The Mecklenburg County Deferred Compensation Agreement — Short Form is a legally binding document that outlines the terms and conditions of an employee's participation in a deferred compensation plan. This type of agreement is typically offered to employees of Mecklenburg County, North Carolina, to provide them with an additional retirement savings option. The Mecklenburg County Deferred Compensation Plan allows employees to defer a portion of their salary on a pre-tax basis, effectively reducing their current taxable income and allowing it to grow tax-deferred until retirement. The short form agreement is a simplified version of the full agreement, providing employees with a concise overview of the main terms and conditions. The agreement covers various important aspects, including eligibility criteria, contribution limits, investment options, withdrawal rules, and beneficiary designation. It is designed to ensure that both the employee and the employer understand their roles and responsibilities in relation to the deferred compensation plan. There are a few different types of Mecklenburg County Deferred Compensation Agreement — Short Form that may be offered to employees based on their employment status or particular circumstances. These variations can include agreements for different employee groups, such as general employees, law enforcement personnel, or firefighters. Each type may have unique provisions tailored to the specific needs and requirements of the employee category. Employees who elect to participate in the Mecklenburg County Deferred Compensation Plan must carefully review the short form agreement before making any decisions. It is crucial to understand the investment options available, the associated risks, and the withdrawal rules to make informed choices that align with personal financial goals. By participating in the Mecklenburg County Deferred Compensation Plan, employees of Mecklenburg County, North Carolina, have the opportunity to supplement their retirement savings with additional tax-advantaged funds. It is essential for employees to consult with financial advisors or retirement planners to fully understand the long-term implications of their decisions and to make the most effective use of this valuable benefit.

Mecklenburg North Carolina Deferred Compensation Agreement - Short Form

Description

How to fill out Mecklenburg North Carolina Deferred Compensation Agreement - Short Form?

