San Antonio, Texas is a vibrant city known for its rich history, vibrant cultural scene, and diverse population. Nestled in the heart of South Texas, San Antonio offers a unique blend of traditional charm and modern amenities. The city is famous for its iconic River Walk, featuring picturesque waterways, charming shops, and world-class dining options. In the context of loan payments, an assumption agreement refers to a legal contract where a borrower transfers the responsibility of loan repayment to another party. San Antonio, Texas offers several types of assumption agreements for loan payments, including: 1. Residential Assumption Agreement: This type of assumption agreement is commonly used in real estate transactions. It allows a buyer to assume the existing mortgage debt of the seller, effectively assuming the loan payments and terms. 2. Commercial Assumption Agreement: When it comes to commercial properties, such as office buildings or shopping centers, a commercial assumption agreement allows a new owner to take over the existing loan payment obligations. 3. Vehicle Assumption Agreement: In the automotive industry, individuals may seek assumption agreements when transferring vehicle ownership. This agreement allows a new owner to assume the outstanding loan payments on a car or any other type of vehicle. San Antonio, Texas, being a thriving metropolis, has a robust financial and real estate industry, making assumption agreements of loan payments common in various sectors. These agreements play a vital role in facilitating smooth and efficient transitions of ownership while maintaining the financial integrity of the loan repayment process. Whether you are a homeowner, a commercial property investor, or a prospective vehicle buyer, understanding the different types of assumption agreements available in San Antonio, Texas, is crucial. Consulting with legal professionals well-versed in local regulations and loan agreements can ensure a seamless process and help protect your rights and interests in these transactions.

San Antonio Texas Assumption Agreement of Loan Payments

Description

How to fill out San Antonio Texas Assumption Agreement Of Loan Payments?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Antonio Assumption Agreement of Loan Payments, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the latest version of the San Antonio Assumption Agreement of Loan Payments, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Assumption Agreement of Loan Payments:

- Look through the page and verify there is a sample for your area.

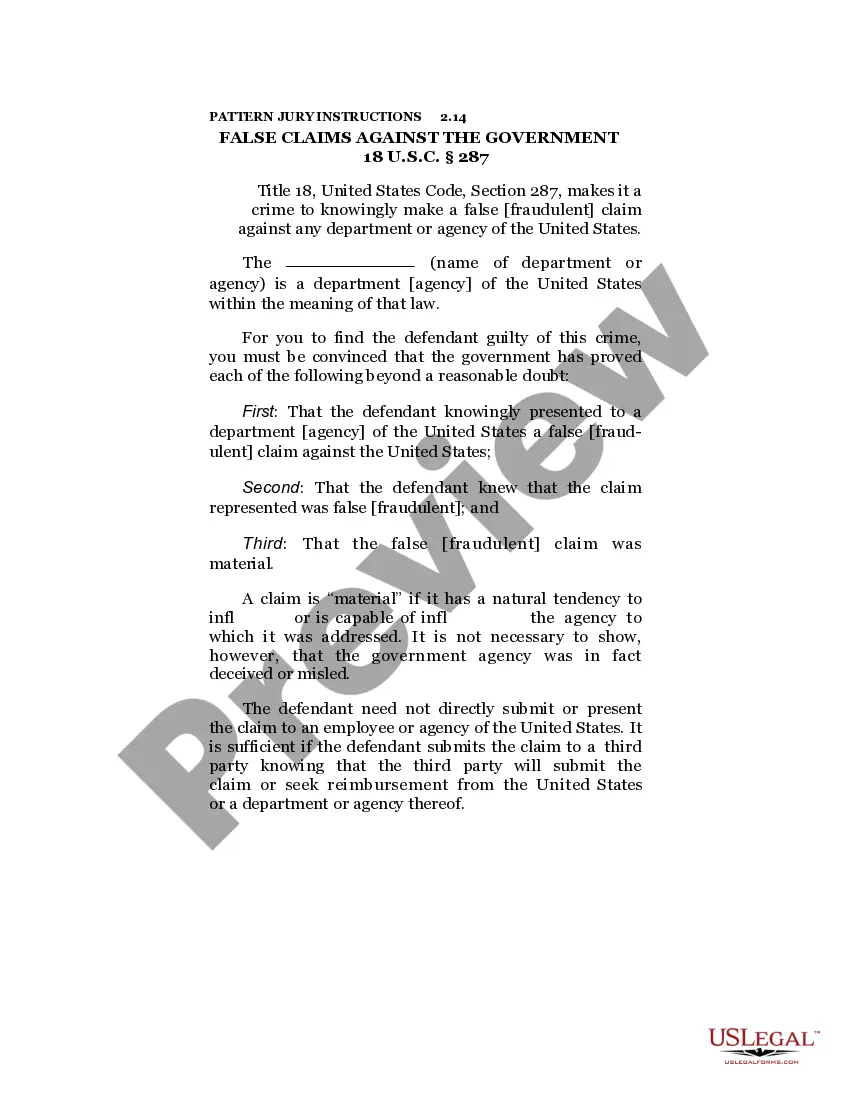

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Antonio Assumption Agreement of Loan Payments and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!