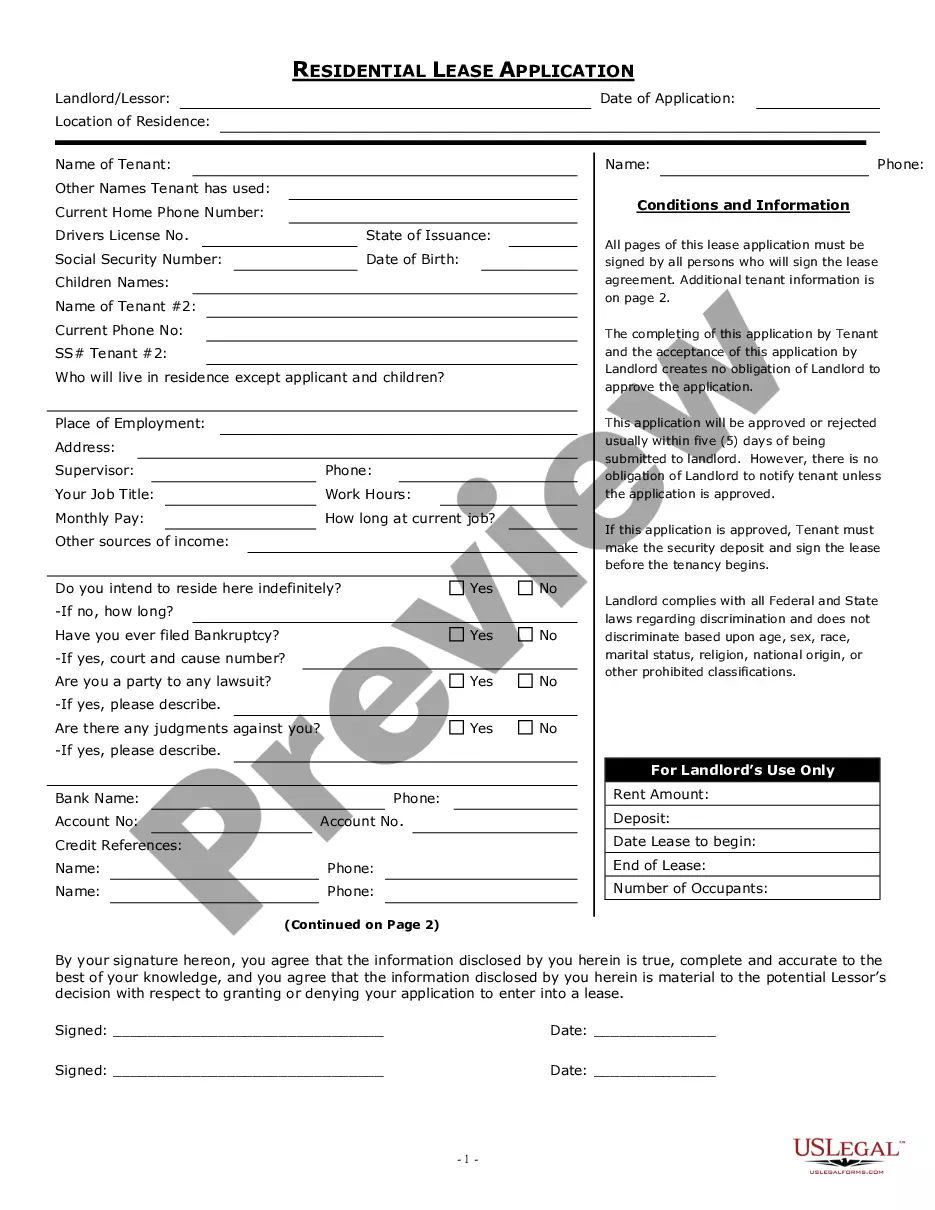

Fulton Georgia Assumption Agreement of Loan Payments is a legal document that outlines the terms and conditions under which a borrower can transfer their existing loan obligations to another party, also known as an assumption. This agreement is common in real estate transactions, wherein a buyer assumes responsibility for the existing mortgage or loan on a property located in Fulton, Georgia. Key terms and conditions included in a Fulton Georgia Assumption Agreement typically cover the rights and obligations of both the original borrower and the assumption. These may include: — Loan Transfer: The agreement specifies the terms for transferring the loan from the original borrower to the assumption. This process usually involves obtaining the lender's approval and fulfilling any requirements they may have. — Liability: The agreement defines the extent to which the original borrower remains liable for the loan after the transfer. This may include provisions for indemnification or release of liability, depending on the negotiation between parties. — Loan Terms: Details of the original loan such as the principal amount, interest rate, repayment schedule, and any existing terms and conditions are outlined. The assumption agrees to assume these conditions and perform the remaining loan payments according to the agreed-upon terms. — Lender's Consent: Typically, an assumption agreement requires the lender's consent to transfer the loan. This means that the lender, usually a financial institution, must review and approve the assumption's financial capabilities before agreeing to the transfer. — Documentation: The agreement may outline the paperwork required for the assumption process, which could include completing a loan assumption application, credit checks, income verification, and other necessary documentation. It's important to note that within the realm of Fulton Georgia Assumption Agreements, there may be different types based on the specific loan being assumed. For instance: 1. Fulton Georgia Assumption Agreement for Residential Mortgages: This type of assumption agreement is commonly used in residential real estate transactions when a buyer takes over the mortgage of a property. 2. Fulton Georgia Assumption Agreement for Commercial Loans: This type of assumption agreement applies to commercial properties, where a buyer or new business owner assumes an existing loan associated with the property. 3. Fulton Georgia Assumption Agreement for Auto Loans: In this case, a borrower transferring their auto loan obligation to another individual or party, usually in the context of selling a vehicle. 4. Fulton Georgia Assumption Agreement for Personal Loans: This type of assumption agreement applies to general personal loans, where the borrower transfers the loan responsibility to another individual. In summary, a Fulton Georgia Assumption Agreement of Loan Payments is a legally binding document that enables the transfer of loan obligations from the original borrower to an assumption. It outlines the terms for transferring the loan, the continuance of liability, loan terms, requirements for lender consent, and other key provisions. Different types of Fulton Georgia Assumption Agreements exist depending on the nature of the loan being assumed.

Fulton Georgia Assumption Agreement of Loan Payments

Description

How to fill out Fulton Georgia Assumption Agreement Of Loan Payments?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Fulton Assumption Agreement of Loan Payments, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities related to document completion straightforward.

Here's how you can locate and download Fulton Assumption Agreement of Loan Payments.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the similar forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Fulton Assumption Agreement of Loan Payments.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Fulton Assumption Agreement of Loan Payments, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to deal with an exceptionally complicated case, we recommend using the services of an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!