Alameda, California Assignment of Money Due is a legal document used to transfer the rights to receive payment from one party (assignor) to another party (assignee) in the city of Alameda, California. It is a contractual agreement that allows the assignee to step in the shoes of the assignor and legally claim the payment owed to them. This assignment is commonly used in various financial transactions, business deals, and debt collections. It provides a convenient way for individuals and businesses to transfer their rights to payment without the need for complex legal procedures. In Alameda, California, the Assignment of Money Due is a recognized legal instrument that helps to streamline the transfer process and ensure the assignee's rights are protected. Some key reasons for executing an Assignment of Money Due in Alameda, California may include the need to: 1. Transfer outstanding accounts receivable: Businesses often use this document to transfer their accounts receivable to a third party, allowing them to generate immediate cash flow instead of waiting for payments from customers. It enables businesses to focus on their core operations without worrying about collecting payments. 2. Facilitate debt collection: Individuals or businesses who are owed money may assign their rights to a debt collection agency or a specialized firm to handle the collection process. The assignment empowers the agency to pursue the debtor and collect the unpaid amount on behalf of the assignor. 3. Selling financial assets: Financial institutions or individuals holding promissory notes, bonds, or other money owed instruments may assign their rights to receive payment to another party. This allows them to sell their financial assets and obtain immediate liquidity. 4. Securing loans: The Assignment of Money Due can also be used as collateral for obtaining loans. By assigning their rights to receive payment, individuals or businesses can use this assignment as security to secure the loan and provide assurance to lenders. It's worth mentioning that there may be different types of Assignment of Money Due in Alameda, California, depending on the nature of the transaction or the specific needs of the assignor. Some variations may include: 1. Absolute assignment: This type of assignment completely transfers all rights to the assignee, who then assumes full responsibility for collecting the money owed. 2. Conditional assignment: In some cases, the assignment may be conditional, where the assignee gains the rights to the payment only if specified conditions are met. This type of assignment might include provisions such as reaching a certain date or providing proof of delivery. 3. Partial assignment: It is possible to assign only a portion of the rights to receive payment. This type of assignment allows the assignor to maintain some control over the payment process while still benefiting from immediate cash flow. Regardless of the type, executing an Alameda, California Assignment of Money Due involves documenting the agreement in writing, including details of the assignor, assignee, the amount owed, the assignment effective date, and any specific conditions or terms agreed upon by both parties.

Alameda California Assignment of Money Due

Description

How to fill out Alameda California Assignment Of Money Due?

Are you looking to quickly draft a legally-binding Alameda Assignment of Money Due or probably any other document to manage your personal or corporate matters? You can go with two options: hire a professional to write a valid paper for you or draft it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant document templates, including Alameda Assignment of Money Due and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

