A Harris Texas Buy Sell or Stock Purchase Agreement covering common stock in a closely held corporation with an option to fund the purchase through life insurance is a legally binding contract that outlines the terms and conditions for the sale and purchase of shares in a privately owned company within Harris County, Texas. This agreement provides a mechanism for shareholders to protect their interests and ensure a smooth transfer of ownership. Keywords: Harris Texas, Buy Sell Agreement, Stock Purchase Agreement, Common Stock, Closely Held Corporation, Option to Fund Purchase, Life Insurance Types of Harris Texas Buy Sell or Stock Purchase Agreements: 1. Traditional Buy Sell Agreement: This type of agreement lays out the terms and conditions for the sale and purchase of shares in a closely held corporation. It includes provisions for the valuation of shares, preemption rights, mandatory or optional buyouts, and the method of funding the purchase. 2. Stock Purchase Agreement: Specifically focuses on the purchase of common stock in a closely held corporation. It outlines the terms of the sale, including the purchase price, payment terms, and any contingencies or conditions that need to be met. 3. Closely Held Corporation: Refers to a private company with a limited number of shareholders and restrictions on the transferability of shares. The agreement ensures that the sale and purchase of shares comply with the corporation's bylaws and any existing shareholder agreements. 4. Option to Fund Purchase through Life Insurance: This clause enables the purchasing shareholder or the corporation to secure the funds needed to complete the purchase by taking out a life insurance policy on a key person or shareholder. In the event of their death, the insurance proceeds are used to buy out their shares. In conclusion, a Harris Texas Buy Sell or Stock Purchase Agreement covering common stock in a closely held corporation with an option to fund the purchase through life insurance provides a comprehensive framework for the sale and purchase of shares. It offers protection to both buyers and sellers, ensuring a smooth transition of ownership while mitigating potential risks.

Harris Texas Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Harris Texas Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Harris Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how you can find and download Harris Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

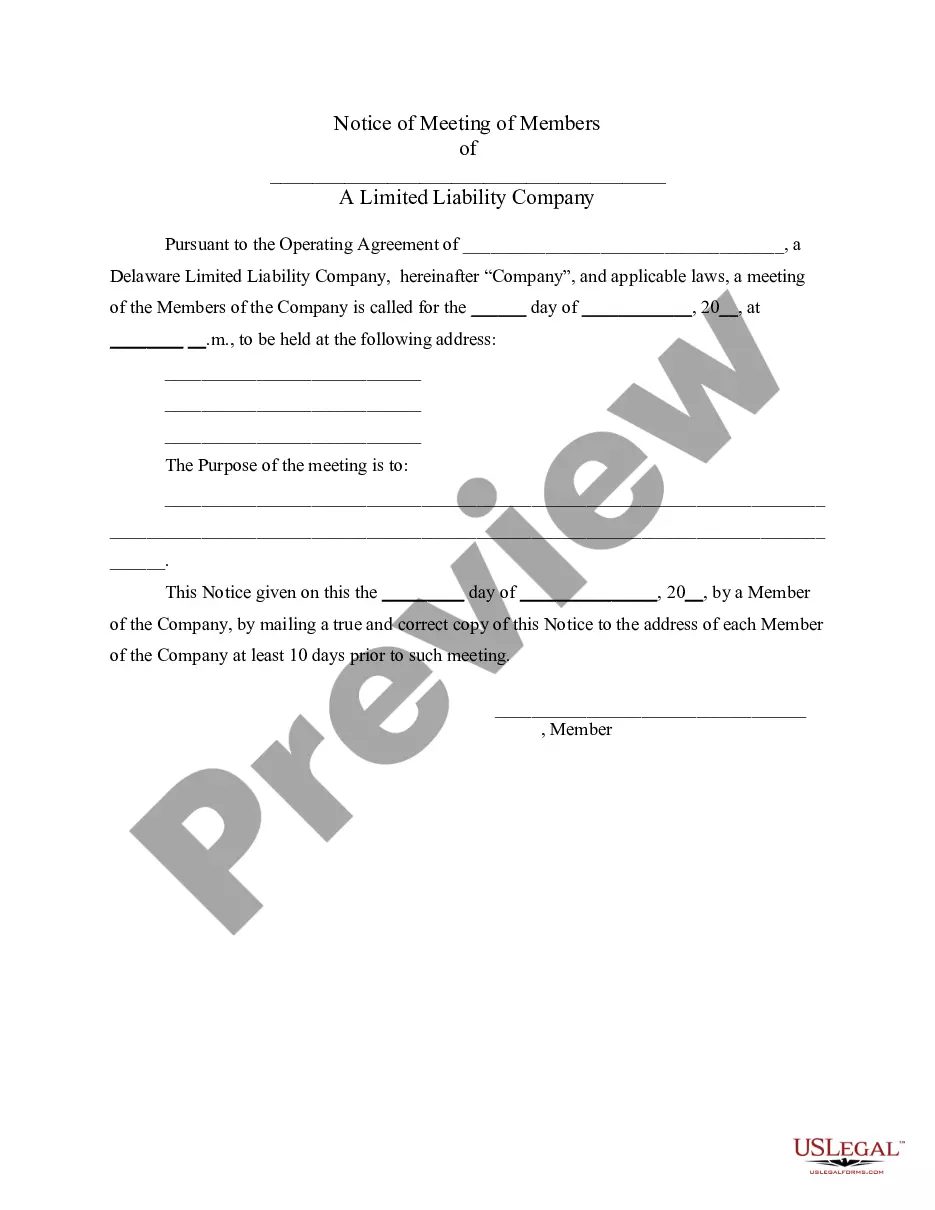

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related document templates or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Harris Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you need to deal with an exceptionally complicated situation, we advise getting a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!