A Dallas Texas Promissory Note — Balloon Note is a legally binding agreement between a borrower and a lender that outlines the terms and conditions of a loan. Specifically, a balloon note refers to a type of promissory note where the borrower makes regular payments of interest and principal over a specified period, followed by a large sum or "balloon payment" at the end of the loan term. In the context of Dallas, Texas, a Balloon Note may be used in various financial transactions such as real estate purchases, business loans, or private loans between individuals. These notes provide flexibility for borrowers by allowing smaller periodic payments throughout the loan's term, with the significant balance due at the end. Different types of Dallas Texas Promissory Note — Balloon Note may include: 1. Residential Real Estate Balloon Note: This type of note is commonly used in real estate transactions, often for purchases involving larger properties or homes. The balloon payment is typically due after a fixed number of years, during which the borrower makes monthly mortgage payments that cover portions of the principal and interest. 2. Commercial Loan Balloon Note: It is common for commercial loans in Dallas, Texas, to have balloon notes. These financing arrangements involve businesses borrowing funds for various purposes, such as expansion, equipment purchase, or working capital. The balloon payment is usually due at the end of the loan term, allowing businesses to repay the loan over time while minimizing their monthly financial obligations. 3. Personal Loan Balloon Note: This type of balloon note can be utilized in private lending scenarios, where individuals lend money to friends, family, or acquaintances. By incorporating a balloon payment at the end of the term, lenders can gain additional interest earnings, while borrowers can enjoy smaller monthly payments until the final payment is due. Regardless of the type, it is crucial for both parties involved in a Dallas Texas Promissory Note — Balloon Note to clearly understand and agree upon the terms, including the loan amount, interest rate, repayment schedule, and the specifics of the balloon payment. Adherence to legal requirements and seeking professional advice during the creation and execution of such notes is highly recommended ensuring compliance with the applicable laws and regulations in Dallas, Texas.

Dallas Texas Promissory Note - Balloon Note

Description

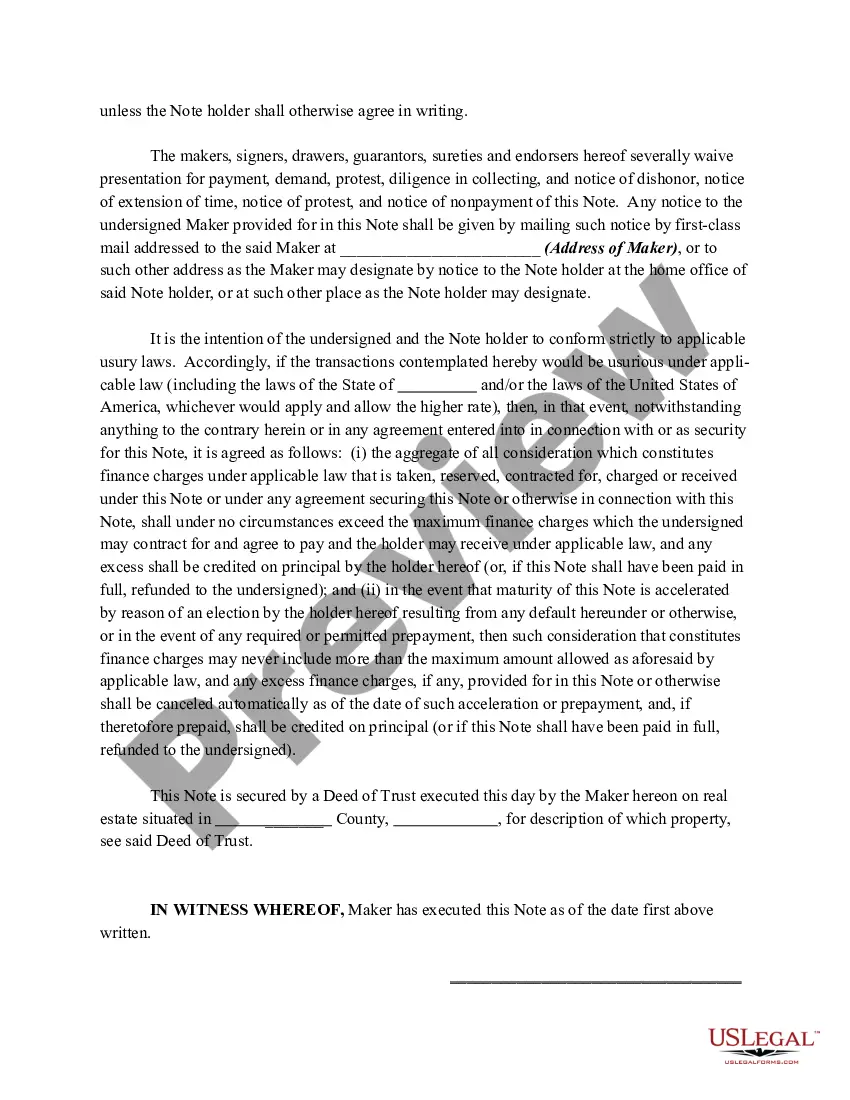

How to fill out Dallas Texas Promissory Note - Balloon Note?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Promissory Note - Balloon Note, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the recent version of the Dallas Promissory Note - Balloon Note, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Dallas Promissory Note - Balloon Note:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Dallas Promissory Note - Balloon Note and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!