Wayne, Michigan Donation or Gift to Charity of Personal Property: A Comprehensive Guide Introduction: In Wayne, Michigan, individuals have the opportunity to give back to society by making donations or gifts of personal property to charitable organizations. This act not only benefits those in need but also provides tax advantages for the donors. This detailed description aims to outline the types of donations or gifts available, the benefits they offer, and the process involved. Types of Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Cash Donations: Donating money to a charitable organization in Wayne, Michigan allows donors to claim a tax deduction on their federal tax returns. Cash donations can support various causes ranging from educational programs and healthcare services to environmental initiatives and poverty alleviation efforts. 2. Vehicle Donations: People in Wayne, Michigan can donate their cars, trucks, motorcycles, or boats to eligible nonprofit organizations. These vehicles are usually sold by the charity to provide funds for their programs. Donors can benefit from tax deductions based on the fair market value of the donated vehicle. 3. Real Estate Donations: Those owning real estate in Wayne, Michigan can donate residential, commercial, or vacant properties to charitable organizations. This type of donation provides significant tax advantages, including deductions for the fair market value of the property at the time of donation. 4. Stock or Securities Donations: Donating appreciated stocks, bonds, or other securities to qualified charitable organizations in Wayne, Michigan can result in two-fold benefits. Donors can avoid capital gains tax on the appreciated value of the securities and claim a deduction for the fair market value of the securities on their tax returns. 5. Clothing and Household Item Donations: Individuals can donate unwanted clothing, furniture, appliances, or other household items to local charities, thrift stores, or donation centers in Wayne, Michigan. These donations help nonprofits generate funds through reselling or provide direct assistance to those in need. Benefits of Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Tax Deductions: All eligible donation types allow individuals to deduct the fair market value of the donated property on their federal tax returns. This deduction helps reduce the overall taxable income, potentially resulting in significant tax savings. 2. Social Impact: Donations make a positive impact on the community, supporting various causes and charitable organizations that work towards improving the lives of individuals in Wayne, Michigan. 3. Environmental Sustainability: By donating or recycling used items, individuals contribute to reducing waste and promoting a sustainable lifestyle within Wayne, Michigan. Process for Wayne, Michigan Donation or Gift to Charity of Personal Property: 1. Choose a Charitable Organization: Select a reputable nonprofit organization that aligns with your philanthropic goals and focus areas. 2. Determine the Eligibility: Ensure that both the donor and the chosen charity meet the eligibility criteria for donation or gift valuation purposes. Some organizations may have specific guidelines or restrictions on the types of donations accepted. 3. Document the Donation: Maintain proper documentation of the donated property, including photographs, appraisals (if necessary), and written acknowledgments from the receiving charity. 4. Consult a Tax Professional: Seek advice from a qualified tax professional or accountant to understand the tax implications and eligibility for deductions. 5. Complete IRS Forms: Fill out the required IRS forms, such as Form 8283 (Noncash Charitable Contributions) or Schedule A (Itemized Deductions), depending on the type and value of the donated property. 6. Keep Records: Maintain records of all relevant documents, including receipts, tax forms, and acknowledgment letters, for future reference and documentation. In conclusion, the Wayne, Michigan Donation or Gift to Charity of Personal Property offers various avenues for individuals to contribute to the betterment of society while enjoying tax benefits. Whether through cash donations, vehicle or real estate donations, stock contributions, or clothing and household item donations, residents of Wayne, Michigan have numerous opportunities to make a positive impact on their community and support causes close to their hearts.

Wayne Michigan Donation or Gift to Charity of Personal Property

Description

How to fill out Wayne Michigan Donation Or Gift To Charity Of Personal Property?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Wayne Donation or Gift to Charity of Personal Property, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any activities associated with document completion simple.

Here's how to find and download Wayne Donation or Gift to Charity of Personal Property.

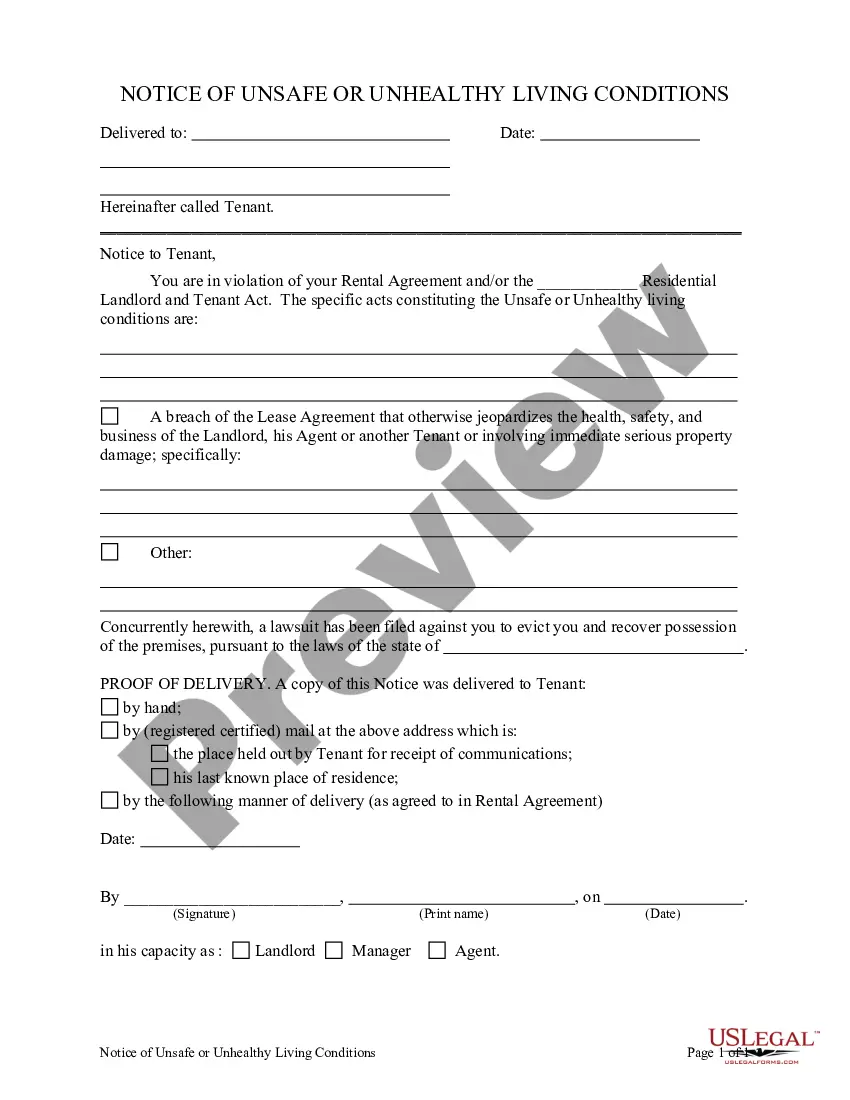

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Wayne Donation or Gift to Charity of Personal Property.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Wayne Donation or Gift to Charity of Personal Property, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to cope with an extremely challenging situation, we recommend using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!