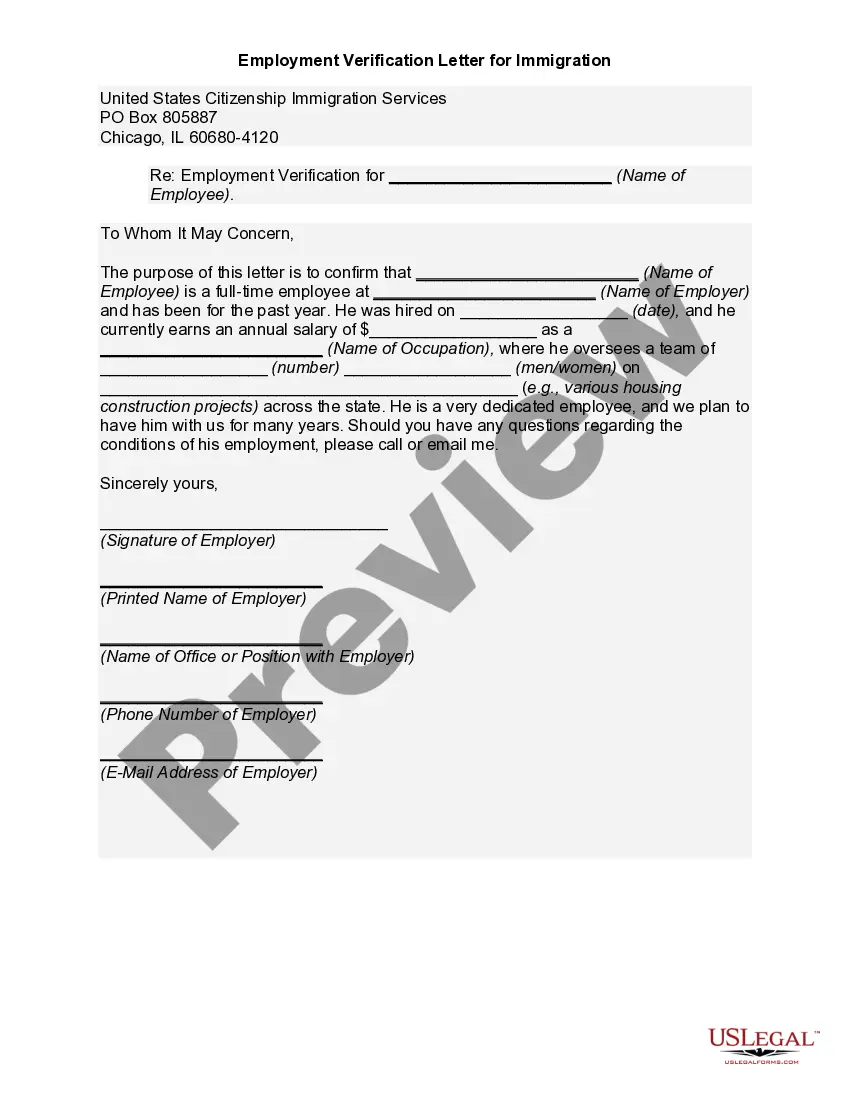

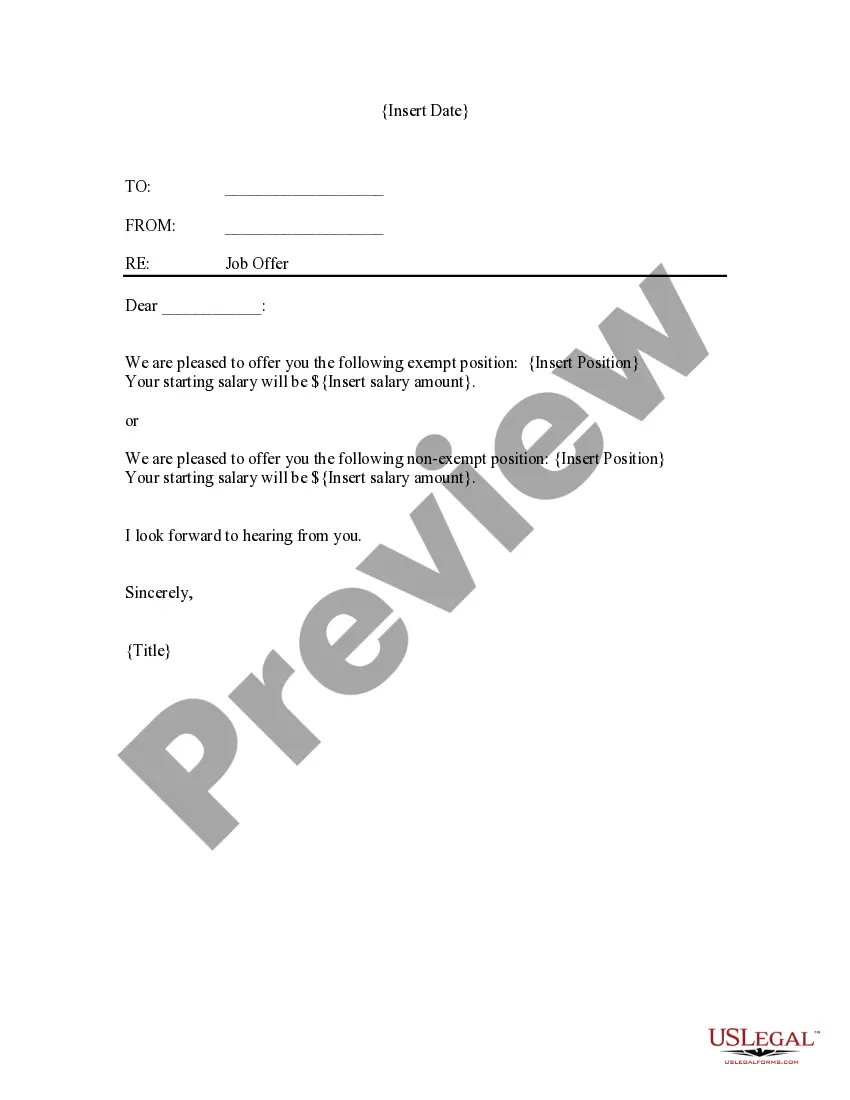

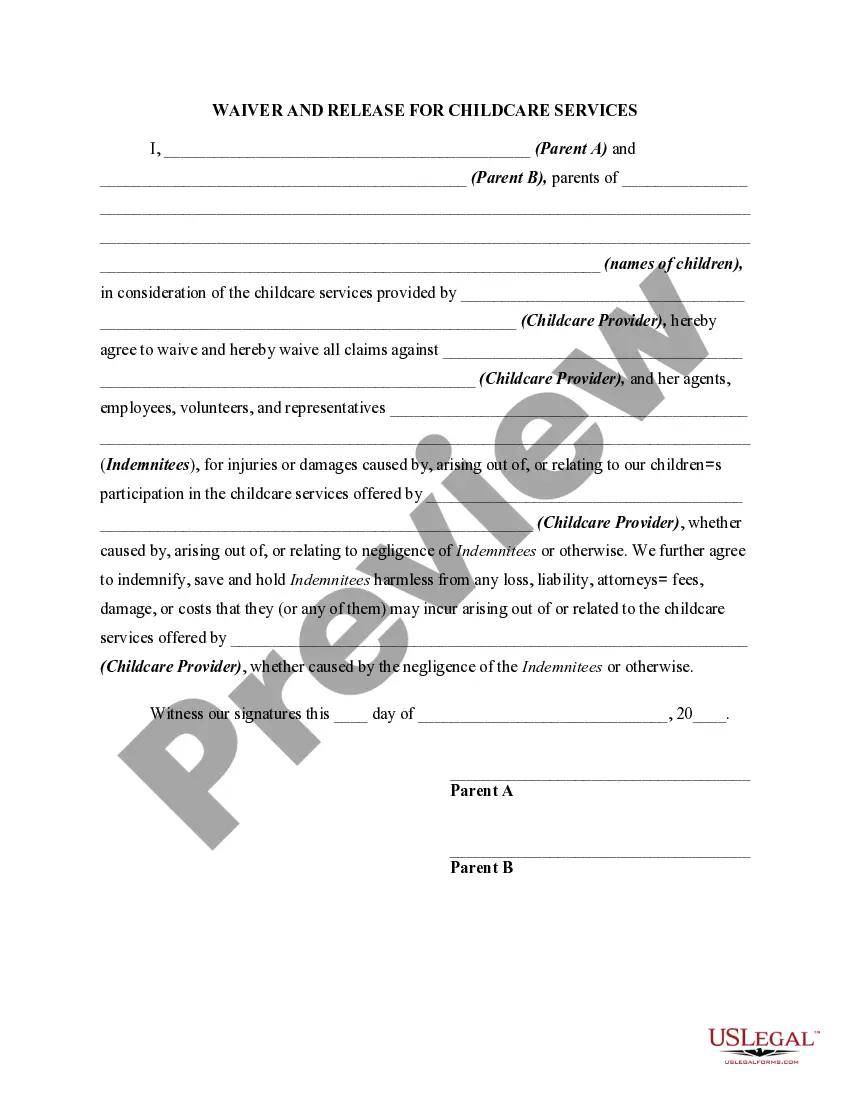

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Mecklenburg Deferred Compensation Agreement - Short Form, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Mecklenburg Deferred Compensation Agreement - Short Form, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Deferred Compensation Agreement - Short Form:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Mecklenburg Deferred Compensation Agreement - Short Form and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Unlike a 401k with contributions housed in a trust and protected from the employer's (and the employee's) creditors, a deferred compensation plan (generally) offers no such protections. Instead, the employee only has a claim under the plan for the deferred compensation.

You can't defer more than $10,000 to either plan (for example, $12,000 to the 401(k) plan and $8,000 to the SIMPLE IRA plan) because your deferrals to each employer's plan can't exceed 100% of your compensation from that employer.

If you quit your job in finance, you will lose your deferred compensation. This is much like how you'd lose your remaining unvested stock grants if you work at a startup. But if you have a dialogue with your manager, you just might be able to keep what's yours.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

Loans are processed within three to five business days and funds are sent out two business days after processing. Loan funds can be sent via direct deposit to your checking or savings account within two to three business days after processing.

