A Fulton Georgia Buy Sell Agreement Between Shareholders and a Corporation is a legally binding agreement that outlines the terms and conditions for buying and selling shares in a corporation located in Fulton County, Georgia. This agreement is essential for safeguarding the interests of both the shareholders and the corporation in the event of certain triggering events, such as death, disability, retirement, or voluntary departure of a shareholder. The main purpose of the Fulton Georgia Buy Sell Agreement Between Shareholders and a Corporation is to establish a fair and orderly process for the transfer of shares. It sets out the procedures to be followed, the pricing mechanism for the shares, and the conditions under which the shares can be sold or transferred. This agreement promotes transparency, clarity, and certainty in the transfer process to minimize disputes between the parties involved. There are different types of Buy Sell Agreements that can be tailored to suit the specific needs of the shareholders and the corporation. Some common variations include: 1. Cross-Purchase Agreement: In this type of agreement, the remaining shareholders have the right or obligation to purchase the shares of the departing shareholder. This can be advantageous when there is a few shareholders. 2. Stock Redemption Agreement: Here, the corporation itself has the right or obligation to repurchase the shares from the departing shareholder. This is typically beneficial when there are many shareholders. 3. Hybrid Agreement: This type of agreement combines both the cross-purchase and stock redemption elements. It allows either the remaining shareholders or the corporation to purchase the shares, depending on certain circumstances or events. A Fulton Georgia Buy Sell Agreement Between Shareholders and a Corporation usually includes several key provisions, such as: — Purchase Price: The agreed-upon price or valuation method for the shares. — Payment Terms: How the purchase price will be paid (e.g., lump sum, installment payments). — Triggers: The events that trigger the buyout, such as death, disability, or retirement. — Right of First Refusal: The rights of existing shareholders to purchase shares before they are sold to an external party. — Non-Compete Clauses: Restrictions on departing shareholders from competing with the corporation. — Dispute Resolution: The process for resolving any conflicts or disagreements that may arise during the buyout process. — Governing Law: The specific laws of Fulton County, Georgia, that will govern the agreement. In conclusion, a Fulton Georgia Buy Sell Agreement Between Shareholders and a Corporation is a vital legal document that outlines the terms and procedures for buying and selling shares within a corporation. It plays a crucial role in ensuring a fair and orderly transfer process while protecting the interests of both shareholders and the corporation.

Fulton Georgia Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Fulton Georgia Buy Sell Agreement Between Shareholders And A Corporation?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Fulton Buy Sell Agreement Between Shareholders and a Corporation meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Fulton Buy Sell Agreement Between Shareholders and a Corporation, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Fulton Buy Sell Agreement Between Shareholders and a Corporation:

- Examine the content of the page you’re on.

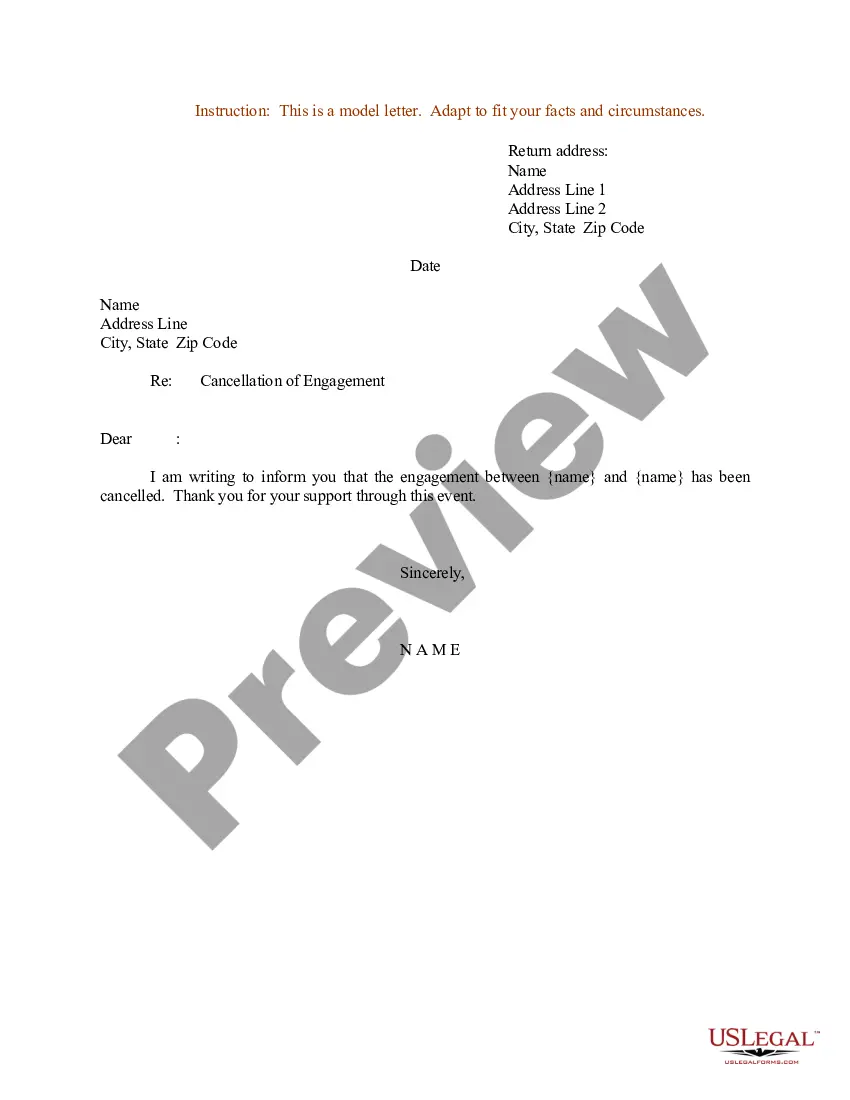

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fulton Buy Sell Agreement Between Shareholders and a Corporation.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!