to determine how their deferred compensation will be invested. They may choose from a range of investment options, such as mutual funds, stocks, bonds, or other authorized vehicles. It is crucial to note that investment choices come with inherent risks, and employees should carefully consider their investment objectives and risk tolerance before making any selections. The Allegheny Pennsylvania Deferred Compensation Agreement — Short Form caters to variations in employee needs and preferences. As such, there may be different types of agreements available to accommodate specific circumstances. Some possible variations could include: 1. Standard Deferred Compensation Agreement: This type of agreement provides straightforward terms and conditions for deferring a portion of an employee's compensation until a later date. It typically offers a range of investment options and allows for distribution flexibility. 2. Vesting Schedule Alteration Agreement: This agreement variation addresses alterations to the vesting schedule, allowing employees to modify the time at which they become fully entitled to their deferred compensation. This can be useful in situations where an employee's financial needs or retirement plans change. 3. Distribution Election Change Agreement: This agreement type allows employees to modify their existing distribution election, which determines how and when they receive their deferred compensation. It is often utilized to adjust distribution preferences based on changing financial circumstances. 4. Investment Option Change Agreement: This agreement variation permits employees to adjust their chosen investment options within the deferred compensation plan. In case of changing market conditions or personal investment preferences, participants can switch or reallocate their funds among the available investment choices. In conclusion, the Allegheny Pennsylvania Deferred Compensation Agreement — Short Form is a vital contractual framework that enables employees and employers to establish a deferred compensation plan. It offers employees advantages like tax deferral, investment options, and distribution flexibility, while employers can attract and retain talented professionals by providing this valuable benefit.

Allegheny Pennsylvania Deferred Compensation Agreement - Short Form

Description

How to fill out Allegheny Pennsylvania Deferred Compensation Agreement - Short Form?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Allegheny Deferred Compensation Agreement - Short Form without expert help.

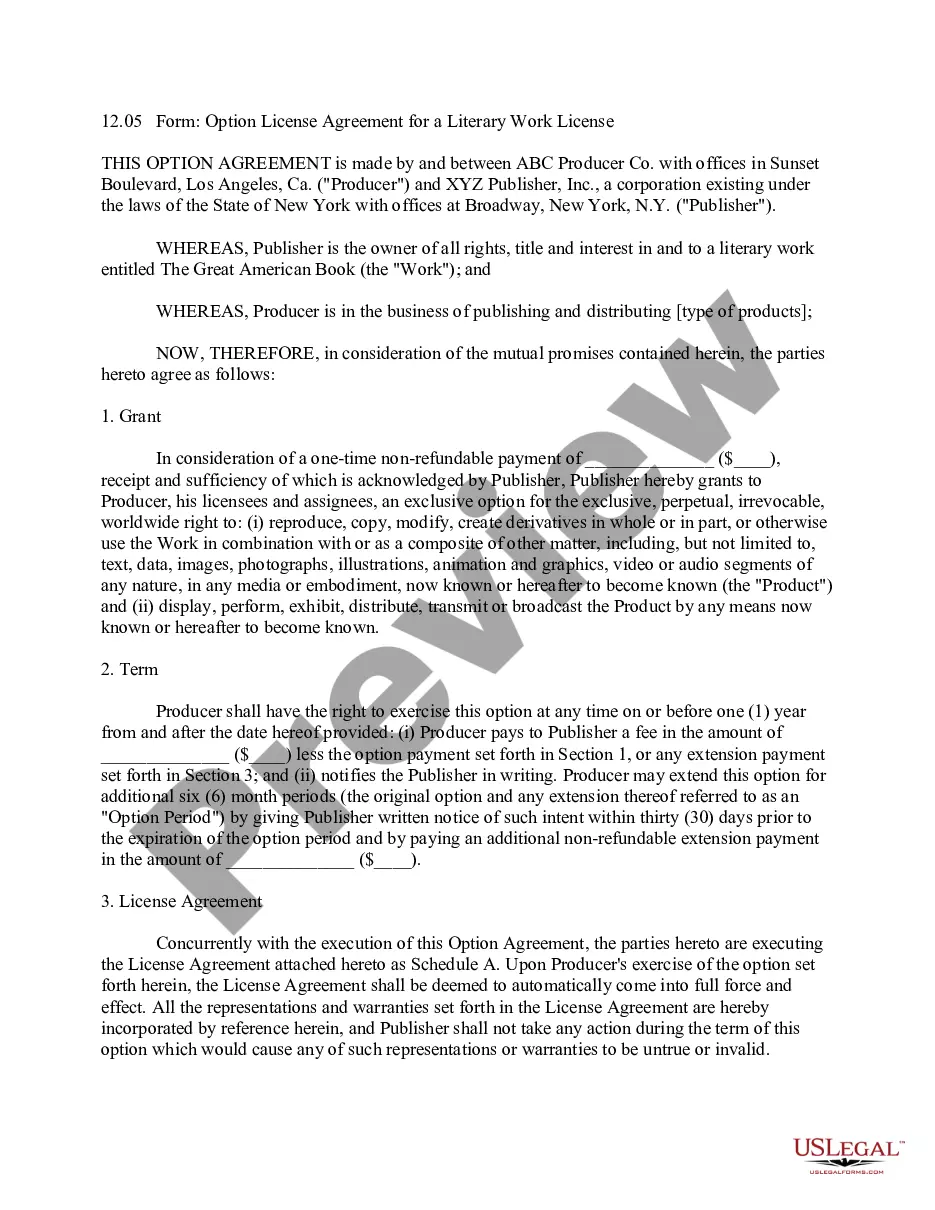

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Allegheny Deferred Compensation Agreement - Short Form on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Allegheny Deferred Compensation Agreement - Short Form:

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Unlike a 401(k) or traditional IRA, there are no contribution limits for a deferred compensation plan. The 401(k) plan contribution limits for 2021 are $19,500, or $26,000 if you are 50 or older. Traditional IRAs have a maximum contribution of $6,000 in 2021, or $7,000 if you are at least 50 years old.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

If you quit your job in finance, you will lose your deferred compensation. This is much like how you'd lose your remaining unvested stock grants if you work at a startup. But if you have a dialogue with your manager, you just might be able to keep what's yours.

Unlike a 401k with contributions housed in a trust and protected from the employer's (and the employee's) creditors, a deferred compensation plan (generally) offers no such protections. Instead, the employee only has a claim under the plan for the deferred compensation.

Early Withdrawals from a 457 Plan Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. This is a very important rule that often times goes overlooked with the 457 plan.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age). Just like other retirement plans, you do need to start taking distributions from your 457 plan by the age of 70 and a half years old.

Deferred compensation is a strategy whereby an employee sets aside income for pay at a later date. You should also note that if your company files for bankruptcy, any funds in a non-qualified deferred compensation plan are not protected from creditors.

Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment. Deferred compensation plans come in two types qualified and non-qualified.