A Houston Texas Buy Sell Agreement Between Shareholders and a Corporation is a legally binding contract that outlines the terms and conditions for the buying and selling of shares between shareholders and the corporation in the city of Houston, Texas. This agreement helps ensure a smooth transition of ownership and protects the interests of both parties involved. Keywords: Houston Texas, buy sell agreement, shareholders, corporation There are different types of Houston Texas Buy Sell Agreements between shareholders and a corporation, each tailored to specific circumstances and requirements. Here are a few examples: 1. Cross-Purchase Buy Sell Agreement: This type of agreement occurs when shareholders agree to purchase shares from each other in the event of a predetermined trigger, such as a retirement, death, disability, or voluntary exit from the corporation. Cross-purchase agreements are typically used in corporations with a few shareholders. 2. Entity-Purchase Buy Sell Agreement: In this type of agreement, the corporation itself agrees to purchase the shares from the exiting shareholder. The corporation is responsible for funding the purchase of shares, usually through insurance policies or company funds. Entity-purchase agreements are common in corporations where there are numerous shareholders. 3. One-way Buy Sell Agreement: This agreement involves only one party, such as the corporation, having the option to buy shares from a shareholder. It provides protection for the corporation in situations where a shareholder wants to exit the company. 4. Two-way Buy Sell Agreement: A two-way buy sell agreement allows both the corporation and the shareholders to have the option to buy or sell shares to each other. This type of agreement is suitable for corporations with multiple shareholders and ensures a fair and orderly process for buying and selling shares. Houston, Texas is home to numerous corporations in various industries, and a well-drafted Buy Sell Agreement is essential to ensure a smooth transfer of ownership and protect the interests of shareholders and the corporation. In conclusion, a Houston Texas Buy Sell Agreement Between Shareholders and a Corporation is a crucial legal document that outlines the terms and conditions for buying and selling shares between shareholders and the corporation. Different types of agreements, such as cross-purchase, entity-purchase, one-way, and two-way, cater to different scenarios and requirements. These agreements enable a seamless transition of ownership and safeguard the interests of all parties involved in the bustling business environment of Houston, Texas.

Houston Texas Buy Sell Agreement Between Shareholders and a Corporation

Description

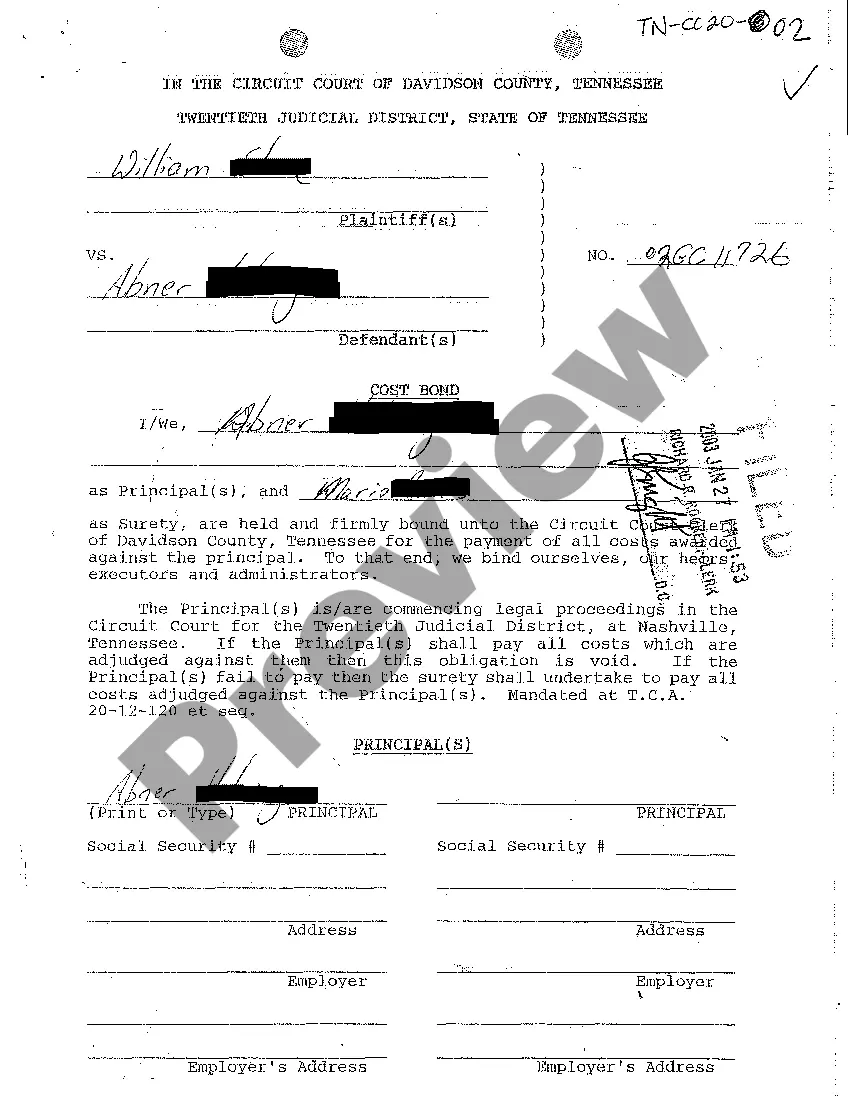

How to fill out Houston Texas Buy Sell Agreement Between Shareholders And A Corporation?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Houston Buy Sell Agreement Between Shareholders and a Corporation, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Houston Buy Sell Agreement Between Shareholders and a Corporation from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Houston Buy Sell Agreement Between Shareholders and a Corporation:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

In an entity purchase buy-sell agreement, the business itself buys separate life insurance policies on the lives of each of the co-owners. The business usually pays the annual premiums and is the owner and beneficiary of the policies.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The way a buy-sell agreement works is that a clear transition for ownership of the business when each partner passes away or chooses to leave the business is decided upon. This legal agreement is most commonly used in the instances of sole proprietorships, closed corporations and partnerships.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.