The Salt Lake Utah Deferred Compensation Agreement, also known as the Salt Lake UT DCA, is a contractual arrangement designed to assist employees in Salt Lake, Utah, with saving for retirement or other future financial needs. It allows employees to defer a portion of their income on a pre-tax or post-tax basis, depending on the type of agreement chosen. There are two different types of Salt Lake Utah Deferred Compensation Agreements — Short Form available to employees: 1. Pre-Tax Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their salary on a pre-tax basis, meaning that the amount deferred is not subject to income tax at the time of deferral. Instead, the deferred amount is taxed when it is eventually distributed to the employee, typically at retirement. 2. Roth Post-Tax Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their salary on a post-tax basis. Unlike the pre-tax option, the Roth agreement requires the employee to pay income tax on the amount deferred at the time of deferral. However, when the funds are distributed, including any investment earnings, it is tax-free, provided certain distribution criteria are met. The Salt Lake Utah Deferred Compensation Agreement — Short Form offers several benefits to employees. Firstly, it allows them to contribute a portion of their income towards long-term financial goals, such as retirement, while enjoying potential tax advantages. By lowering their taxable income, employees can potentially reduce their overall tax liability. Secondly, the agreement enables employees to invest their deferred funds, typically in a range of investment options such as mutual funds, stocks, bonds, or other securities. These investment choices offer potential growth and the opportunity for their deferred funds to increase over time. Furthermore, the Salt Lake Utah Deferred Compensation Agreement — Short Form offerflexibilityin regarTototo how and when the deferred funds are distributed. Once eligible, employees can choose to receive periodic withdrawals, opt for a lump sum payment, or roll their funds over into an Individual Retirement Account (IRA) or another qualified plan. It's important to note that the Salt Lake Utah Deferred Compensation Agreement — Short Form is subject to specific rules and regulations outlined by the Internal Revenue Service (IRS) and any applicable state or local laws. Employees considering participating in this type of agreement should carefully review all terms and provisions before making a decision. In summary, the Salt Lake Utah Deferred Compensation Agreement — Short Form is a valuable retirement savings option available to employees in Salt Lake, Utah. Through pre-tax or post-tax deferrals, employees can grow their retirement savings while enjoying potential tax benefits. With multiple distribution options and the ability to choose from various investments, this agreement offers flexibility and empowerment to employees who prioritize their future financial wellbeing.

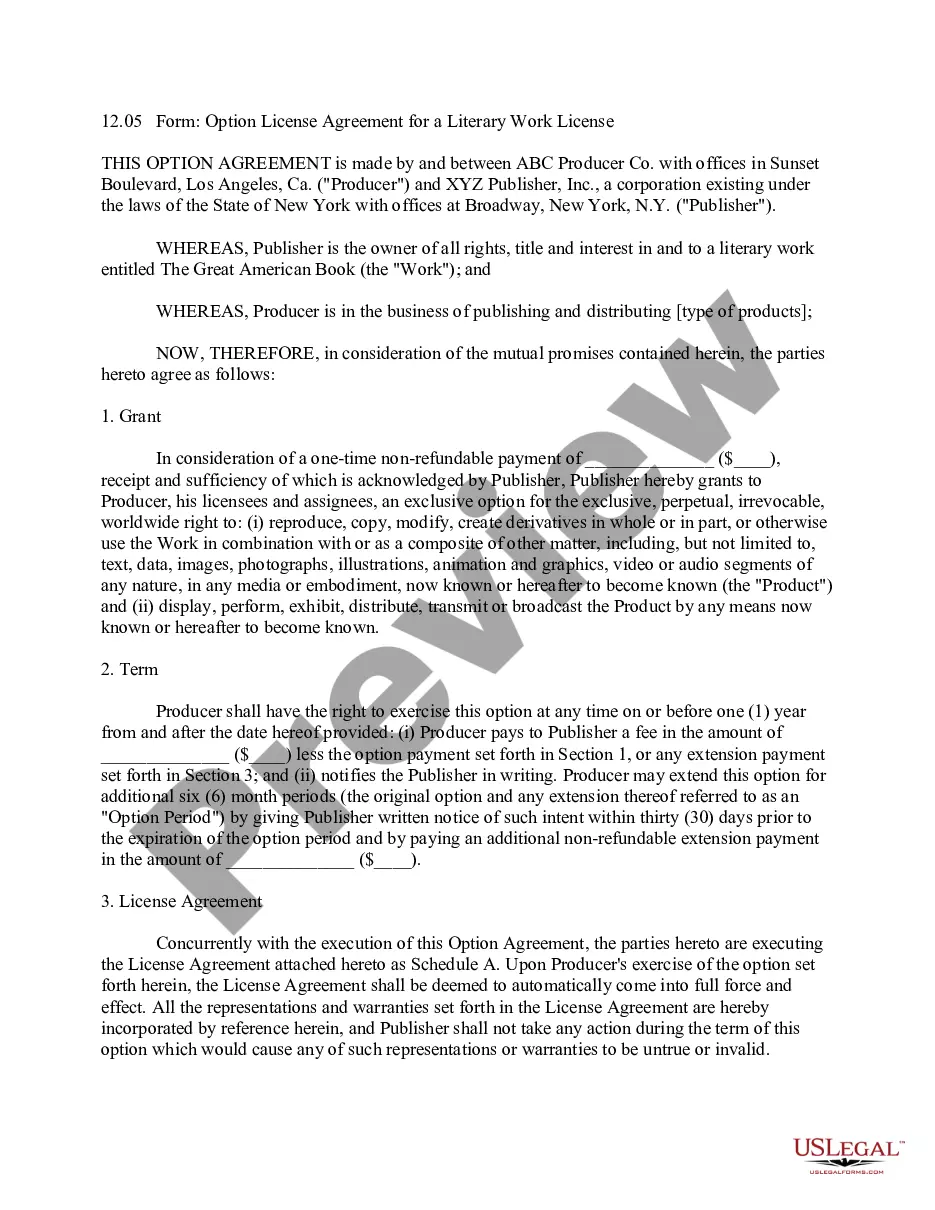

Salt Lake Utah Deferred Compensation Agreement - Short Form

Description

How to fill out Salt Lake Utah Deferred Compensation Agreement - Short Form?

Do you need to quickly draft a legally-binding Salt Lake Deferred Compensation Agreement - Short Form or probably any other form to manage your personal or business matters? You can go with two options: hire a legal advisor to draft a legal paper for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Salt Lake Deferred Compensation Agreement - Short Form and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Salt Lake Deferred Compensation Agreement - Short Form is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Salt Lake Deferred Compensation Agreement - Short Form template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!