You may keep your contributions in the Plan and continue to build savings for retirement. However, you may withdraw your contributions if you: Have a Plan account balance of less than $5,000, exclusive of any assets you may have in a rollover account, AND. Have not contributed to the Plan in the last two years, AND.

Deferred compensation is a strategy whereby an employee sets aside income for pay at a later date. You should also note that if your company files for bankruptcy, any funds in a non-qualified deferred compensation plan are not protected from creditors.

You may withdraw money from your 457 plan when you retire or leave your job and possibly when you experience financial hardship. You'll have to make mandatory withdrawals after age 70 ½, and your beneficiary can withdraw money from the plan upon your death.

Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment. Deferred compensation plans come in two types qualified and non-qualified.

More info

The largest ethnic group included Germans, who accounted for about 18,000 of the country's population. The Baltic peoples are often referred to collectively as the Baltic German people, the original inhabitants of Latvia, Lithuania, Estonia, and Poland. The first German settlers to Latvia were those from Bavaria who settled in Member. In 1880, the German government recognized the Baltic German language as being a separate nation. In 1939, Hitler ordered the deportation, through Estonia, of all the Baltic German minority residing in the Baltic countries. From 1940 to 1944, more than 1.5 million inhabitants of the Baltic countries were deported from the region to concentration camps. Although there are no official statistics on the extent of native population in Latvia, German, or German-speaking ethnic minorities, most experts place the native population and the ethnic minorities in Latvia at least 1 and 2% at the beginning of World War II.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.