The Wake North Carolina Deferred Compensation Agreement — Short Form is a legally binding document that outlines the terms and conditions for deferring compensation for employees in Wake County, North Carolina. This agreement is specifically designed for employees who wish to delay the receipt of a portion of their income, typically for retirement or tax planning purposes. The Wake North Carolina Deferred Compensation Agreement — Short Form serves as a simplified version of the standard deferred compensation agreement and is suitable for employees who do not require extensive customization or additional provisions. It provides a concise yet comprehensive framework for deferring compensation, ensuring both the employer and the employee are aware of their rights, obligations, and the procedures involved. Within the Wake North Carolina Deferred Compensation Agreement — Short Form, employees will find key details regarding the deferred compensation arrangement, including the amount or percentage of income they wish to defer and the specific period over which the deferral will occur. Additionally, the agreement may include provisions outlining the investment options available for the deferred funds and the process for adjusting or modifying the deferral election. While there is only one standard Wake North Carolina Deferred Compensation Agreement — Short Form, it is essential to note that the specific provisions within this agreement may vary depending on employer preferences and the needs of the workforce. As such, certain variations of the agreement may exist to cater to individual circumstances. These variations may include additional sections on vesting schedules, matching contributions, or eligibility requirements, among others. In summary, the Wake North Carolina Deferred Compensation Agreement — Short Form is a concise and standardized document that enables employees within Wake County, North Carolina, to defer a portion of their income for future use. It ensures that both parties involved understand the terms of the deferral and provides a framework for effective administration and record-keeping.

Wake North Carolina Deferred Compensation Agreement - Short Form

Description

How to fill out Wake North Carolina Deferred Compensation Agreement - Short Form?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, locating a Wake Deferred Compensation Agreement - Short Form meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Wake Deferred Compensation Agreement - Short Form, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Wake Deferred Compensation Agreement - Short Form:

