Houston, Texas is a bustling city known for its rich cultural diversity, booming economy, and vibrant community. Located in the southeastern part of Texas, this sprawling metropolis serves as the state's largest and most populous city. With a history dating back to its establishment in 1836, Houston has evolved into a global hub for various industries such as energy, healthcare, NASA's space exploration, and international trade. When it comes to the financial sector, Houston serves as home to numerous banks and financial institutions, allowing it to cater to the financial needs of individuals, businesses, and organizations alike. In the context of corporate governance, the minutes of a meeting of the directors of a company in Houston, Texas regarding a bank loan are crucial in documenting important decisions and discussions that transpire during such meetings. The minutes of the meeting provide a detailed account of the proceedings and serve as an official record that outlines the key topics discussed, actions taken, and resolutions made regarding the bank loan sought by the company. These minutes carry great significance in ensuring transparency, accountability, and compliance within the organization. They serve as a reference point for future deliberations, audits, and legal requirements. There can be different types of Houston, Texas Minutes of Meeting of the Directors regarding a Bank Loan based on the nature and purpose of the loan, as well as the specific circumstances of the meeting. Some possible variations may include: 1. Initial Loan Consideration Meeting: This type of meeting focuses on exploring the potential need for a bank loan, assessing the financial viability, and discussing the objectives and scope of the loan. The minutes document the directors' discussions on loan terms, interest rates, collateral requirements, and potential lenders. 2. Loan Application Meeting: In this meeting, the directors discuss the specific details of the loan application process, including the required documents and forms. The minutes capture the directors' deliberations on the company's financial statements, creditworthiness, and strategies to secure the loan successfully. 3. Loan Negotiation Meeting: This type of meeting centers on negotiating the loan terms with the bank or financial institution. The minutes outline the negotiations, including interest rates, repayment schedules, grace periods, and any special conditions, ensuring that the directors' decisions are accurately recorded for future reference. 4. Loan Approval Meeting: Once the loan application has been submitted and reviewed, there is a meeting where the directors review and approve or reject the loan proposal. The minutes summarize the directors' discussions, considerations, and final decisions regarding the approval or rejection of the loan application. 5. Loan Utilization Meeting: This meeting occurs after the loan has been disbursed, and the directors discuss the proper utilization and allocation of the funds. The minutes detail the directors' decisions on utilizing the loan for designated purposes and monitoring its progress. In conclusion, Houston, Texas is a vibrant city with a thriving financial sector and serves as a hub for businesses seeking financial support. The minutes of meeting of the directors regarding bank loans play a critical role in recording and documenting important decisions, discussions, and actions taken during the loan acquisition process. These minutes ensure transparency, compliance, and serve as a valuable reference for future audits and legal requirements.

