Dear State Tax Commission, Regarding the decedent's estate in Cuyahoga, Ohio, I am writing to you on behalf of the estate administrator to request clarification and guidance on certain tax-related matters. Cuyahoga County, located in the state of Ohio, houses a diverse population and has a significant number of estates. The decedent's estate in question is situated within this jurisdiction. It is crucial for the estate administrator to understand the tax regulations and obligations applicable to the decedent's estate in order to fulfill their responsibilities adequately. The first matter we require clarification on is the necessary forms and documentation to be submitted to the State Tax Commission with regard to the estate administration. We kindly request information regarding the specific forms or documents required, along with any applicable deadlines that must be adhered to. Furthermore, we would appreciate guidance on the determination of estate tax liability. It is imperative for the estate administrator to comprehend the relevant laws and regulations governing estate taxes in Cuyahoga, Ohio. Clear instructions regarding the calculation methods, exemptions, or deductions available for the estate would be highly beneficial. Additionally, we would like to inquire about any potential estate tax credits or incentives that might apply to the decedent's estate. Understanding these credits and incentives, if available, would allow the estate administrator to maximize the estate's benefits while ensuring compliance with all applicable tax laws. Moreover, we kindly request the details of any additional requirements, such as mandatory disclosures or supporting documentation, that the State Tax Commission may deem necessary in the administration of the decedent's estate. A comprehensive understanding of these requirements would ensure a seamless and accurate filing process. Lastly, please provide us with any additional resources, publications, or online portals where we can access relevant materials pertaining to the tax obligations of an estate in Cuyahoga, Ohio. The estate administrator seeks to be fully informed and equipped with the necessary tools to comply with all tax requirements. In conclusion, we kindly request the State Tax Commission's guidance and support in addressing the tax-related matters pertaining to the decedent's estate in Cuyahoga, Ohio. Clarity on the required forms and documentation, guidance on tax liability determination, information on potential credits or incentives, details of any additional requirements, and access to relevant resources would greatly assist in the efficient and accurate administration of the estate. Thank you for your attention to this matter, and we look forward to your prompt response. Sincerely, [Your Name] [Your Title/Role] [Contact Information]

