Middlesex Massachusetts Deferred Compensation Agreement — Short Form is a legal document that outlines the terms and conditions of deferred compensation for employees in Middlesex County, Massachusetts. This agreement serves as a vital tool in providing an alternative compensation plan for employees, allowing them to defer a portion of their salary until a later date, typically upon retirement. The Middlesex Massachusetts Deferred Compensation Agreement — Short Form provides employees with the opportunity to receive income from their deferred compensation during their retirement years, helping secure their financial stability post-employment. By deferring a portion of their salary, employees can take advantage of potential tax benefits and accumulate savings over time. This agreement sets forth the specifics of the deferred compensation plan, including the percentage or amount of salary to be deferred and the duration of the deferral period. It also outlines the investment options available to the employee, which may include stocks, bonds, or other investment vehicles, depending on the chosen plan. It further explains the circumstances under which the deferred compensation can be distributed, such as upon retirement, disability, or in the event of the employee's death. Furthermore, it is important to note that there may be different types or variations of the Middlesex Massachusetts Deferred Compensation Agreement — Short Form, tailored to specific employee groups or organizations within Middlesex County. These variants may address unique considerations, such as vesting schedules (the time period before employees are entitled to their deferred compensation) or eligibility requirements based on employment status, ensuring that the agreement is aligned with the needs and goals of the particular workforce it serves. In conclusion, the Middlesex Massachusetts Deferred Compensation Agreement — Short Form is a vital tool that enables employees in Middlesex County to defer a portion of their salary, thereby securing their financial future upon retirement. With variations tailored to different employee groups, this agreement ensures that employees have access to a flexible and customized deferred compensation plan that aligns with their unique circumstances.

Middlesex Massachusetts Deferred Compensation Agreement - Short Form

Description

How to fill out Middlesex Massachusetts Deferred Compensation Agreement - Short Form?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Middlesex Deferred Compensation Agreement - Short Form suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Middlesex Deferred Compensation Agreement - Short Form, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Middlesex Deferred Compensation Agreement - Short Form:

