The Collin Texas Deferred Compensation Agreement — Short Form is a legally binding contract implemented by the county of Collin, Texas, for employees interested in deferring a portion of their compensation for future use. This agreement allows employees the opportunity to contribute pre-tax dollars towards retirement savings and potentially reduce their current taxable income. The Collin Texas Deferred Compensation Agreement — Short Form is designed to be concise and straightforward, providing employees with a convenient option for participation. It outlines the terms and conditions of the plan, including contribution limits, investment options, vesting schedules, and distribution options. There are different types of Collin Texas Deferred Compensation Agreement — Short Form available, tailored to suit the specific needs of different individuals. These include: 1. Basic Deferred Compensation Agreement — Short Form: This type of agreement is the most common and offers a simple yet effective structure for participating employees. It allows for a variety of contribution levels and investment choices, empowering employees to personalize their retirement savings strategy. 2. Beneficiary Designation Deferred Compensation Agreement — Short Form: This agreement is similar to the basic form but emphasizes the aspect of designating beneficiaries who will receive the deferred compensation in the event of the employee's death. This ensures the employee's assets are distributed according to their wishes and provides a sense of financial security to their loved ones. 3. Special Deferred Compensation Agreement — Short Form: This unique agreement is designed for select employees who have specific financial circumstances or objectives. It caters to individuals with distinct needs, such as higher contribution limits, different investment options, or restrictive vesting schedules. Regardless of the type of Collin Texas Deferred Compensation Agreement — Short Form chosen, it is important for participating employees to carefully review all provisions and consult with financial advisors if necessary. This agreement offers employees an opportunity to secure their financial future by setting aside part of their income on a tax-deferred basis, ensuring a comfortable retirement or meeting other long-term financial goals.

Collin Texas Deferred Compensation Agreement - Short Form

Description

How to fill out Collin Texas Deferred Compensation Agreement - Short Form?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Collin Deferred Compensation Agreement - Short Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Collin Deferred Compensation Agreement - Short Form from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Collin Deferred Compensation Agreement - Short Form:

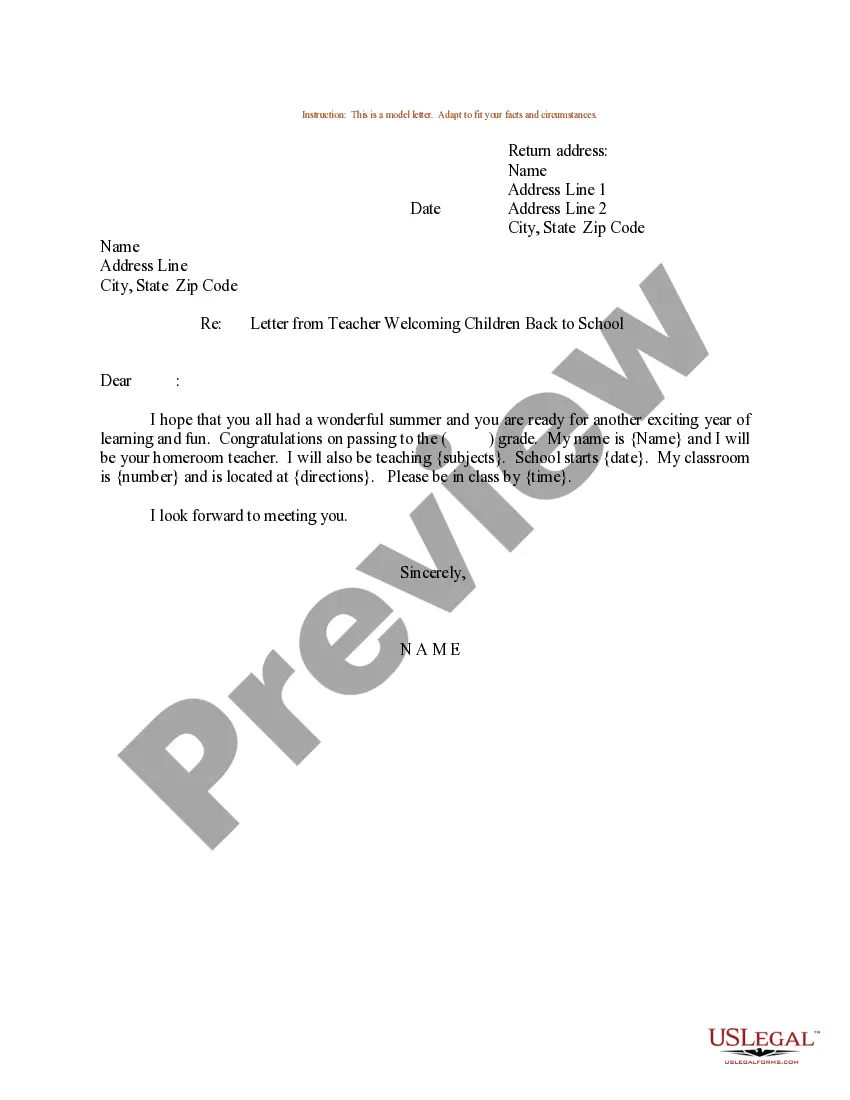

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!