The Wake North Carolina Deferred Compensation Agreement — Long Form is a comprehensive legal document that outlines the terms and conditions for deferring compensation for employees in Wake County, North Carolina. This agreement is designed to provide employees with the option to defer a portion of their salary or wages on a pre-tax basis, thereby allowing them to maximize their retirement savings. In the context of employee benefits, a deferred compensation agreement is a valuable tool that helps employees plan for their financial future by deferring a portion of their salary or wages until a later date, typically retirement. By participating in this program, employees have the opportunity to accumulate additional funds that can supplement their retirement income. The Wake North Carolina Deferred Compensation Agreement — Long Form lays out the specific terms and conditions that employees must adhere to when participating in the program. This includes the eligibility criteria for participation, the maximum amount that can be deferred, the various investment options available, and the vesting schedule for employer contributions. One important aspect of this agreement is the tax advantages associated with deferred compensation. By deferring a portion of their salary or wages, employees can potentially lower their current taxable income, resulting in reduced income tax liabilities. Instead, the deferred compensation is only subject to taxation when it is actually distributed to the employee. Additionally, the Wake North Carolina Deferred Compensation Agreement — Long Form may include provisions for employer matching contributions, where the employer matches a portion of the employee's deferred compensation contributions. This serves as an additional incentive for employees to participate in the program and further enhances their retirement savings. It is worth noting that different types or variations of the Wake North Carolina Deferred Compensation Agreement — Long Form may exist, depending on factors such as the specific employer or agency implementing the agreement. However, regardless of these variations, the fundamental purpose remains the same — to provide employees with a vehicle to defer a portion of their compensation and enhance their retirement savings. In conclusion, the Wake North Carolina Deferred Compensation Agreement — Long Form is a comprehensive legal document that enables employees to defer a portion of their salary or wages on a pre-tax basis. By participating in this program, employees can accumulate additional retirement savings, potentially reduce their current taxable income, and take advantage of employer matching contributions.

Wake North Carolina Deferred Compensation Agreement - Long Form

Description

How to fill out Wake North Carolina Deferred Compensation Agreement - Long Form?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Wake Deferred Compensation Agreement - Long Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Wake Deferred Compensation Agreement - Long Form from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Wake Deferred Compensation Agreement - Long Form:

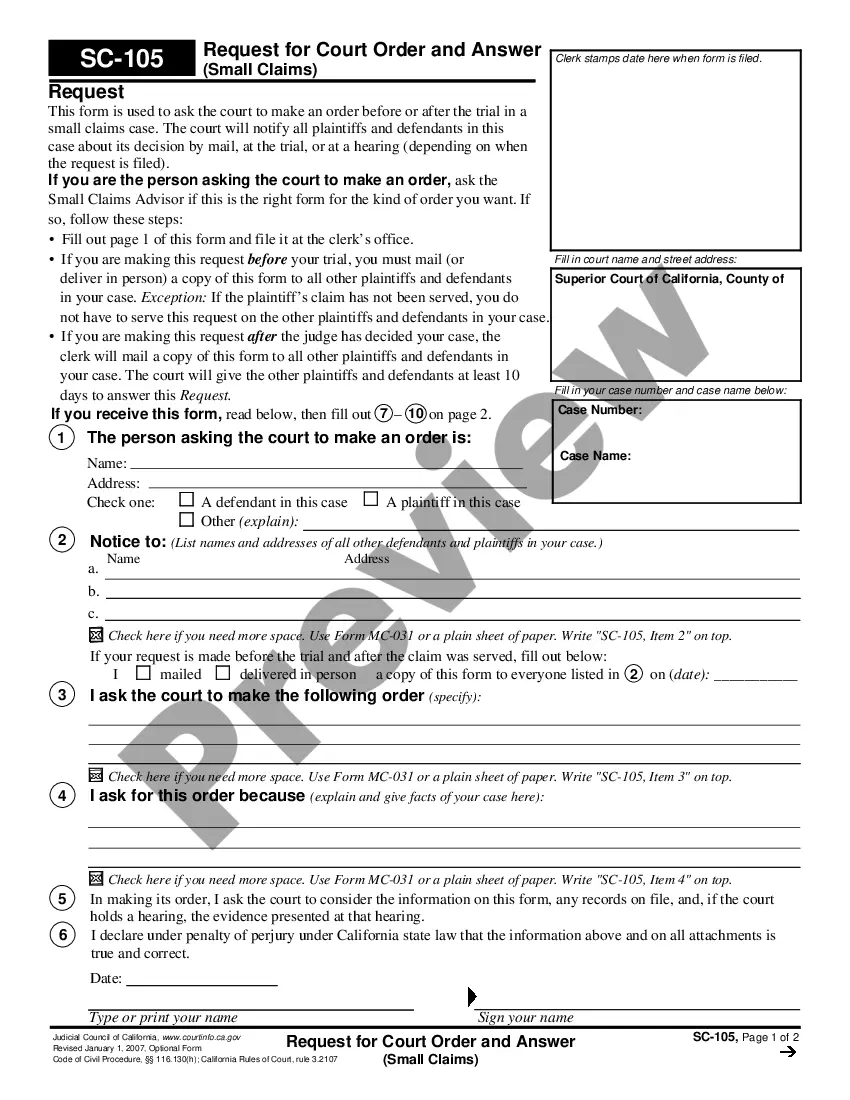

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!