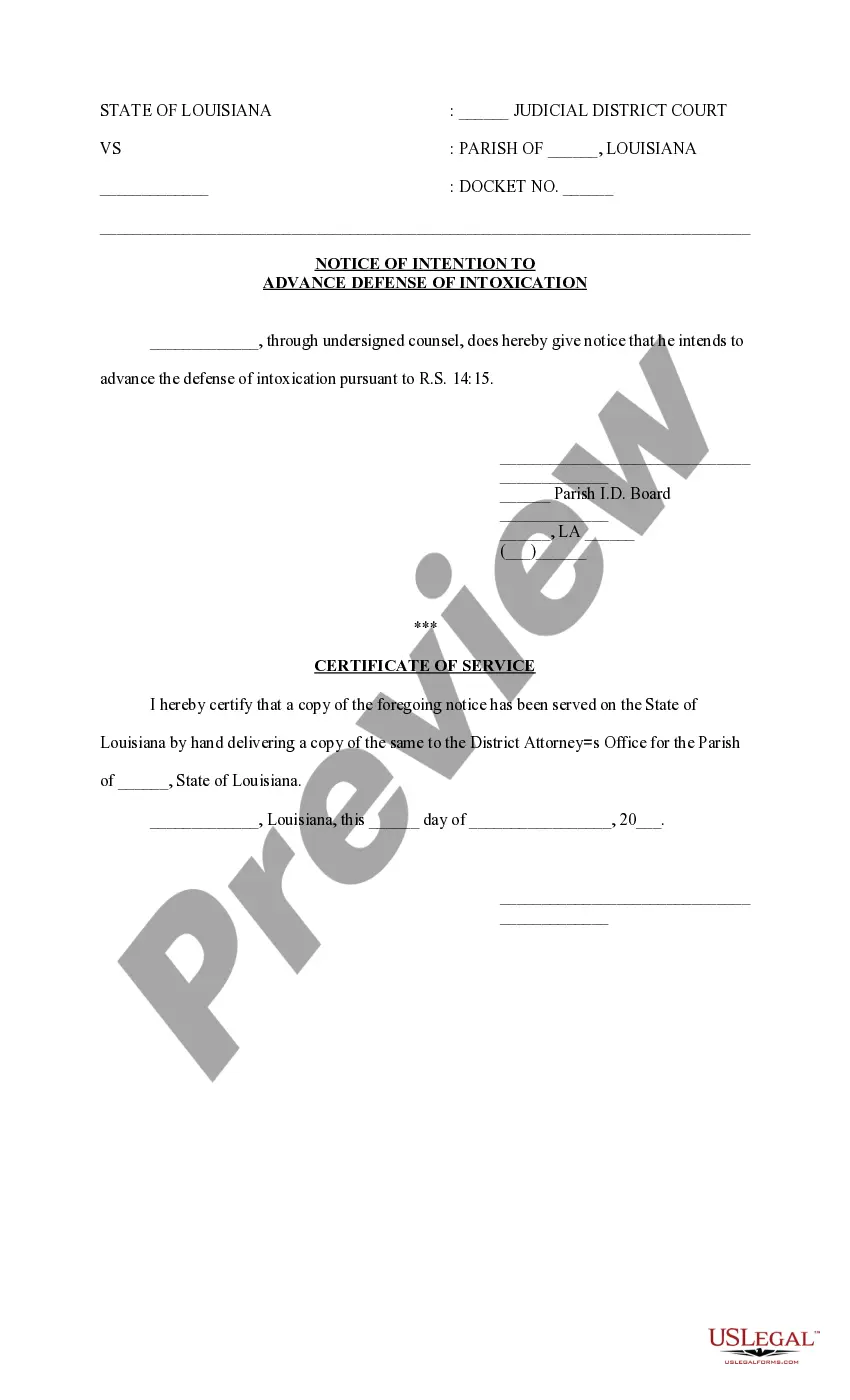

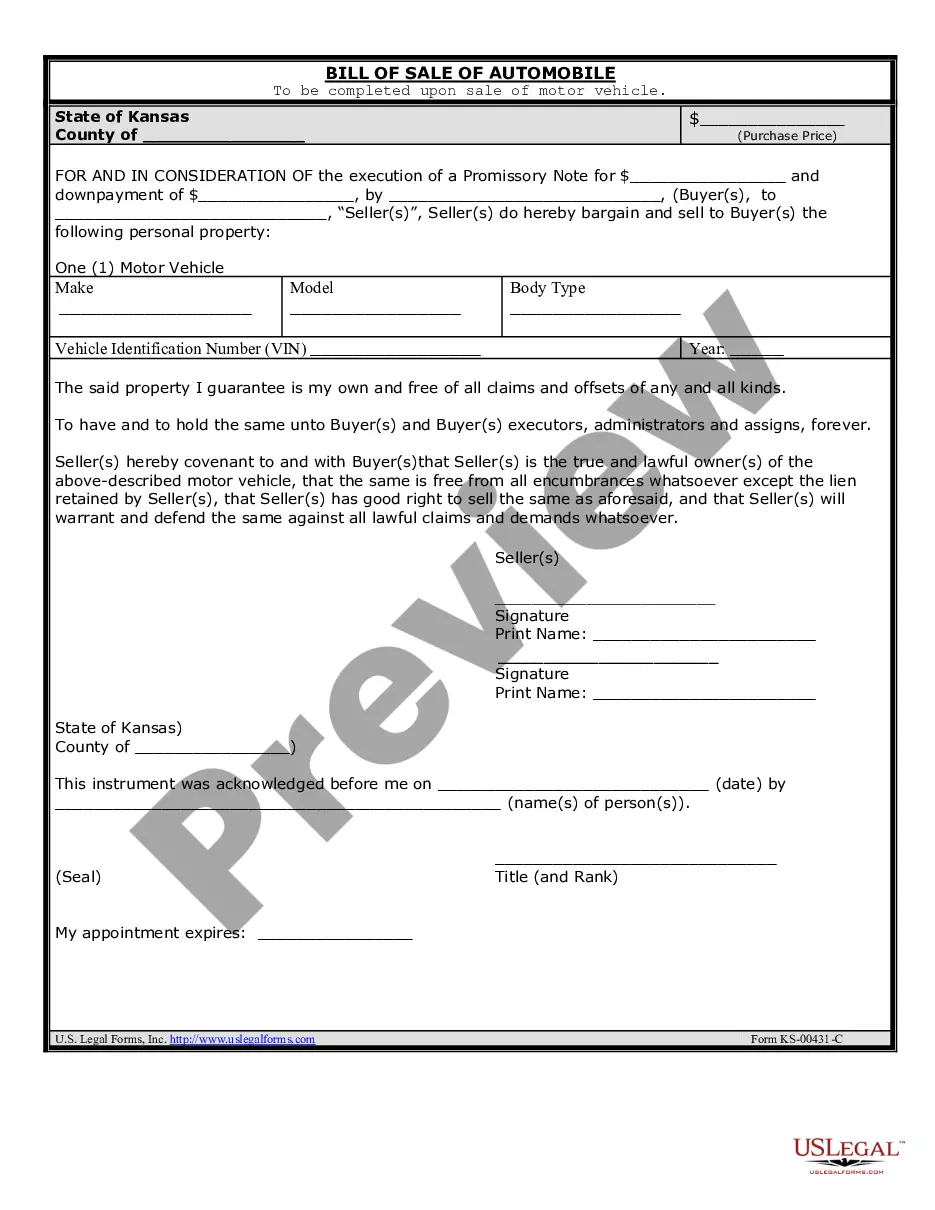

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Middlesex Deferred Compensation Agreement - Short Form.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!