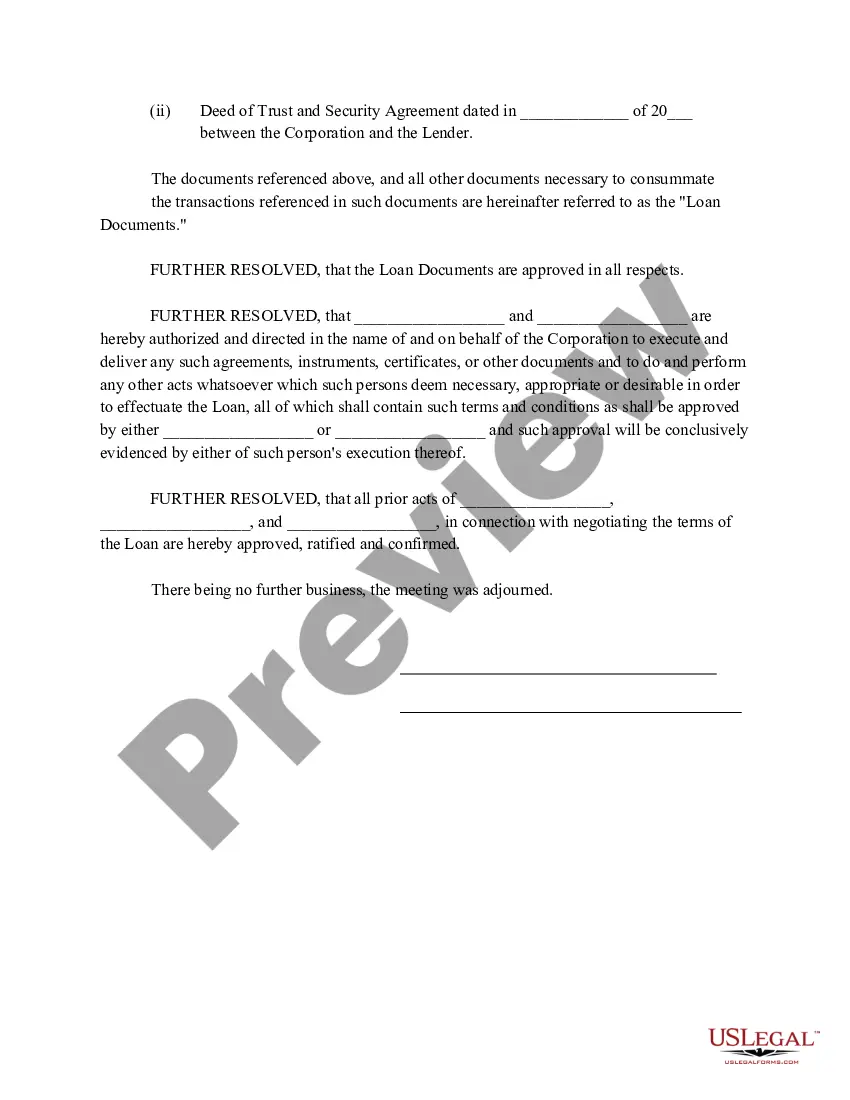

Minutes of Meeting of the Directors regarding Bank Loan in Phoenix, Arizona: Phoenix, Arizona, is a vibrant and bustling city known for its rich history, stunning desert landscapes, and thriving business community. It is crucial for directors of companies operating in this region to effectively manage their financial concerns, such as securing bank loans. In this article, we will delve into the details of a meeting held by the directors of a Phoenix-based company to discuss bank loan matters and provide a comprehensive overview of the key aspects involved. The meeting started promptly in the spacious conference room of the company's headquarters in Phoenix, Arizona. The assembled directors, including the CEO and CFO, gathered around a large oak table adorned with folders and documents outlining the pertinent information regarding the bank loan. The primary purpose of the meeting was to evaluate the company's financial position, assess the need for a bank loan, and discuss the various options available. The directors focused on exploring potential loan providers, assessing interest rates, loan terms, and other crucial factors influencing the decision-making process. Additionally, they deliberated on the loan amount required and evaluated the potential impact on the company's cash flow and overall financial stability. Different types of Phoenix Arizona Minutes of Meeting of the Directors regarding Bank Loan can be categorized based on the specific nature of the loan or purpose of the meeting, including but not limited to: 1. Acquisition Loan Discussion: Some directors' meetings may be dedicated to deliberating the acquisition of another company or business unit through the utilization of a bank loan. This type of meeting would involve detailed analysis of the target company's financial position, market potential, and the potential growth opportunities resulting from the acquisition. 2. Expansion Loan Discussion: In cases where companies plan to expand their operations, enter new markets, or launch new products, directors may convene meetings centered around securing a bank loan to finance these growth initiatives. These discussions would focus on the projected returns, market analysis, and detailed plans for the expansion. 3. Working Capital Loan Discussion: Directors may also hold meetings specifically aimed at securing a bank loan to address short-term liquidity needs and manage day-to-day operational expenses. These meetings would typically revolve around the company's current cash flow, accounts payable, accounts receivable, and the detailed financial projections necessary to support the loan application. Throughout the discussions, the directors analyzed key financial statements, such as balance sheets, income statements, and cash flow statements, to provide a comprehensive understanding of the company's financial health. They diligently reviewed the loan requirements, complied with relevant regulations, and worked closely with the financial team to ensure accurate and complete documentation for the loan application. The meeting concluded with an action plan outlining the steps to be taken to secure the bank loan, including the responsible individuals, timelines, and required submission documents. The directors exchanged thoughts on potential risks and contingency plans, ensuring thoughtful decision-making and meticulous execution. In conclusion, Phoenix, Arizona, is a dynamic hub where directors gather for meetings specifically focused on securing bank loans to meet their company's financial needs. These meetings, categorized based on the loan's purpose, involve detailed discussions, financial analysis, and intricate planning to ensure the loan aligns with the company's objectives and improves its financial stability.