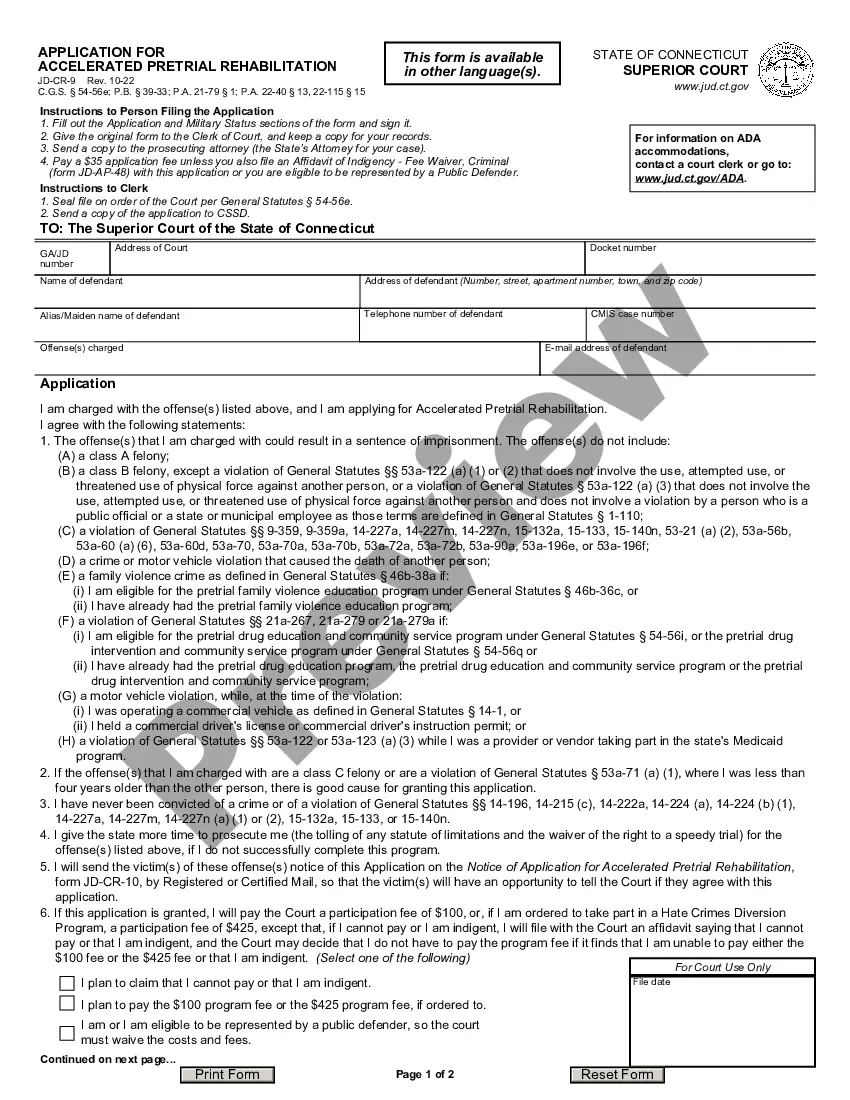

- To start with, carefully verify if the Alameda Assignment of Money Due is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Alameda Assignment of Money Due template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

In Alameda County, the seller is typically responsible for the country transfer tax fee as well as 50% of the city transfer taxes. The buyer pays for the recording, escrow, title and 50% of the city transfer taxes. Buyers in San Francisco County pay the costs for the recording, title and insurance.

When property changes owners, the County Assessor's Office has a form that must be filed to update the tax records. You can submit this form when you go to record your deed at the Alameda County Clerk-Recorder's Office. It is forwarded to the Assessor's Office. The Alameda County PCOR form can be downloaded HERE.

In Alameda County, home buyers usually have more closing costs to cover, when compared to sellers. This is true for most counties across the country, in fact. That's because the buyer is the one assuming ownership of the home, so most of the services are performed on their behalf.

Important Information: Beginning June 15, 2021, all courthouses are open to the public and most in-person services are restored.

Methods of Payment Cash, Debit/ATM Card - In Person Only. Credit cards are not accepted for in person and mail requests. Money Order, Cashier's or Traveler's Check - payable to: Alameda County Clerk Recorder.

In addition to the basic recording fee of $89.00 for the first page and $3.00 for each page thereafter, there are other fees which may be due on deeds and leases. Collection of fees include: Documentary Transfer Tax. City Real Property Transfer Tax.

There is no charge for the Preliminary Change of Ownership Report (PCOR) if it is complete and accompanies the transfer document. Otherwise, the fee is $20.00.... AlamedaHayward$12.00$8.50per thousand on full valueper thousand on full valueOrdinance No. 2987 AMCOrdinance No. 92-2610 more columns

Alameda County Divorce Filing Fees There is a $435 filing fee which may be waived if you meet the minimum financial guidelines You can file your court documents in person or by mail.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

Transfer tax is collected on sales, exchanges, legal entity changes of control and leases of more than 35 years (including options) among other forms of transfers. In Northern California the seller of the property customarily pays the transfer tax during the escrow process.