San Jose California Deferred Compensation Agreement — Long Form is a comprehensive document that outlines a legally binding agreement between an employer and its employees in San Jose, California regarding deferred compensation benefits. This agreement provides an avenue for employees to set aside a portion of their earnings to be paid out at a later date, commonly during retirement. The San Jose California Deferred Compensation Agreement — Long Form is designed to address the specific needs and regulations of the city of San Jose, California, ensuring that both the employer and employee are in compliance with local laws and guidelines. This agreement offers various types depending on the specific circumstances and preferences of the parties involved. 1. Defined Contribution Plan: This type of deferred compensation agreement allows employees to contribute a predetermined amount or percentage of their salary on a regular basis. The employer may also offer matching contributions up to a certain limit. The funds are typically invested and grow tax-deferred until the employee's retirement. 2. Defined Benefit Plan: Unlike a defined contribution plan, a defined benefit plan guarantees a specific amount of income to the employee upon retirement. The employer calculates the retirement benefits based on factors like length of service, salary history, and a predetermined formula, ensuring a secure retirement income for employees. 3. Nonqualified Deferred Compensation (NDC) Plan: This is a flexible deferred compensation option that allows employees to defer a certain portion of their salary or bonuses, over and above the limits provided by qualified plans like 401(k)s or pension plans. NDC plans can be structured to provide various payout schedules, such as lump-sum payments, installments, or annuities. 4. Executive Deferred Compensation: This type of agreement is specifically designed for high-level executives, providing them with additional benefits and incentives to support their long-term financial goals. Executive deferred compensation plans may offer enhanced contribution limits, specialized investment options, and unique payout provisions tailored to meet the unique needs of executives. The San Jose California Deferred Compensation Agreement — Long Form ensures that both parties understand the terms and conditions of the deferred compensation arrangement, including eligibility, contribution limits, vesting periods, investment options, payout options, and potential tax implications. It offers employees an opportunity to bolster their retirement savings while providing employers with a competitive compensation package to attract and retain talented professionals. Overall, the San Jose California Deferred Compensation Agreement — Long Form serves as a crucial tool to establish a fair and mutually-beneficial deferred compensation program in compliance with specific regulations set forth by the city of San Jose, California.

San Jose California Deferred Compensation Agreement - Long Form

Description

How to fill out San Jose California Deferred Compensation Agreement - Long Form?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Jose Deferred Compensation Agreement - Long Form, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the San Jose Deferred Compensation Agreement - Long Form, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Jose Deferred Compensation Agreement - Long Form:

- Glance through the page and verify there is a sample for your region.

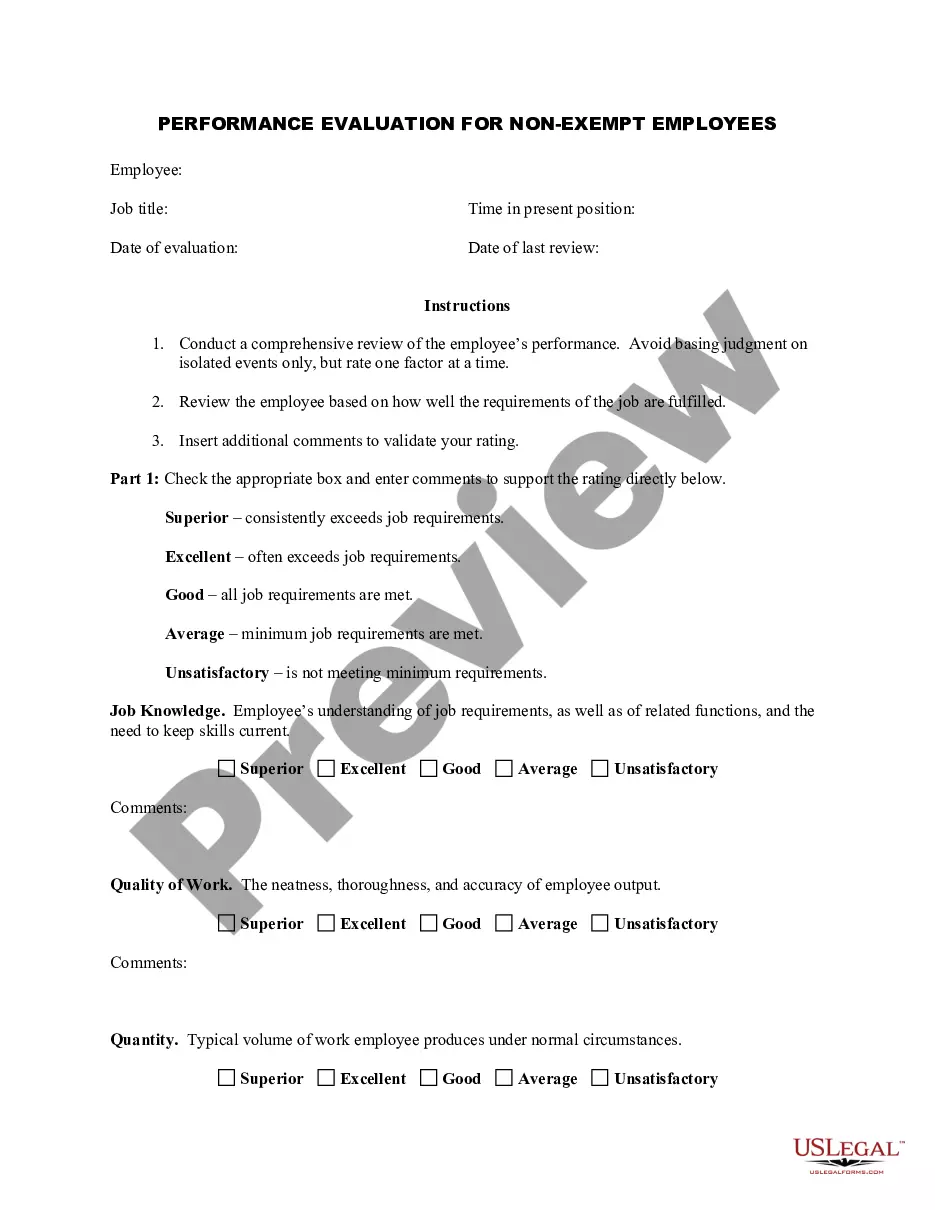

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your San Jose Deferred Compensation Agreement - Long Form and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!