Phoenix Arizona Minutes of Meeting of the Directors regarding Bank Loan

Description

How to fill out Phoenix Arizona Minutes Of Meeting Of The Directors Regarding Bank Loan?

Do you need to quickly draft a legally-binding Phoenix Minutes of Meeting of the Directors regarding Bank Loan or maybe any other document to take control of your own or business matters? You can select one of the two options: hire a professional to draft a legal paper for you or draft it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Phoenix Minutes of Meeting of the Directors regarding Bank Loan and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Phoenix Minutes of Meeting of the Directors regarding Bank Loan is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by using the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Phoenix Minutes of Meeting of the Directors regarding Bank Loan template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the documents we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Directors' loan accounts are generally recorded in the company's financial statements as an asset, or sometimes as a negative liability, and they are recoverable as a debt due to the company.

6. Who prepares Board Meeting Minutes? The Company Secretary shall record the proceedings of the Meetings. Where there is no Company Secretary, any other person duly authorised by the Board or by the Chairman in this behalf shall record the proceedings.

Loan account is a representative personal account, as it represents the person from whom the loan is obtained or to whom the loan is given. Hence, it is classified as a personal account.

The term loan account is very broad and often used to cover multiple scenarios, which can sometimes make it difficult to grasp. Very generally, a shareholder's loan account would represent the amount that the business owes you as a shareholder or director, and/or the amount you owe the business.

To record receipt of the loanGo to Banking, click the required bank account, then click New Entry and from the drop-down list click Sale / Receipt.

To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.

6 practical tips for more effective board meeting minutesPreparation is everything. Prepare yourself for the specific board meeting you'll be taking notes for.Aim for concise and precise.Use an objective voice.Keep board members accountable.Don't be afraid to ask for clarification.Timing is key.

The Account Loan from Director should be a Current Liability. A debit Loan Account (money loaned by the Director) can only exist if certain ATO requirements are met.

If your company receives a loan from a director, to ensure your accounts are accurate, you need to record this. You can do this by creating an other receipt transaction. Once you've recorded the receipt of the loan, you can then record the repayments, using an other payment transaction.

How Do You Record a Loan Receivable in Accounting?Debit Account. The $15,000 is debited under the header Loans. This means the amount is deducted from the bank's cash to pay the loan amount out to you.Credit Account. The amount is listed here under this liability account, showing that the amount is to be paid back.