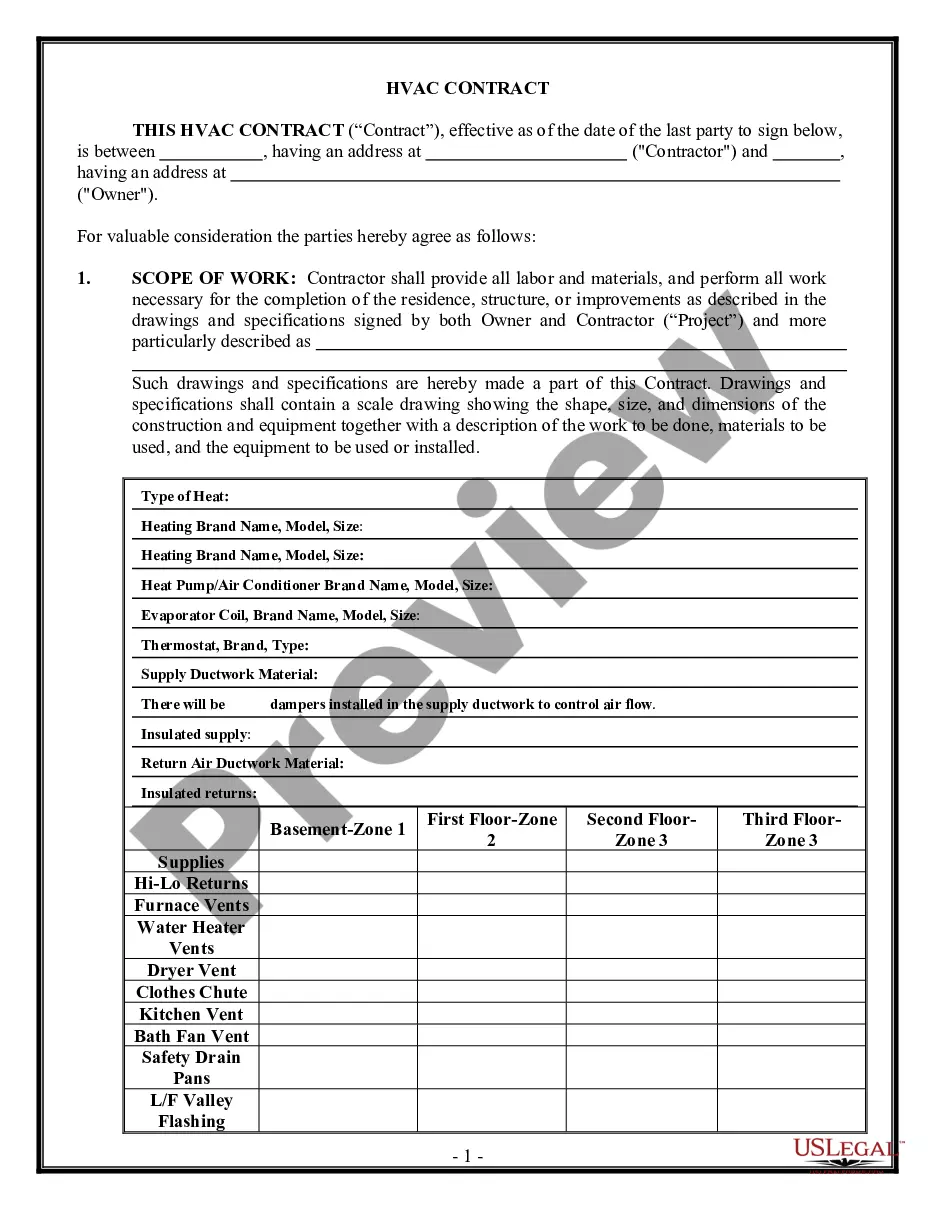

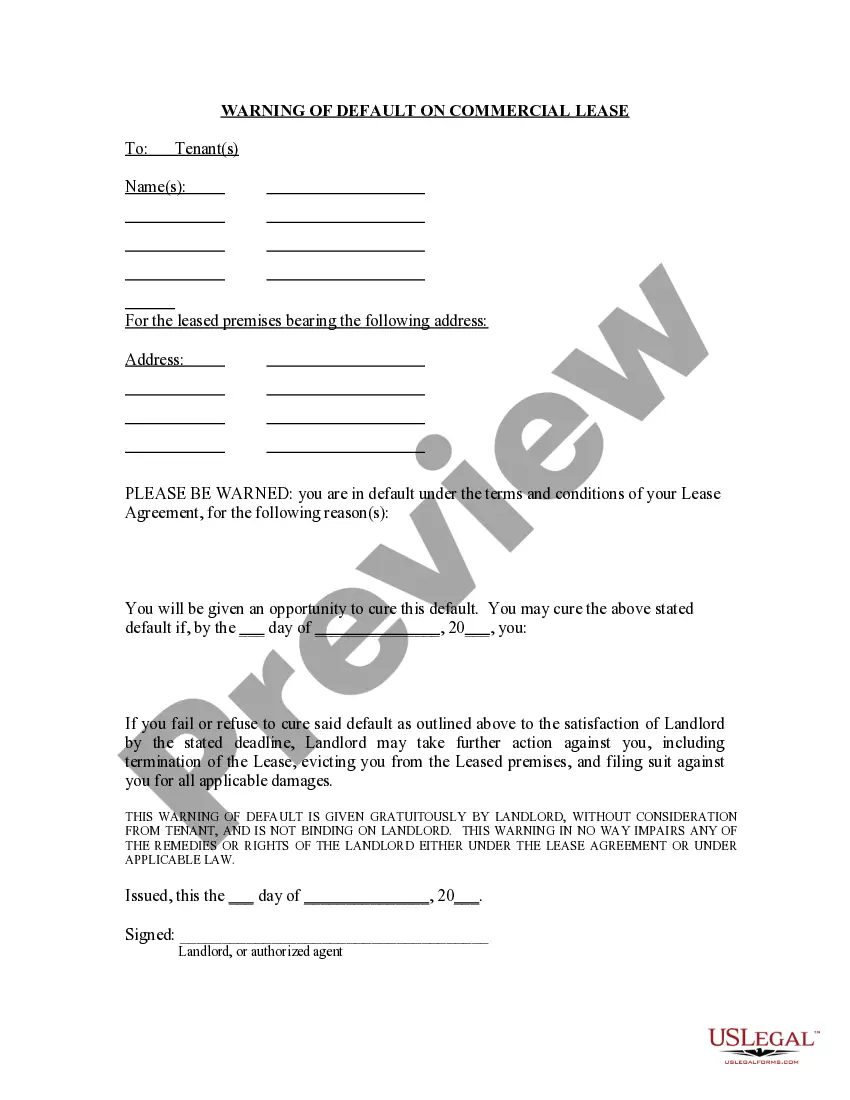

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wake Deferred Compensation Agreement - Short Form.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

More In Retirement Plans Generally, for years beginning after 12/31/2001, an eligible deferred compensation plan under IRC Section 457(b) (or ?section 457 plan?) must meet the written plan document requirements. The plan must comply in form and operation with the requirements of the Code and regulation.

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment.

Most of us don't stay in one job forever. Depending on the terms of your NQDC plan, you may end up forfeiting all or part of your deferred compensation if you leave the company early. That's why these plans are also used as ?golden handcuffs? to keep important employees at the company.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

Deferred compensation plans come in two types ? qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

Elective deferral limit The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $20,500 in 2022 ($19,500 in 2020 and in 2021; $19,000 in 2019).

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation accounting Accounts payable represent a liability, or an amount you owe. Liabilities are increased by credits. For accurate accounting books, the business must credit accounts payable the amount of the deferred compensation. This creates a record representing that you still owe the employee money.

Deferred compensation is often considered better than a 401(k) for high-paid executives looking to reduce their tax burden. As well, contribution limits on deferred compensation plans can be much higher than 401(k) limits.