Lima, Arizona Commercial Lease — Short Form for Recording Notice of Lease serves as a legal document that outlines the terms and conditions of a commercial lease agreement in the city of Lima, Arizona. This document is crucial for protecting the rights and interests of both the landlord and the tenant. The Lima, Arizona Commercial Lease — Short Form for Recording Notice of Lease covers various aspects of the lease, including the duration of the lease, rent payments, security deposits, permitted use of the property, maintenance responsibilities, and any additional terms and conditions agreed upon by both parties. This lease agreement is designed specifically for commercial properties in Lima, Arizona and complies with the relevant state and local laws. It is ideal for landlords and tenants seeking a simplified and straightforward lease document. There may be different types or variations of the Lima, Arizona Commercial Lease — Short Form for Recording Notice of Lease, depending on specific requirements or lease arrangements. Some possible variations may include: 1. Triple Net Lease: This type of lease includes clauses that require the tenant to pay for additional expenses, such as property taxes, insurance, and maintenance costs, on top of the base rent. 2. Gross Lease: In a gross lease, the landlord assumes the responsibility for most operating expenses, including property taxes, insurance, and maintenance costs. The tenant pays a fixed rent amount without any added expenses. 3. Percentage Lease: This lease structure is common for retail properties, where the tenant pays a base rent plus a percentage of their gross sales. 4. Short-term Lease: This type of lease spans a shorter duration, typically for a few months or a year. It might be suitable for businesses looking for flexibility or temporary space. 5. Long-term Lease: On the other hand, a long-term lease typically involves a commitment of several years, providing stability for both the tenant and the landlord. It is crucial for both parties to carefully review and negotiate all terms within the Lima, Arizona Commercial Lease — Short Form for Recording Notice of Lease to ensure mutual understanding and protection. Seeking legal advice is often recommended ensuring compliance with local and state laws, as well as to address any specific requirements or concerns of each party involved.

Pima Arizona Commercial Lease - Short Form for Recording Notice of Lease

Description

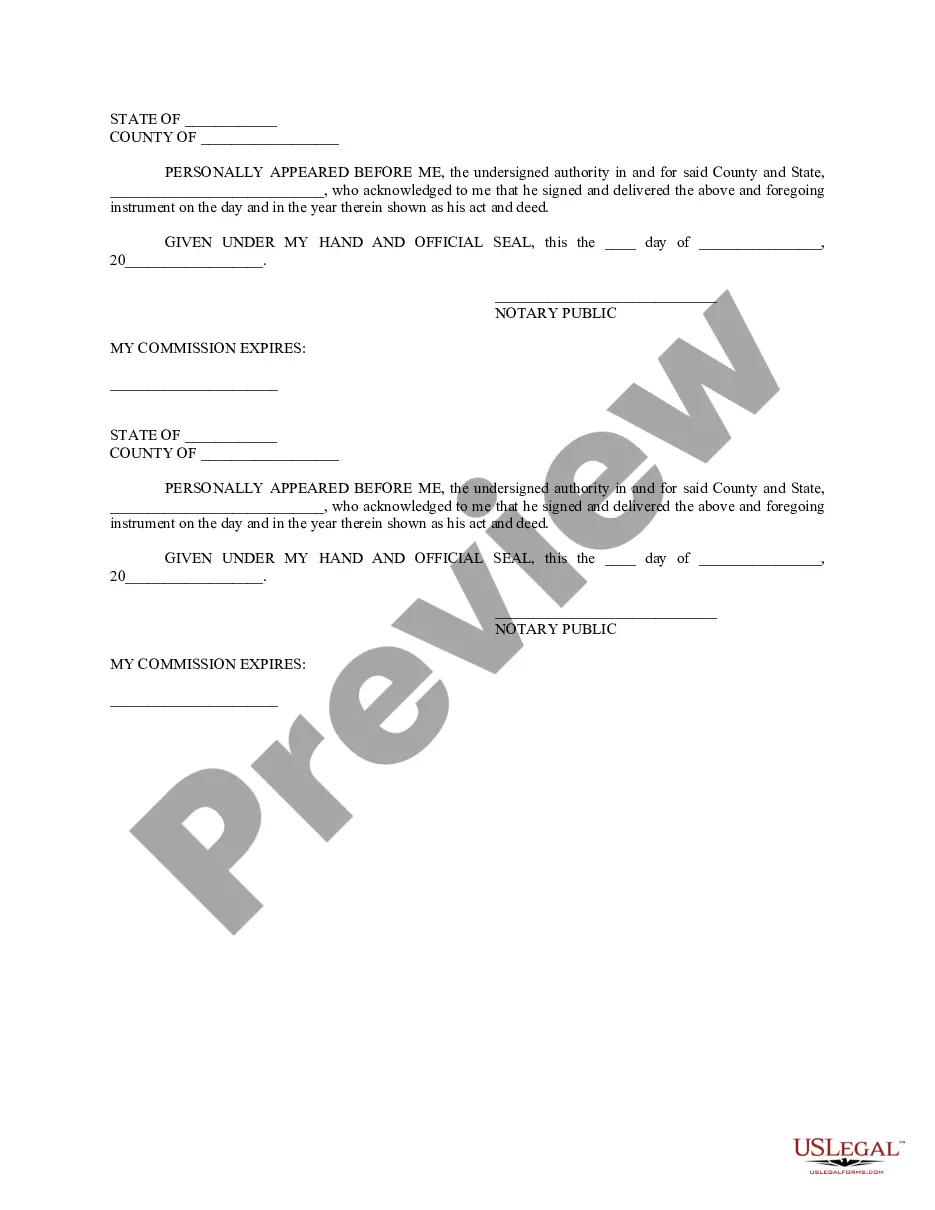

How to fill out Pima Arizona Commercial Lease - Short Form For Recording Notice Of Lease?

If you need to find a reliable legal form provider to get the Pima Commercial Lease - Short Form for Recording Notice of Lease, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to find and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Pima Commercial Lease - Short Form for Recording Notice of Lease, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Pima Commercial Lease - Short Form for Recording Notice of Lease template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Pima Commercial Lease - Short Form for Recording Notice of Lease - all from the convenience of your sofa.

Join US Legal Forms now!