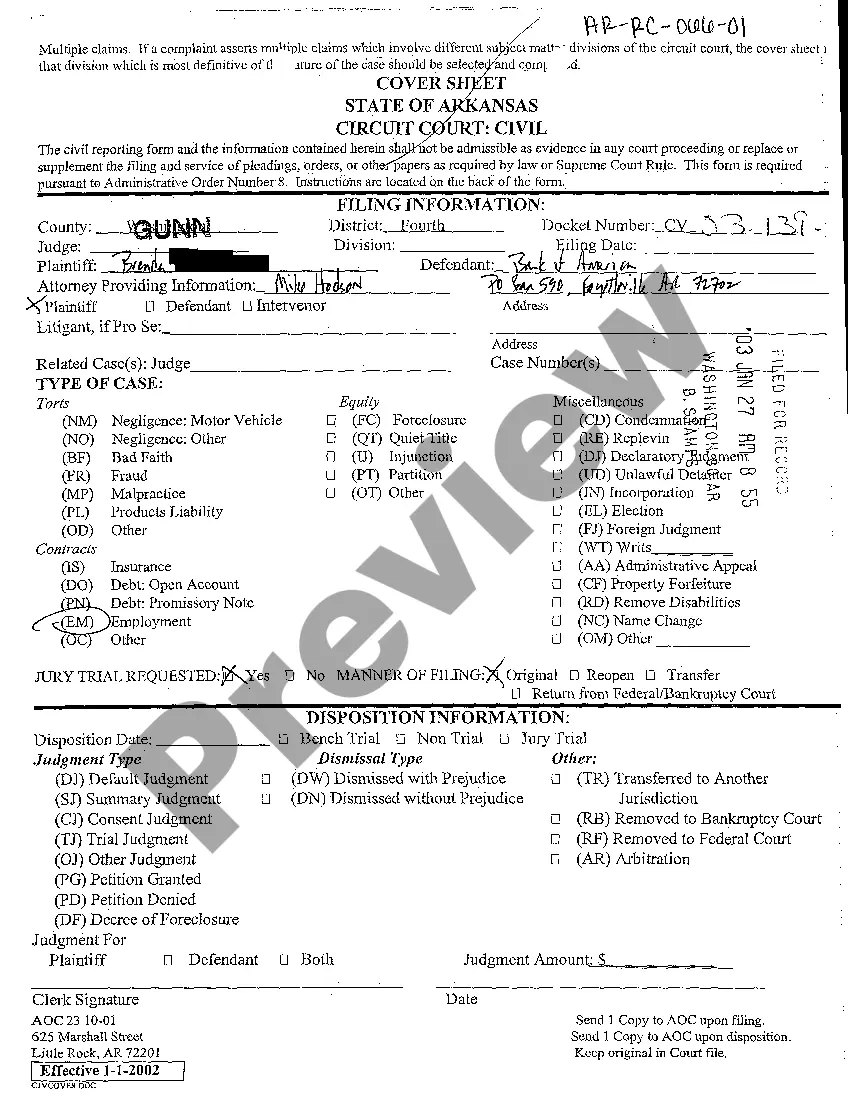

A San Antonio Texas Asset Purchase Agreement — More Complex is a legal document that outlines the terms and conditions of purchasing assets in the San Antonio, Texas region. This type of agreement is best suited for more intricate transactions involving significant assets and requires a comprehensive framework to ensure both parties' rights and responsibilities are protected. The agreement includes various clauses and provisions that cater to the complexity of the asset purchase, making it more comprehensive than a standard asset purchase agreement. It covers a wide range of elements, such as the identification and description of the assets being transferred, purchase price, payment terms, representations and warranties, closing conditions, indemnification, and dispute resolution. There can be different types of San Antonio Texas Asset Purchase Agreement — More Complex, and they may vary based on the specific nature of the transaction or assets involved. Some possible categories or variations could include: 1. San Antonio Texas Real Estate Asset Purchase Agreement — More Complex: This type of agreement is specifically designed for purchasing real estate assets in the San Antonio, Texas area. It delves into additional details such as zoning restrictions, title insurance, property condition assessments, and environmental considerations. 2. San Antonio Texas Manufacturing Asset Purchase Agreement — More Complex: This variation of the asset purchase agreement focuses on acquiring manufacturing assets, including machinery, equipment, inventory, and intellectual property. It may contain specialized provisions related to manufacturing processes, quality control, and transfer of proprietary technology. 3. San Antonio Texas Technology Asset Purchase Agreement — More Complex: This type of agreement is tailored to the acquisition of technology assets, such as software, patents, trademarks, copyrights, and other intellectual property rights. It may involve extensive due diligence processes and specific provisions for the protection and transfer of intangible assets. Each of these variations addresses the unique complexities and considerations associated with different types of assets, ensuring that the agreement encompasses the specific requirements of the transaction while safeguarding the interests of both the buyer and the seller. In conclusion, a San Antonio Texas Asset Purchase Agreement — More Complex serves as a vital legal instrument for intricate asset purchase transactions in San Antonio, Texas. Its extensive nature and specific provisions make it adaptable to various types of assets, such as real estate, manufacturing, and technology assets.

