Fairfax Virginia Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

Laws and rules in every field vary across the nation.

If you are not an attorney, it can be challenging to navigate through the numerous regulations when drafting legal documents.

To evade costly legal assistance while preparing the Fairfax Assignment of Money Owed, you require a verified template valid for your jurisdiction.

That's the simplest and most economical method to access current templates for any legal situations. Discover them all with just a few clicks and maintain your paperwork organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform proves extremely advantageous.

- US Legal Forms is an online repository trusted by millions, featuring over 85,000 legal forms specific to each state.

- It's an ideal solution for both professionals and individuals seeking DIY templates for various life and business situations.

- All forms are reusable: once you select a sample, it will remain accessible in your profile for future use.

- Therefore, having an account with an active subscription allows you to simply Log In and re-download the Fairfax Assignment of Money Owed from the My documents section.

- For new users, a few additional steps are required to acquire the Fairfax Assignment of Money Owed.

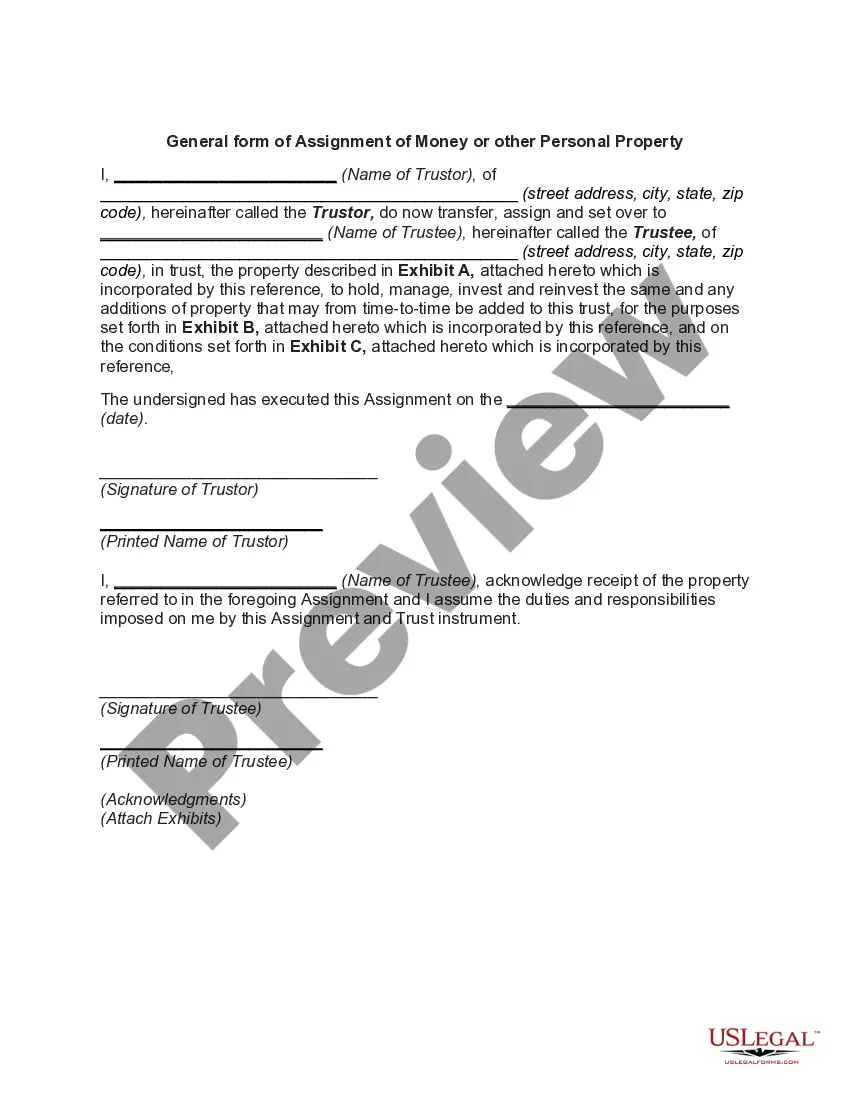

- Review the page content to confirm you’ve located the correct sample.

- Use the Preview feature or read the form description if provided.

Form popularity

FAQ

Virginia State income taxes are due on May 1. The tax period for the first half of personal property taxes is from January 1 to June 30. The first half of business tangible personal property taxes are due on May 5. The tax period for the first half of real estate taxes is from January 1 to June 30.

In Virginia, you could lose your home to a tax sale if you don't pay your property taxes. People who own real property have to pay property taxes. The government uses the money that these taxes generate to pay for schools, public services, libraries, roads, parks, and the like.

Under the Virginia Constitution, the General Assembly may give localities the power to grant full or partial exemptions from real estate taxes to persons 65 years of age or older or for persons permanently and totally disabled. The exemption applies to owner-occupied property used as the sole dwelling of such persons.

Real estate taxes are due in two equal installments. The due dates are July 28 and December 5 each year. If the due date falls on a weekend, the due date moves to the next business day.

Pay online with e-check or credit/debit card. A third-party processing fee is assessed for credit/debit card payments. There is no charge for e-check payments. For vehicle tax bills, you will need the last 4 digits of your VIN and property number as shown on your tax bill.

Fairfax County's 1.03% average effective property tax rate is below average by national standards, but it's still a good bit higher than Virginia's 0.80% state average effective rate. But these rates can vary based on where you live within Fairfax County.

Property taxes are generally due twice a year; around June/July, depending on the jurisdiction and again in December. It is also worth noting that property taxes are paid in arrears.

The current real estate tax rate is $1.14 per $100 of assessed value. According to board documents, the rate that would collect the same amount of real estate tax as the last year would be $1.0583 per $100 of assessed value.

Real estate taxes are paid annually in two installments due July 28 and December 5.

Overview of Virginia Taxes With an average effective property tax rate of 0.80%, Virginia property taxes come in well below the national average of 1.07%.