The Riverside California Bill of Sale — Quitclaim is a legal document that serves as proof of the transfer of ownership rights between two parties for a specific property located in Riverside, California. This document confirms that the seller has relinquished their rights, interests, or claims to the property, and the buyer has acquired full ownership. A detailed description of the various types of Riverside California Bill of Sale — Quitclaim is as follows: 1. Residential Property Quitclaim Bill of Sale: This type of quitclaim bill of sale is used when transferring ownership of a residential property, such as a house or condominium, in Riverside, California. It outlines the details of the property being transferred, including the address, legal description, and any exemptions or conditions associated with the property. 2. Commercial Property Quitclaim Bill of Sale: This type of quitclaim bill of sale is used for the transfer of ownership rights of a commercial property, such as an office building, retail store, or industrial facility, within Riverside, California. It includes detailed information about the property, including its location, size, and any existing leases or tenants. 3. Vacant Land Quitclaim Bill of Sale: This particular type of quitclaim bill of sale is used when transferring ownership of undeveloped land in Riverside, California. It specifies the legal boundaries and restrictions, such as zoning laws or easements, associated with the vacant land being sold. 4. Vehicle or Watercraft Quitclaim Bill of Sale: This type of quitclaim bill of sale is utilized when transferring ownership rights of a vehicle or watercraft registered in Riverside, California. It includes essential details such as the Vehicle Identification Number (VIN), make, model, year, and any liens or encumbrances attached to the vehicle or watercraft being transferred. In conclusion, the Riverside California Bill of Sale — Quitclaim is a comprehensive legal document that allows for the transfer of ownership rights for various types of properties, including residential, commercial, vacant land, vehicles, and watercraft. These different types of quitclaim bills of sale are specifically tailored to meet the requirements and legal obligations set forth by the Riverside, California jurisdiction.

