A Fairfax Virginia Buy Sell Agreement Between Shareholders and a Corporation is a legal document that outlines the terms and conditions for the purchase or sale of shares in a corporation located in Fairfax, Virginia. This agreement serves as a protection mechanism for both the corporation and its shareholders in the event of certain triggering events such as the death, disability, retirement, or voluntary departure of a shareholder. In this jurisdiction, there are several types of Buy Sell Agreements commonly used: 1. Cross-Purchase Agreement: This type of agreement enables the remaining shareholders to purchase the shares of a departing shareholder. Each shareholder agrees to buy a proportionate share of the departing shareholder's stock, typically based on their ownership percentage. 2. Redemption Agreement: In a Redemption Agreement, the corporation itself has the right and obligation to buy back the departing shareholder's stock. The remaining shareholders' ownership percentages increase proportionately as a result of the redemption. 3. Hybrid Agreement: A Hybrid Agreement combines the elements of both cross-purchase and redemption agreements. It offers flexibility in determining whether the corporation or the individual shareholders will be responsible for purchasing the departing shareholder's stock. Key provisions included in a Fairfax Virginia Buy Sell Agreement Between Shareholders and a Corporation may encompass: — Purchase Price: The agreement will specify the method of valuing the shares to determine the purchase price, such as fair market value or a pre-determined formula. — Triggering Events: The events that will trigger the buy-sell provisions, such as death, disability, retirement, or voluntary departure of a shareholder. — Right of First Refusal: The agreement may grant shareholders the right of first refusal to purchase the shares before they can be sold to an external party. — Payment Terms: The agreement will outline the terms of payment, whether it is a lump-sum payment, installment payments, or through a loan. — Non-Compete and Non-Disclosure: To protect the interests of the corporation, shareholders may be required to agree to non-compete and non-disclosure clauses to prevent them from starting similar businesses or sharing sensitive information with competitors. — Dispute Resolution: The agreement may include provisions for resolving potential disputes, such as through mediation or arbitration, to avoid costly and time-consuming litigation. Overall, a Fairfax Virginia Buy Sell Agreement Between Shareholders and a Corporation is a crucial legal document that provides clarity and security to shareholders and the corporation itself. It ensures a smooth transition in ownership and minimizes potential conflicts while protecting the best interests of both parties involved.

Fairfax Virginia Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Fairfax Virginia Buy Sell Agreement Between Shareholders And A Corporation?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Fairfax Buy Sell Agreement Between Shareholders and a Corporation meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Fairfax Buy Sell Agreement Between Shareholders and a Corporation, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Fairfax Buy Sell Agreement Between Shareholders and a Corporation:

- Check the content of the page you’re on.

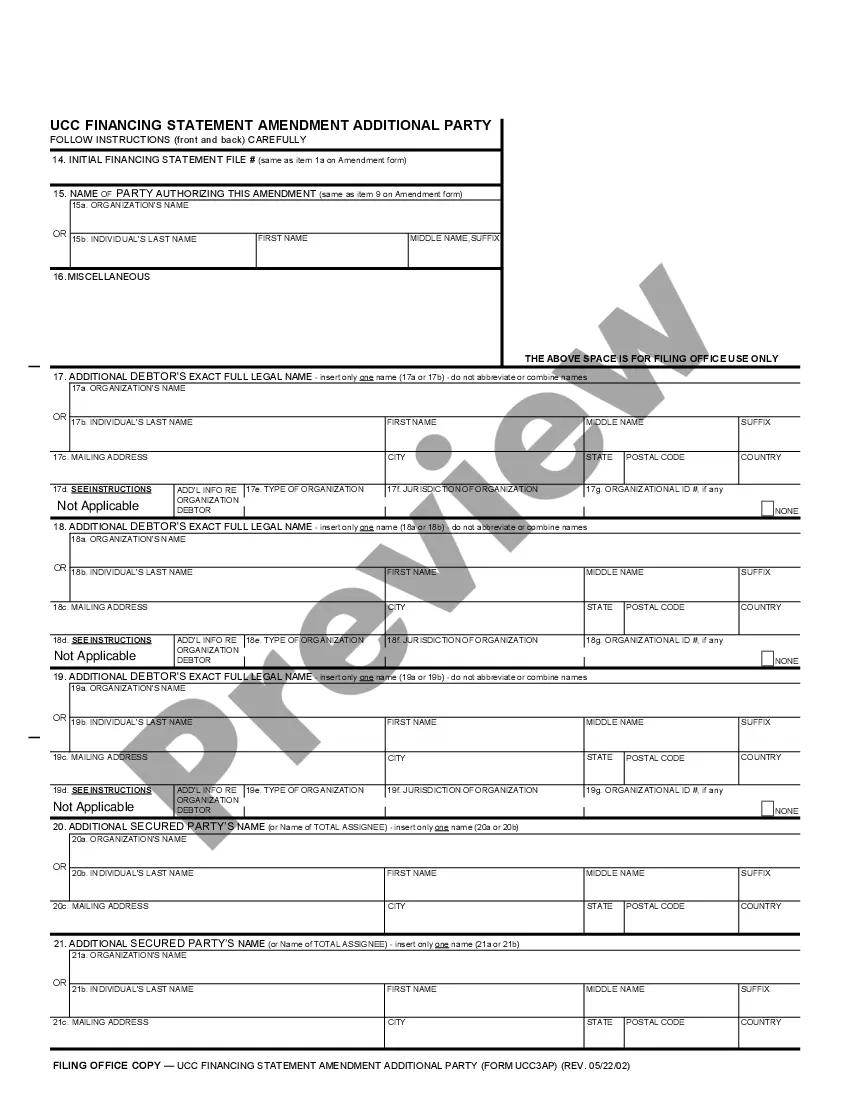

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Fairfax Buy Sell Agreement Between Shareholders and a Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!