Houston Texas Minutes of Meeting of the Directors regarding Bank Loan

Description

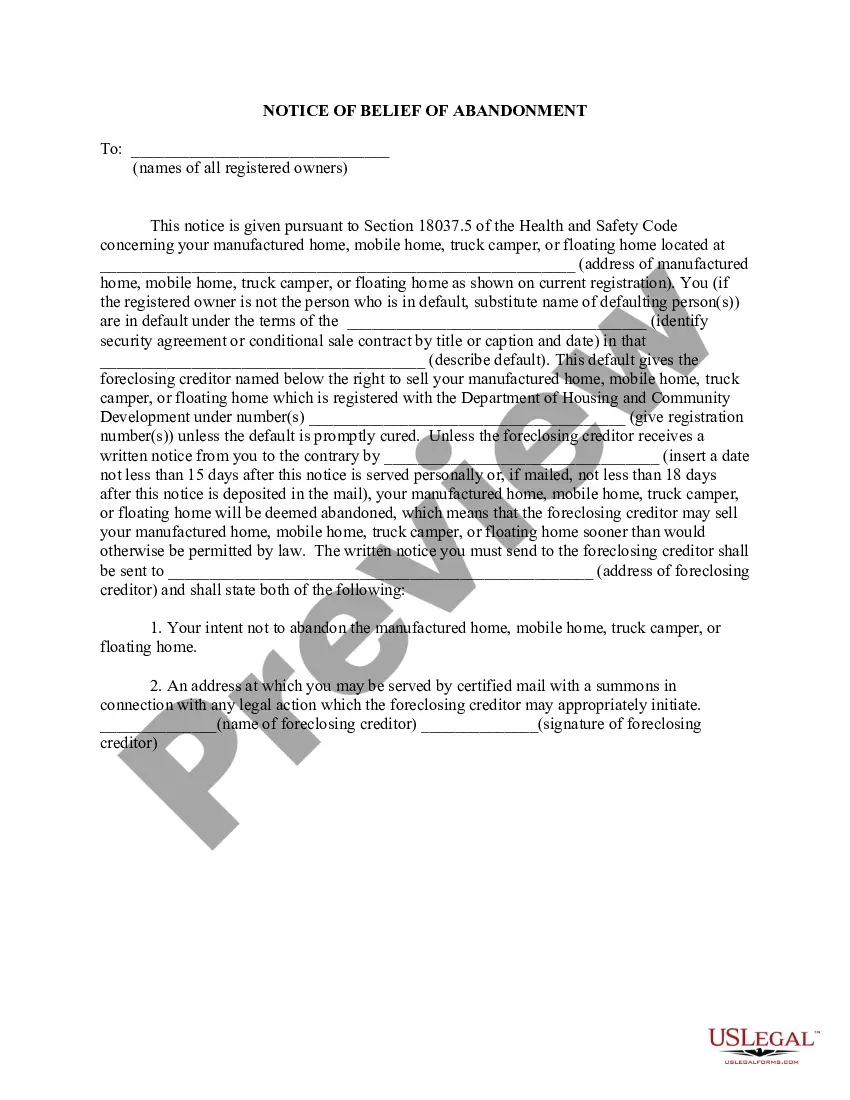

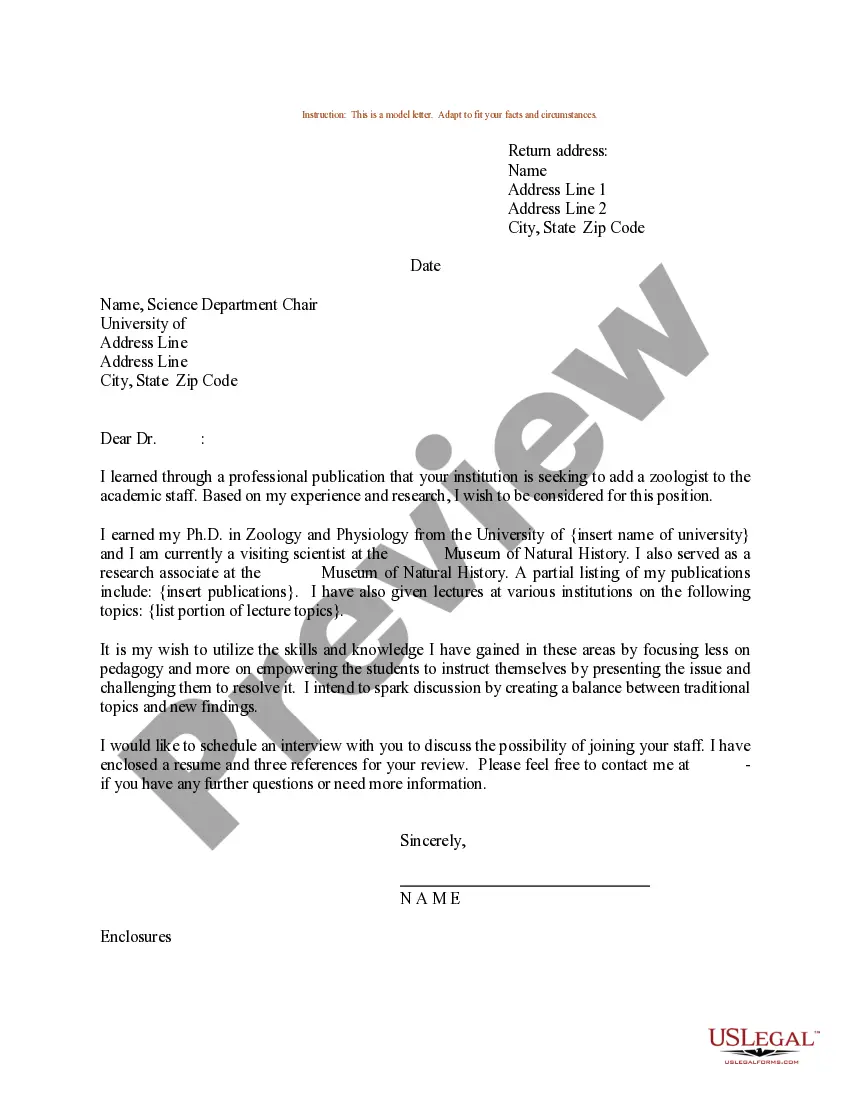

How to fill out Houston Texas Minutes Of Meeting Of The Directors Regarding Bank Loan?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Houston Minutes of Meeting of the Directors regarding Bank Loan, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the current version of the Houston Minutes of Meeting of the Directors regarding Bank Loan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Minutes of Meeting of the Directors regarding Bank Loan:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Houston Minutes of Meeting of the Directors regarding Bank Loan and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!