Riverside California Bill of Sale - Quitclaim

Description

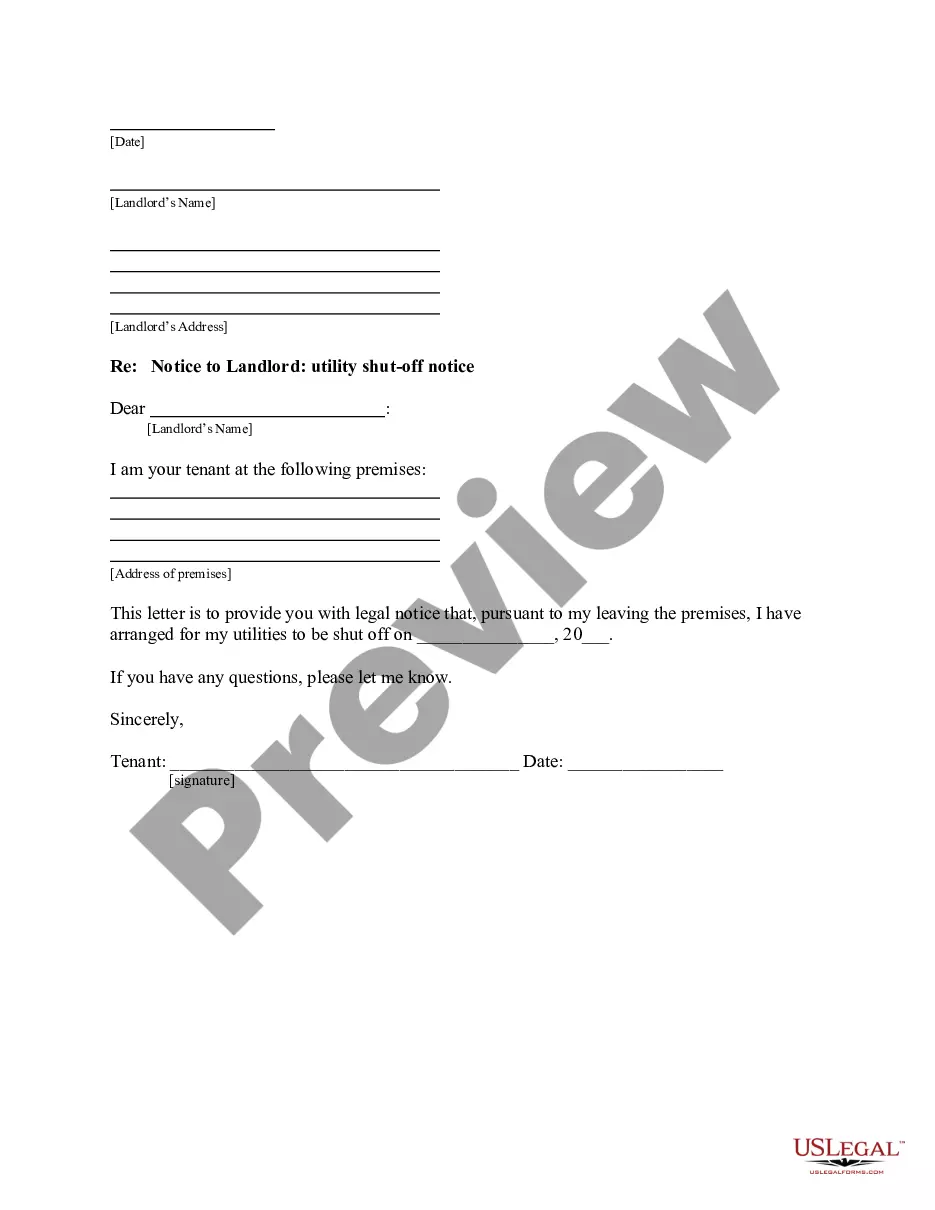

How to fill out Riverside California Bill Of Sale - Quitclaim?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Riverside Bill of Sale - Quitclaim, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Riverside Bill of Sale - Quitclaim from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Riverside Bill of Sale - Quitclaim:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

The tax rate is $0.55 for each $500 or fraction thereof when the consideration or value of the interest or property conveyed, exclusive of the value of any lien or encumbrance remaining at the time of sale, exceeds $100. Within the City of Riverside the tax rate is $1.10 per $500.

Riverside County, CaliforniaCounty Administrative Center. 4080 Lemon St, 1st floor / PO Box 751, Riverside, California 92501 / 92502-0751.Gateway Office. 2724 Gateway Dr, Riverside, California 92507.Hemet Office.Palm Desert Office.Temecula Office.Blythe Office.

Calculations of California Real Property Transfer Tax Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

Riverside County, CaliforniaCounty Administrative Center. 4080 Lemon St, 1st floor / PO Box 751, Riverside, California 92501 / 92502-0751.Gateway Office. 2724 Gateway Dr, Riverside, California 92507.Hemet Office.Palm Desert Office.Temecula Office.Blythe Office.

It requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice, except those expressly exempted from payment of recording fees, per each transaction per parcel of real property, not to exceed $225 per single transaction.

The tax rate is $0.55 for each $500 or fraction thereof when the consideration or value of the interest or property conveyed, exclusive of the value of any lien or encumbrance remaining at the time of sale, exceeds $100. Within the City of Riverside the tax rate is $1.10 per $500.

As in other states, a quitclaim deed in California comes with filing costs, which vary by county. As of 2018, for example, the costs in Los Angeles County include a base fee of $15 and additional fees of approximately $87. Additional pages filed are $3 each. The cost is reasonable compared to fees in other states.

In California, there are several ways to record real estate documents:In-person submission. Under this option, a person or his messenger service may visit the county recorder's office to submit the recording over the counter.Mail-in recording.Use of a title company or attorney courier service.

Online processing time is 48 hours. This is our average processing time, which may occasionally increase as our volume of requests increases. We will mail you your record upon completion. The County of Riverside is not responsible for the delivery of mail by the United States Post Office or any other delivery service.

Interesting Questions

More info

Then the next owner can buy the house. In return the owner forfeits his rights to ownership, including all proceeds from any sale of the home. A quitclaim deed is also sometimes used by a buyer to gain purchase title. In this case, the buyer assumes all rights to the home and transfers the owner's registration to the buyer in any subsequent sale. The transfer of registration is made with the approval of the County Assessor and the City Clerk. To become a quitclaim deed owner, a person must obtain a Certificate of Qualification from the California Department of Housing and Community Development (DCD). If not, he must complete a California Residential Landlord-Tenant Act (RPT 6010) course. Residential Tenancies Act (RTA) (Cal. CIV.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.