Palm Beach Florida Indemnification Agreement and Warranty from Customer Regarding Embroidering or Monogramming

Description

How to fill out Palm Beach Florida Indemnification Agreement And Warranty From Customer Regarding Embroidering Or Monogramming?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Palm Beach Indemnification Agreement and Warranty from Customer Regarding Embroidering or Monogramming is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Palm Beach Indemnification Agreement and Warranty from Customer Regarding Embroidering or Monogramming. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

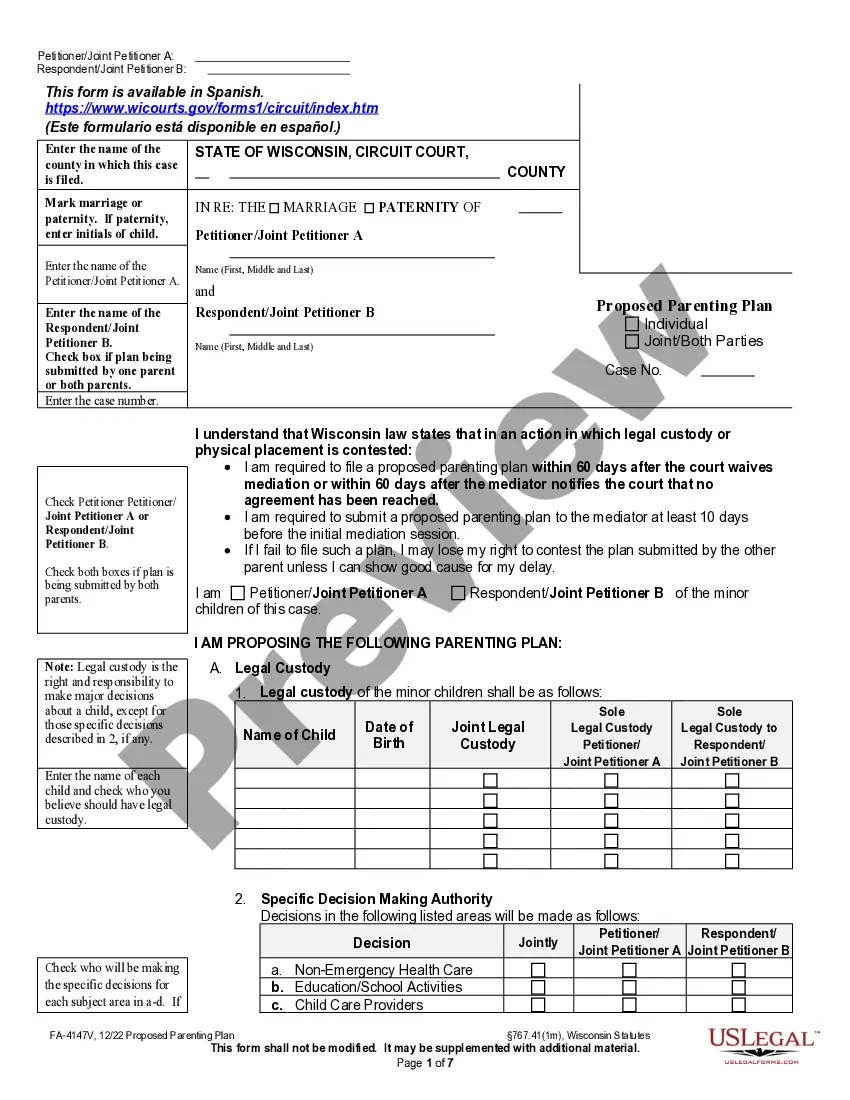

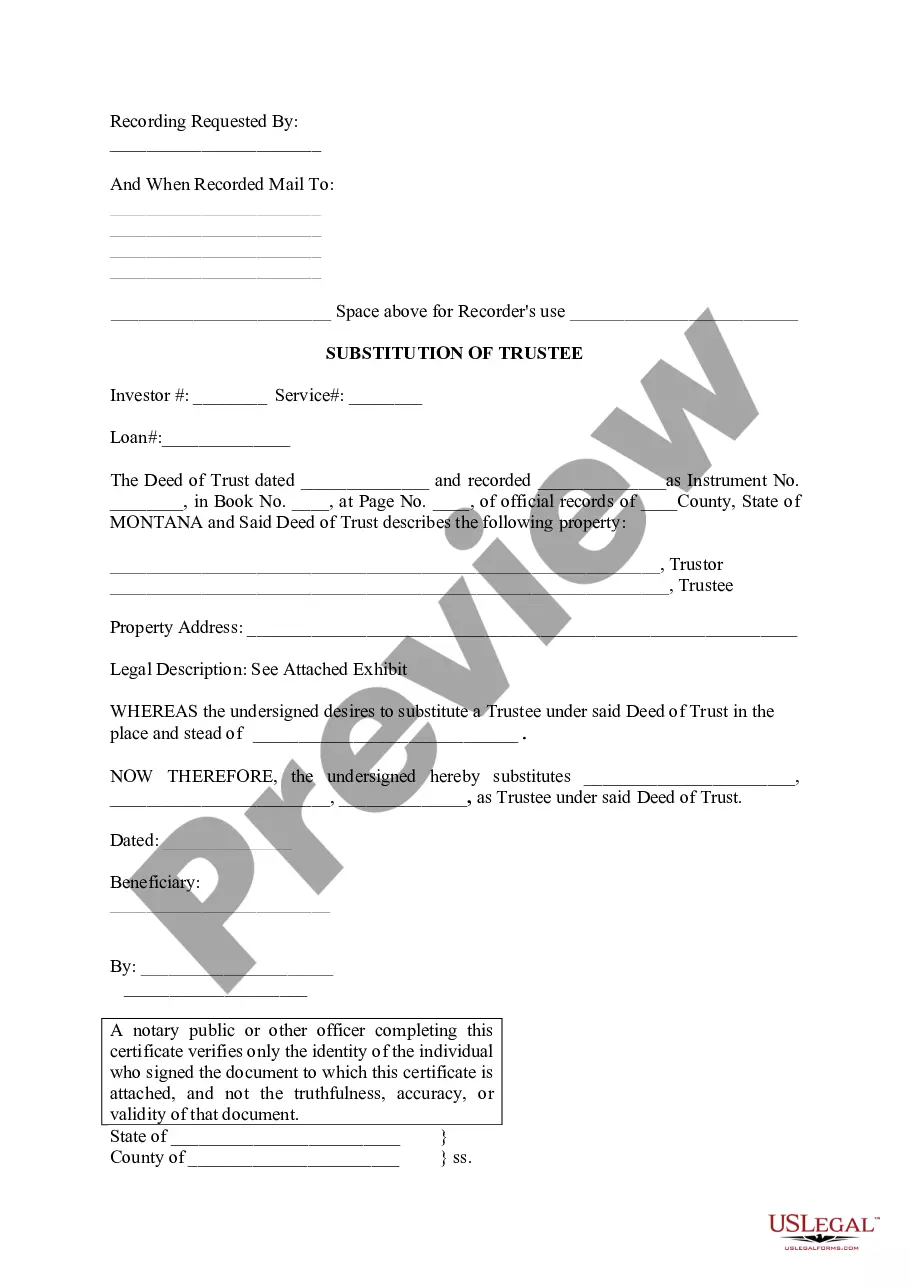

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Palm Beach Indemnification Agreement and Warranty from Customer Regarding Embroidering or Monogramming in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

Enforcement of Contract of IndemnityA contract of indemnity can be invoked according to its terms like the express promise.Damages, legal costs of judgement, the amount paid under the terms of the agreement are some of the claims which Indemnity holder can include in its claims.More items...?

The object and effect of a contractual indemnity are to alter the common law or statutory rights of parties. It does not matter whether you act for the party giving or receiving the indemnity it is essential that you consider the extent to which a contracting party seeks to alter those existing rights.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Court will not enforce an indemnification provision that indemnifies an indemnitee for its own negligence unless the intention of the parties is clearly and unambiguously expressed. Courts first look for specific language in the contract that address the fault or negligence of the indemnitee.

$20/Month. The cost of professional indemnity insurance varies considerably. While these policies are extremely common, and typically inexpensive for most industries, the cost can increase significantly for specialized services with much higher risks.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.