Oakland Michigan Buy Sell Agreement Between Shareholders and a Corporation is a legal document that outlines the terms and conditions under which shareholders can buy and sell shares of a corporation. This agreement is designed to provide clarity and structure to the process of transferring ownership interests in the company. It helps protect the interests of both the corporation and the shareholders, and ensures a smooth transition of ownership. A typical Oakland Michigan Buy Sell Agreement Between Shareholders and a Corporation includes several key provisions. First, it outlines the circumstances under which a shareholder can sell their shares, such as death, disability, retirement, or voluntary departure. It may also include preemptive rights, which allow existing shareholders to purchase the shares of a departing shareholder before they can be sold to an outside party. The agreement also establishes the valuation method for determining the price of shares. Common methods include using a fixed formula, obtaining an independent appraisal, or relying on a specified book value. This ensures that the selling shareholder receives a fair price and prevents disputes over the value of the shares. Additionally, the agreement may include provisions related to the funding of share purchases. It can require shareholders to maintain life insurance policies to fund the buyout of shares upon their death, or establish a sinking fund or a line of credit to provide funding for share purchases in other circumstances. There are different types of Oakland Michigan Buy Sell Agreement Between Shareholders and a Corporation that can be tailored to suit specific needs. Some common variations include: 1. Cross-Purchase Agreement: In a cross-purchase agreement, the remaining shareholders have the first right to purchase the shares of a departing shareholder. This type of agreement is beneficial in smaller corporations with a limited number of shareholders. 2. Stock Redemption Agreement: In a stock redemption agreement, the corporation itself has the right and the obligation to buy back shares from a departing shareholder. This type of agreement is often preferred in larger corporations with multiple shareholders. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and stock redemption agreements. It allows the remaining shareholders and the corporation to have the option of buying back shares depending on the circumstances. In conclusion, an Oakland Michigan Buy Sell Agreement Between Shareholders and a Corporation is a crucial legal document that governs the buying and selling of shares within a corporation. It provides a framework for the transfer of ownership interests, valuation of shares, and funding mechanisms. Different types of agreements can be customized to meet the specific needs of the corporation and its shareholders.

