The Chicago Illinois Assumption Agreement of Loan Payments is a legally binding document that outlines the terms and conditions under which a new borrower assumes the responsibility of an existing loan. In this agreement, the new borrower agrees to make all future loan payments and assumes liability for the full outstanding balance. Chicago, Illinois, being a major financial hub and a populous city, offers various types of assumption agreements related to loan payments. Some common types include: 1. Residential Mortgage Assumption Agreement: This type of assumption agreement is commonly used in the real estate market when a buyer wishes to assume the existing mortgage of a property they are purchasing. The agreement outlines the terms of the assumption, such as the interest rate, repayment period, payment schedule, and any other conditions set forth by the lender. 2. Commercial Loan Assumption Agreement: This type of assumption agreement is designed for commercial properties, such as office buildings, retail spaces, or industrial units. It allows a new borrower to take over an existing commercial loan and assume responsibility for the loan payments. The agreement typically includes detailed financial terms, conditions, and any special requirements related to the commercial property. 3. Auto Loan Assumption Agreement: This type of assumption agreement is specific to vehicle financing. When an individual wishes to transfer the ownership of a financed vehicle to another party, they can use the Auto Loan Assumption Agreement. This document specifies the terms of the assumption, including payment obligations, interest rate, insurance requirements, and any other financial considerations. 4. Student Loan Assumption Agreement: In the realm of education financing, student loan assumption agreements allow a new borrower to assume the responsibility of existing student loans. With this agreement, the new borrower agrees to repay the loan in place of the original borrower, taking over the loan payment obligations, interest rates, and any repayment terms or conditions. It is important to note that each type of assumption agreement may have specific requirements, eligibility criteria, and legal obligations imposed by lenders or governing bodies. It is recommended to consult legal professionals or financial experts to ensure compliance with all relevant laws and regulations when engaging in these agreements.

Chicago Illinois Assumption Agreement of Loan Payments

Description

How to fill out Chicago Illinois Assumption Agreement Of Loan Payments?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Chicago Assumption Agreement of Loan Payments.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Chicago Assumption Agreement of Loan Payments will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Chicago Assumption Agreement of Loan Payments:

- Ensure you have opened the proper page with your localised form.

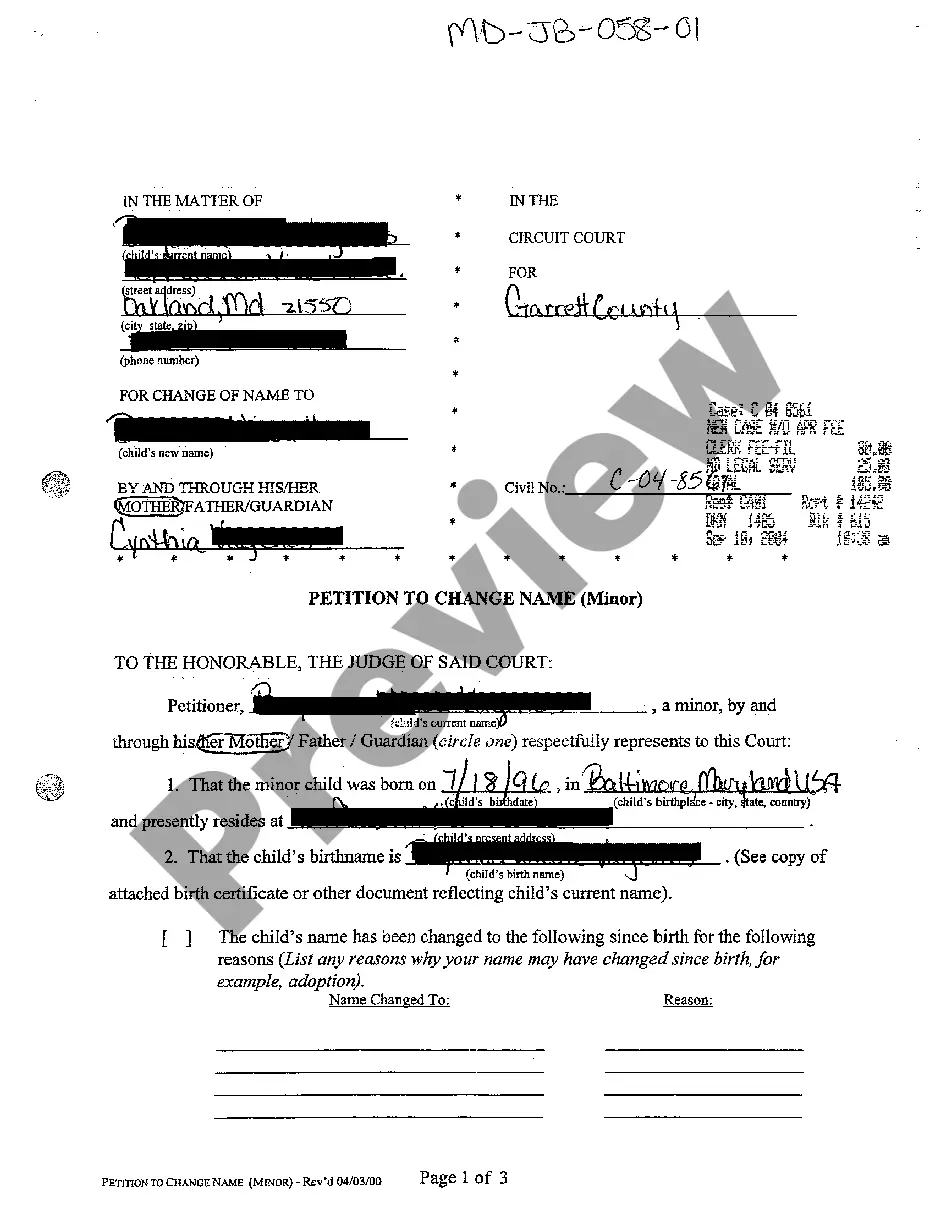

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Chicago Assumption Agreement of Loan Payments on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!