Orange California Assumption Agreement of Loan Payments is a legal document that pertains to the transfer of loan obligations from one party to another in Orange, California. This agreement allows the new borrower to assume the existing loan along with all its terms, conditions, and payments. An assumption agreement is typically used when a property owner intends to sell their property but cannot pay off their outstanding loan. Instead of fully paying off the loan, the seller transfers the responsibility of loan repayment to the buyer. The buyer assumes the loan balance and commits to making future payments as specified in the original loan agreement. In Orange, California, there are various types of Assumption Agreements of Loan Payments that one might come across. They include: 1. Residential Assumption Agreement: This type of assumption agreement is commonly used in residential real estate transactions. It allows a buyer to take over the seller's existing mortgage loan while assuming the responsibility for regular payments. 2. Commercial Assumption Agreement: This type of assumption agreement applies to commercial properties, such as office buildings, retail spaces, or industrial facilities. Similar to residential agreements, the buyer assumes the existing loan but tailored to the nature and needs of commercial properties. 3. FHA Assumption Agreement: This type of assumption agreement specifically pertains to loans insured by the Federal Housing Administration (FHA). It enables the buyer to assume an FHA-insured loan, typically with more flexible qualification criteria and terms. 4. VA Assumption Agreement: VA loans, backed by the Department of Veterans Affairs (VA), offer another type of assumption agreement. This agreement allows a qualified buyer, usually a veteran or a service member, to assume the existing VA loan with the approval of the VA and the lender. When entering into an Assumption Agreement of Loan Payments in Orange, California, it is crucial for both parties involved to carefully review the terms. The agreement should outline the loan amount, interest rate, payment schedule, and any other pertinent clauses from the original loan agreement. Additionally, it is essential to consult with a real estate attorney or a loan officer to ensure compliance with state and federal laws. Overall, the Orange California Assumption Agreement of Loan Payments facilitates the smooth transfer of loan obligations, enabling property owners to sell their properties and buyers to assume existing loans with the goal of achieving a seamless and beneficial transaction.

Orange California Assumption Agreement of Loan Payments

Description

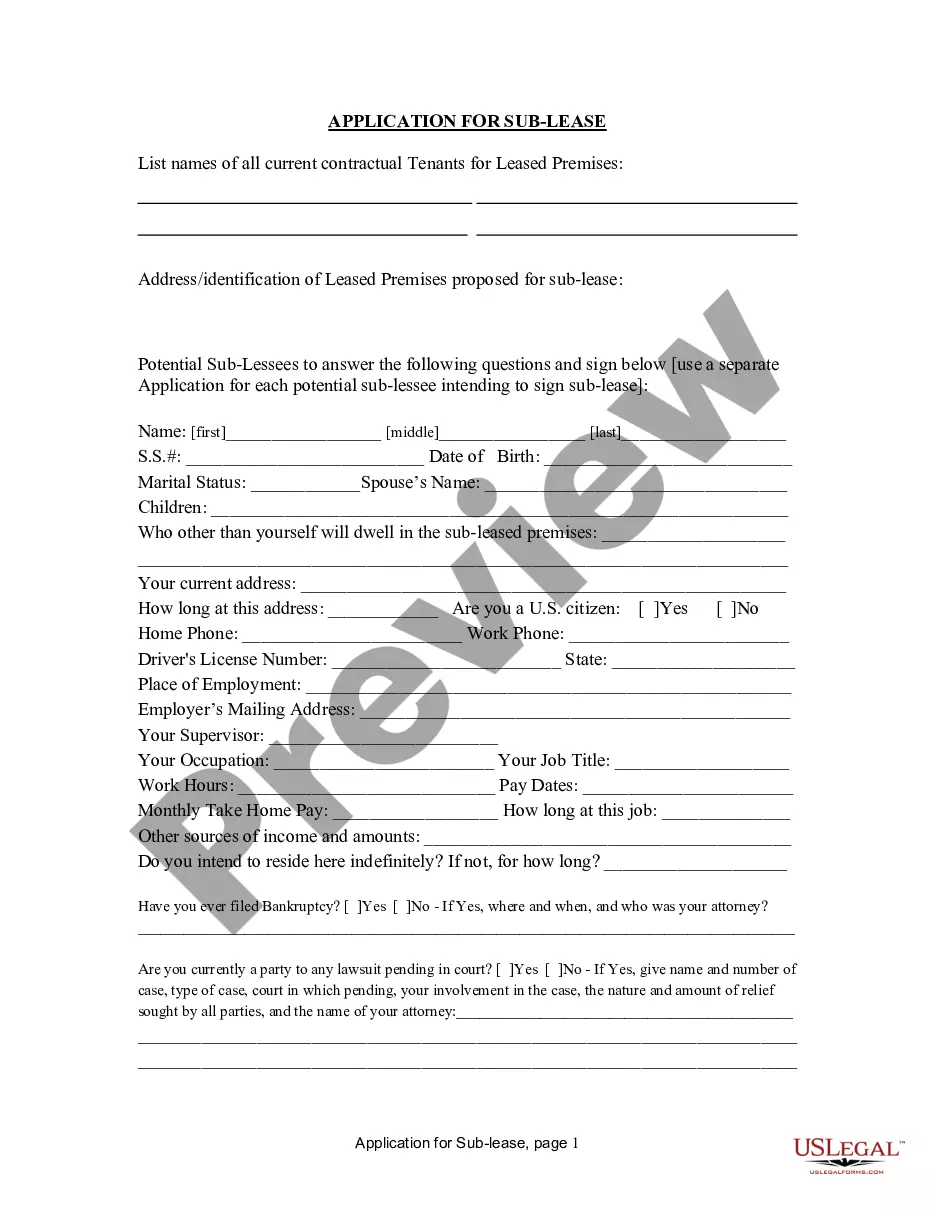

How to fill out Orange California Assumption Agreement Of Loan Payments?

Do you need to quickly create a legally-binding Orange Assumption Agreement of Loan Payments or maybe any other form to handle your own or corporate affairs? You can select one of the two options: hire a professional to draft a legal paper for you or draft it completely on your own. The good news is, there's another option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant form templates, including Orange Assumption Agreement of Loan Payments and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, carefully verify if the Orange Assumption Agreement of Loan Payments is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Orange Assumption Agreement of Loan Payments template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!