San Antonio Texas Asset Purchase Agreement - More Complex

Description

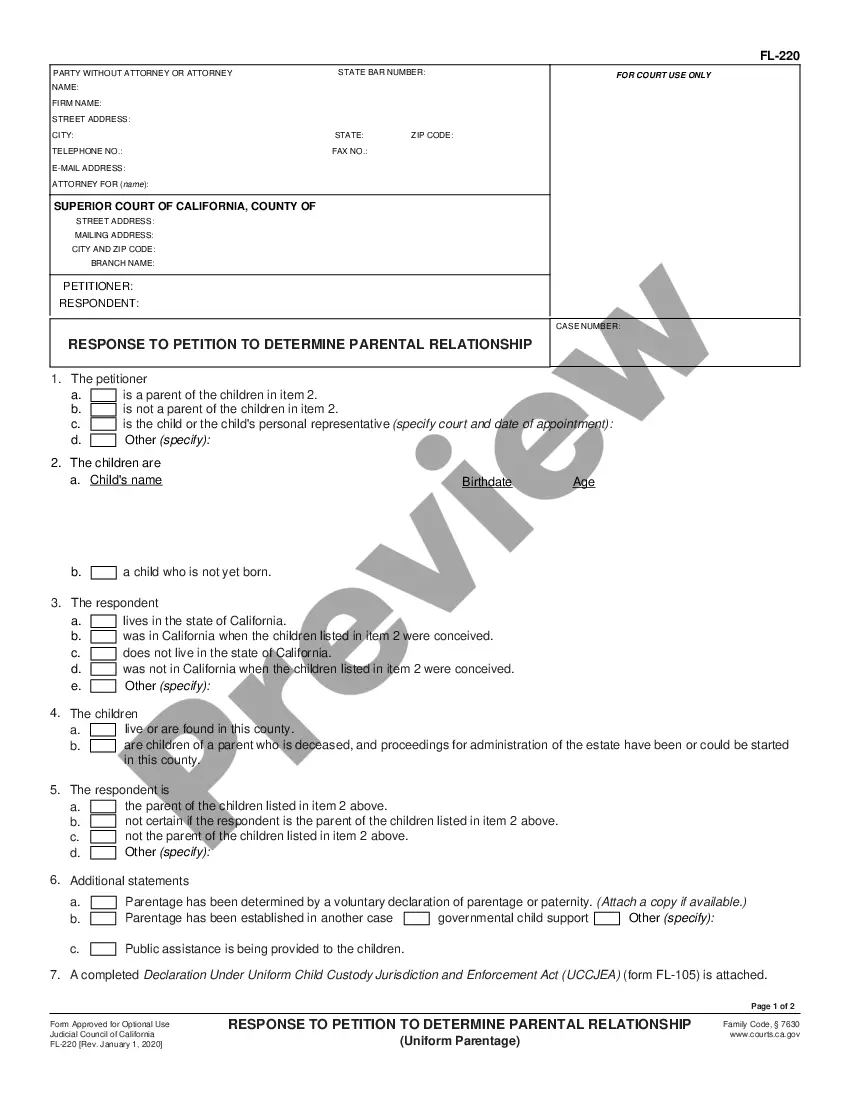

How to fill out San Antonio Texas Asset Purchase Agreement - More Complex?

If you need to get a trustworthy legal paperwork provider to get the San Antonio Asset Purchase Agreement - More Complex, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse San Antonio Asset Purchase Agreement - More Complex, either by a keyword or by the state/county the document is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Antonio Asset Purchase Agreement - More Complex template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the San Antonio Asset Purchase Agreement - More Complex - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Buyers prefer asset sales since they allow them to write off assets for tax purposes and also allow them to leave behind any liabilities or other potential risks that the selling company may have.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.)

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Buyers often prefer asset sales because they can avoid inheriting potential liability that they would inherit through a stock sale. They may want to avoid potential disputes such as contract claims, product warranty disputes, product liability claims, employment-related lawsuits and other potential claims.

Here are parts of an asset purchase agreement that you may want to include in your document.Recitals.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Experienced buyers and sellers may try to add clauses to the sale and purchase agreement that will allow them to cancel the agreement if they change their mind especially if the other party is inexperienced. It's important not to agree to additional clauses without legal advice.

Asset Sale AdvantagesNo legal liability for the corporation prior to the purchase.No liabilities for employees The seller's employees are terminated at the close of escrow, even if the buyer is going to rehire all of them.Costs paid for the assets are depreciable.More items...

Tax Rates. Generally, a stock sale is better for the seller and an asset sale is better for the buyer. In a stock sale, the seller can realize the gain on their business at preferred capital gains tax rates. In an asset sale, any gains are exposed to the seller's ordinary income tax rate on certain assets.

Deciding whether to structure a business sale as an asset sale or a stock sale is complicated because the parties involved benefit from opposing structures. Generally, buyers prefer asset sales, whereas sellers prefer stock sales.

A purchase contract is as legally binding as is stated in the agreement itself. A purchase agreement should stipulate acceptable reasons for a buyer backing out of a purchase. Otherwise, once it's signed, you stand to lose your earnest money deposit should you break your contract.