Oakland Michigan Buy Sell Agreement Between Shareholders and a Corporation

Description

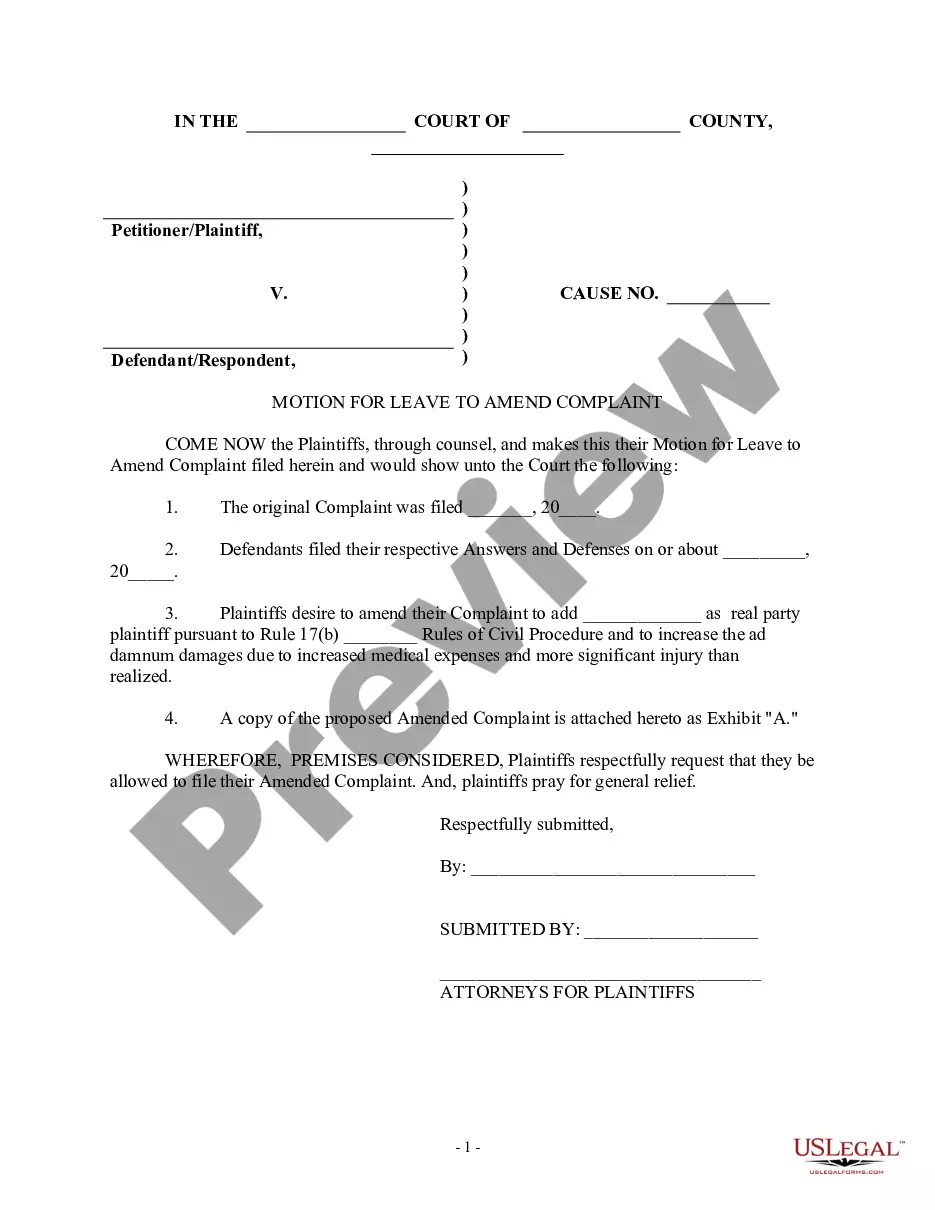

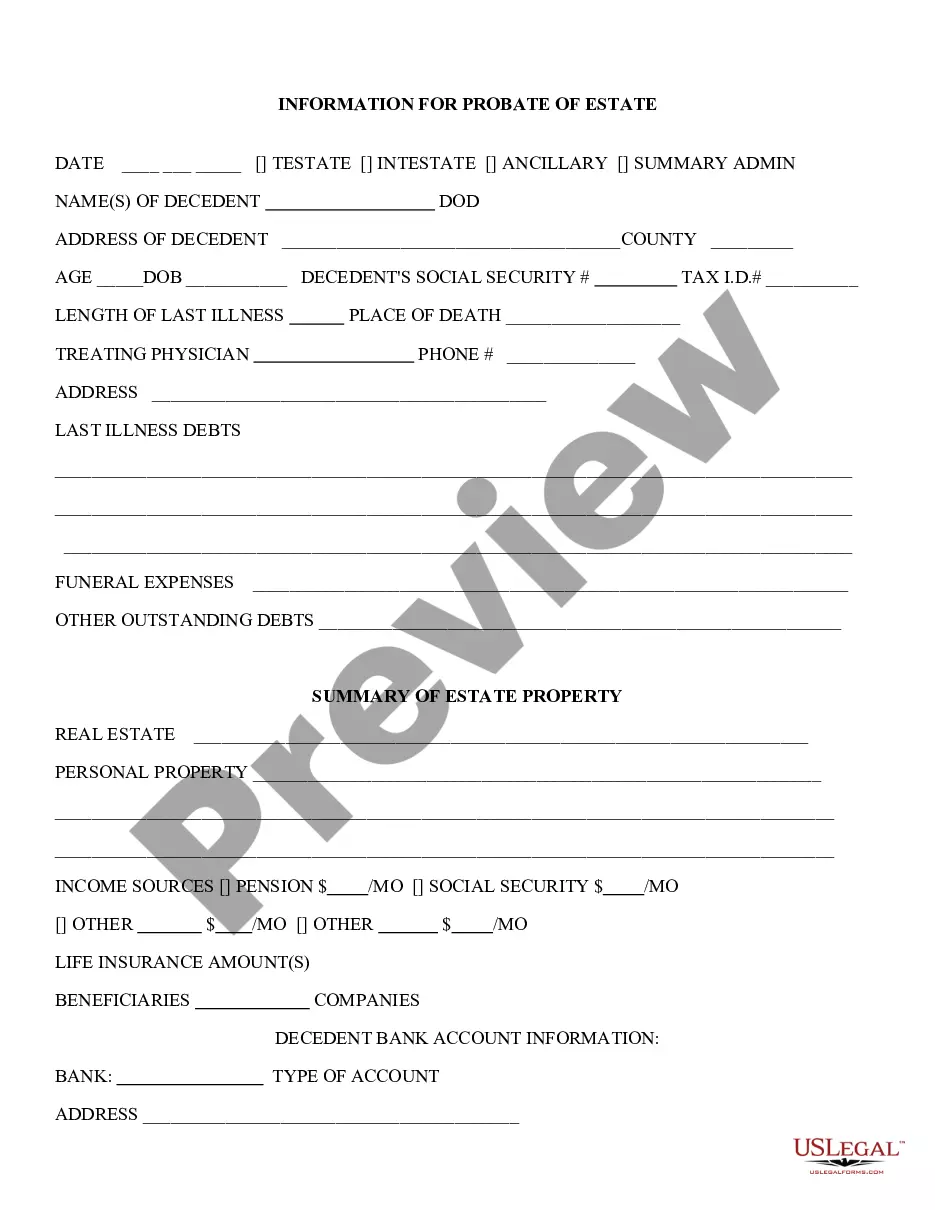

How to fill out Oakland Michigan Buy Sell Agreement Between Shareholders And A Corporation?

If you need to find a reliable legal document provider to obtain the Oakland Buy Sell Agreement Between Shareholders and a Corporation, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to find and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to look for or browse Oakland Buy Sell Agreement Between Shareholders and a Corporation, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Oakland Buy Sell Agreement Between Shareholders and a Corporation template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Oakland Buy Sell Agreement Between Shareholders and a Corporation - all from the comfort of your sofa.

Join US Legal Forms now!