San Bernardino California Commercial Lease — Short Form for Recording Notice of Lease is a legally binding document that establishes the terms and conditions of a commercial lease agreement in the city of San Bernardino, California. This form is used to publicly record the lease agreement in the county's official records, ensuring its enforceability and providing notice to potential interested parties. The San Bernardino California Commercial Lease — Short Form for Recording Notice of Lease typically includes vital information such as the names and addresses of the landlord and tenant, the location and description of the commercial premises, the lease term and options, rent payment details, security deposit requirements, permitted use of the premises, maintenance and repair obligations, indemnification clauses, insurance requirements, and dispute resolution procedures. There may be different types or variations of the San Bernardino California Commercial Lease — Short Form for Recording Notice of Lease, depending on specific situations or requirements. Some potential types could include: 1. Modified Gross Lease: This type of lease typically involves a base rent amount that includes common area maintenance charges, property taxes, and insurance, while the tenant pays separately for utilities, janitorial services, and other operational expenses. 2. Triple Net Lease: In a triple net lease, the tenant is responsible for paying all property-related expenses, including property taxes, insurance, and maintenance costs, in addition to the base rent. 3. Percentage Lease: This type of lease is commonly used in retail settings, where the tenant pays a base rent plus a percentage of their gross sales as rent. It offers a flexible rental structure, allowing the landlord to benefit from the tenant's success. 4. Ground Lease: A ground lease primarily applies to vacant land, enabling tenants to construct a building or operate a business on the leased premises. It typically has a long-term duration, and the leased land reverts to the landlord at the end of the lease term, including any improvements made by the tenant. It is important to consult with a qualified attorney or real estate professional when drafting or negotiating a San Bernardino California Commercial Lease — Short Form for Recording Notice of Lease to ensure compliance with local laws, protect both parties' interests, and address any specific requirements or circumstances relevant to the lease agreement.

San Bernardino California Commercial Lease - Short Form for Recording Notice of Lease

Description

How to fill out San Bernardino California Commercial Lease - Short Form For Recording Notice Of Lease?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including San Bernardino Commercial Lease - Short Form for Recording Notice of Lease, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information resources and tutorials on the website to make any activities related to document execution simple.

Here's how you can purchase and download San Bernardino Commercial Lease - Short Form for Recording Notice of Lease.

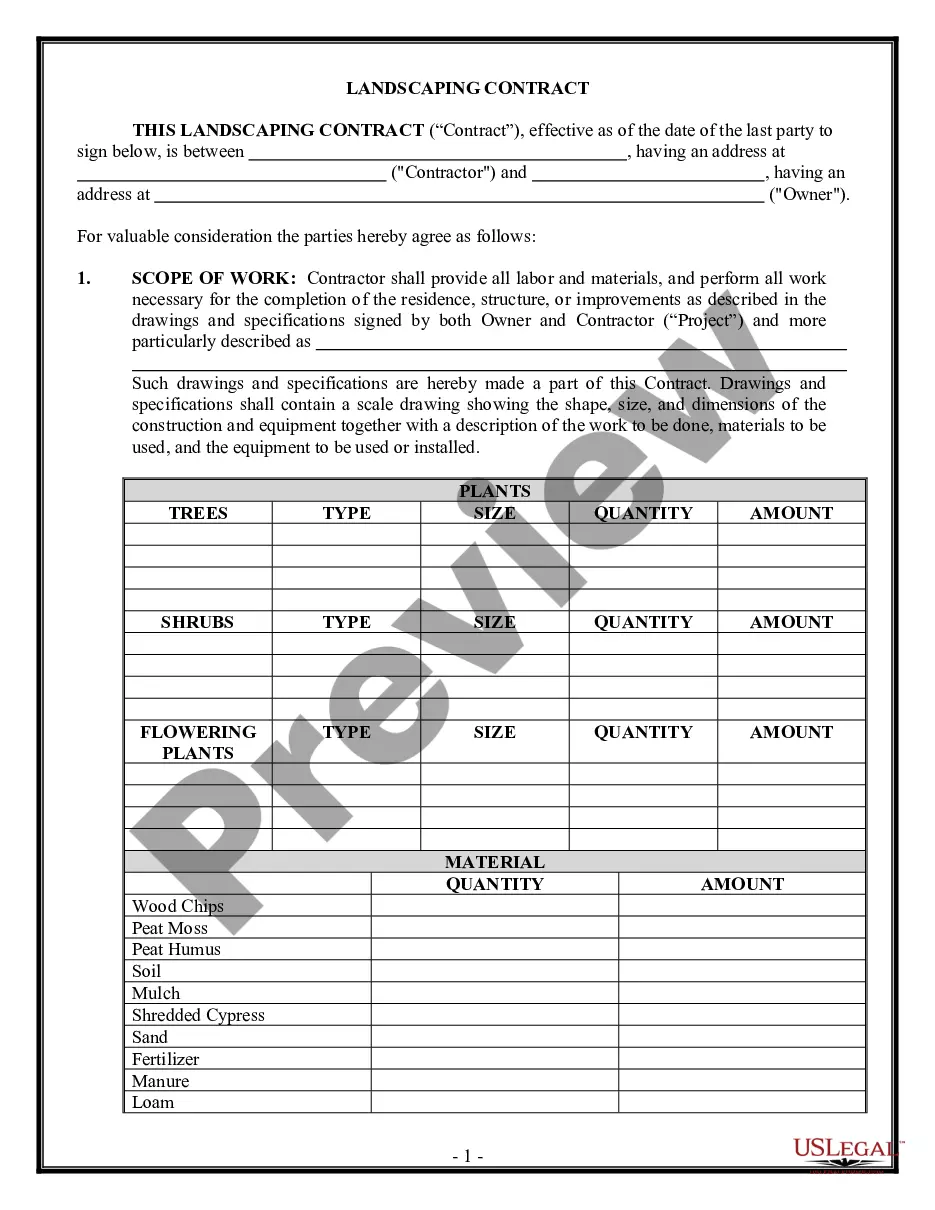

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related document templates or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase San Bernardino Commercial Lease - Short Form for Recording Notice of Lease.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Bernardino Commercial Lease - Short Form for Recording Notice of Lease, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to deal with an extremely complicated case, we advise getting a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!