Cuyahoga Ohio Sample Letter to State Tax Commission concerning Decedent's Estate

Description

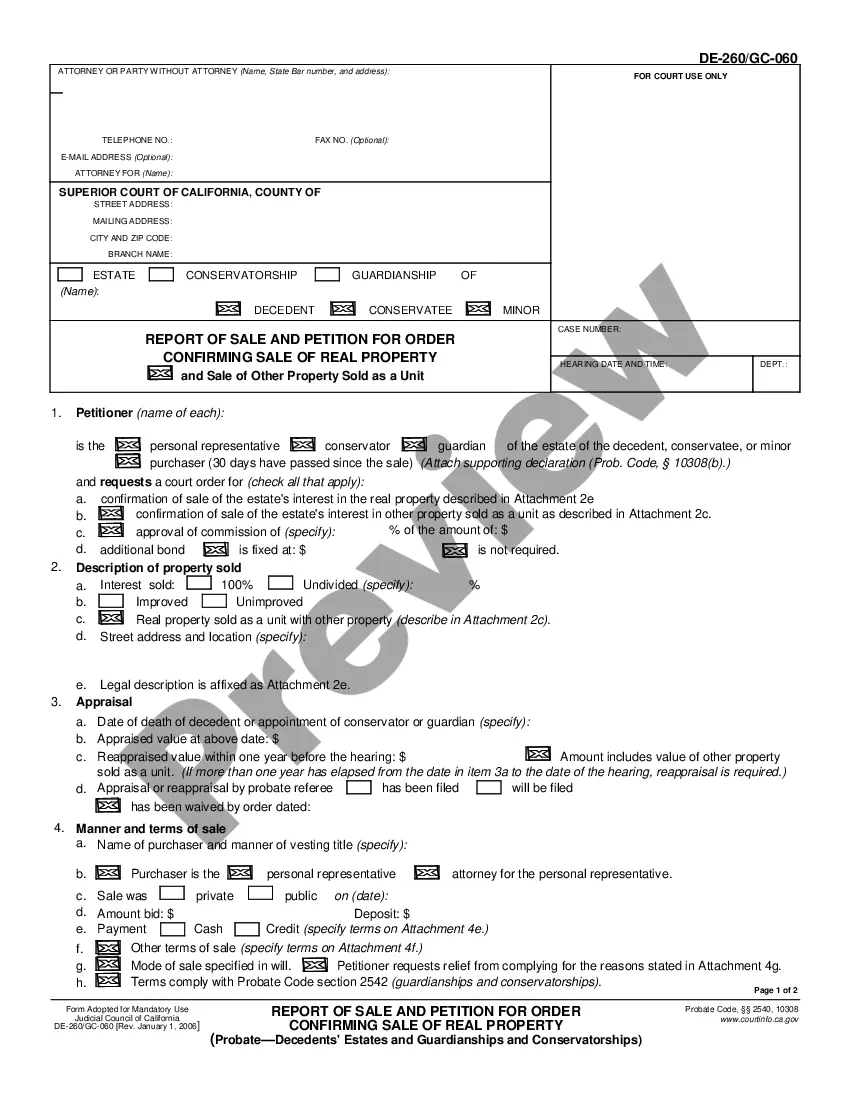

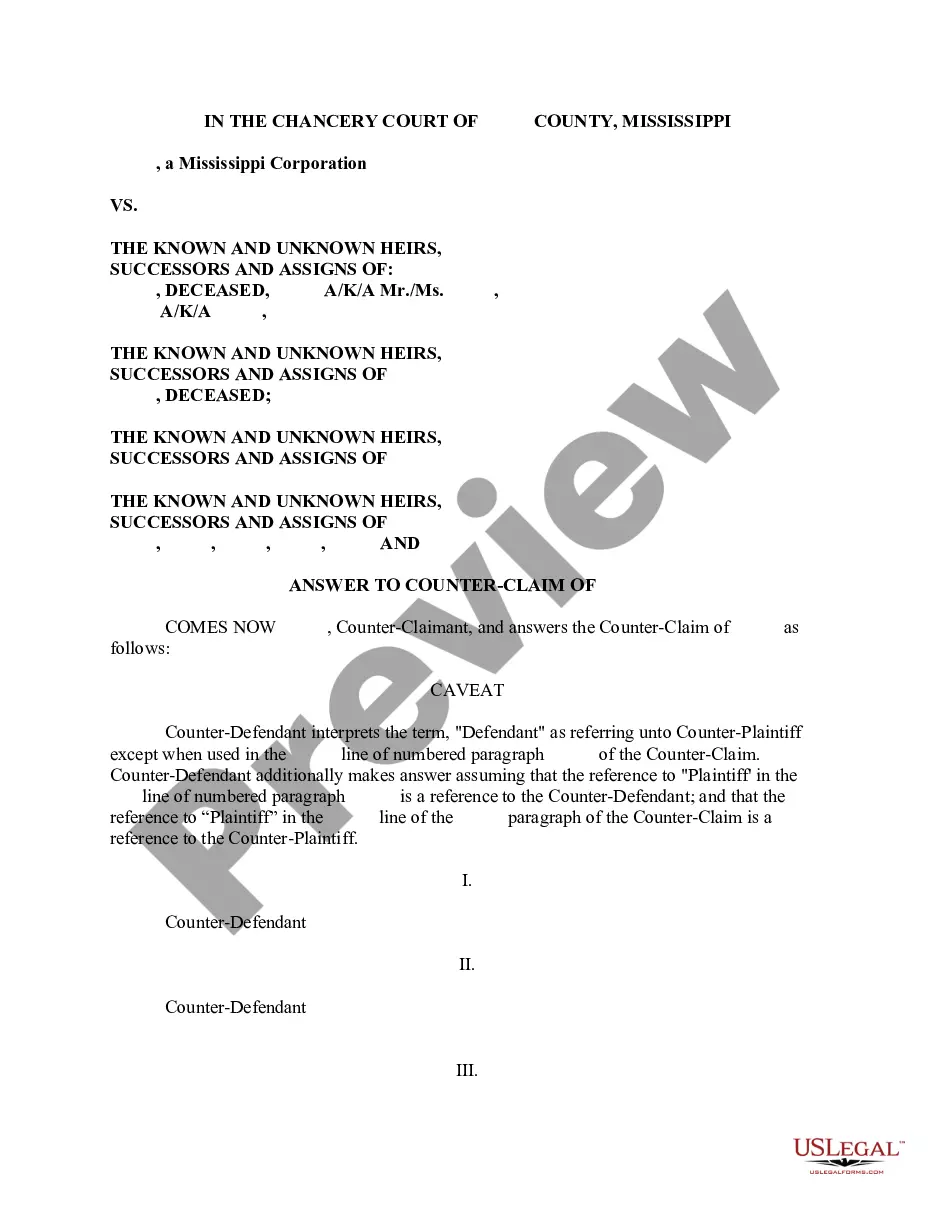

How to fill out Cuyahoga Ohio Sample Letter To State Tax Commission Concerning Decedent's Estate?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Cuyahoga Sample Letter to State Tax Commission concerning Decedent's Estate meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Apart from the Cuyahoga Sample Letter to State Tax Commission concerning Decedent's Estate, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Cuyahoga Sample Letter to State Tax Commission concerning Decedent's Estate:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Cuyahoga Sample Letter to State Tax Commission concerning Decedent's Estate.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!