Oakland Michigan Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance Description: An Oakland Michigan Buy Sell or Stock Purchase Agreement is a legally binding document that outlines the terms and conditions of buying or selling common stock in a closely held corporation. This agreement provides a clear arrangement for the purchase and sale of stocks, while also offering the option to fund the purchase through life insurance policies. The purpose of this agreement is to establish a fair and orderly process for transferring ownership of common stock in a closely held corporation. This is especially important in situations where there are multiple shareholders, as it helps prevent conflicts and ensures a smooth transition of ownership in the event of certain triggering events such as death, disability, retirement, or voluntary sale. To fund the stock purchase, this agreement incorporates the option to utilize life insurance policies. Life insurance can provide the necessary funds to buy out the shares of a deceased shareholder, ensuring that their family or estate receives fair compensation while allowing the surviving shareholders to maintain control of the corporation. This option helps to alleviate financial burdens and ensures the continuity of the business. The Oakland Michigan Buy Sell or Stock Purchase Agreement may have different variations tailored to specific circumstances or preferences. Some of these variations include: 1. Cross-Purchase Agreement: This type of agreement involves the purchase of shares by individual shareholders directly from the selling shareholder or their estate. Each shareholder is responsible for maintaining their own life insurance policies to fund the purchase. 2. Entity-Purchase Agreement: In this arrangement, the corporation itself purchases the shares from the selling shareholder. The corporation is responsible for maintaining the life insurance policies on the lives of the shareholders. 3. Wait-and-See Agreement: This agreement combines elements of both the cross-purchase and entity-purchase agreements. Initially, the individual shareholders have the right to purchase the shares, but if they choose not to or do not have the necessary funds, the corporation has the option to step in and buy the shares instead. It is important to consult with legal professionals experienced in corporate law and estate planning when drafting an Oakland Michigan Buy Sell or Stock Purchase Agreement. Properly creating and executing this document ensures that the interests of all parties involved are protected and that the transfer of ownership is conducted in a fair and efficient manner.

Oakland Michigan Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Oakland Michigan Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Oakland Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Oakland Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

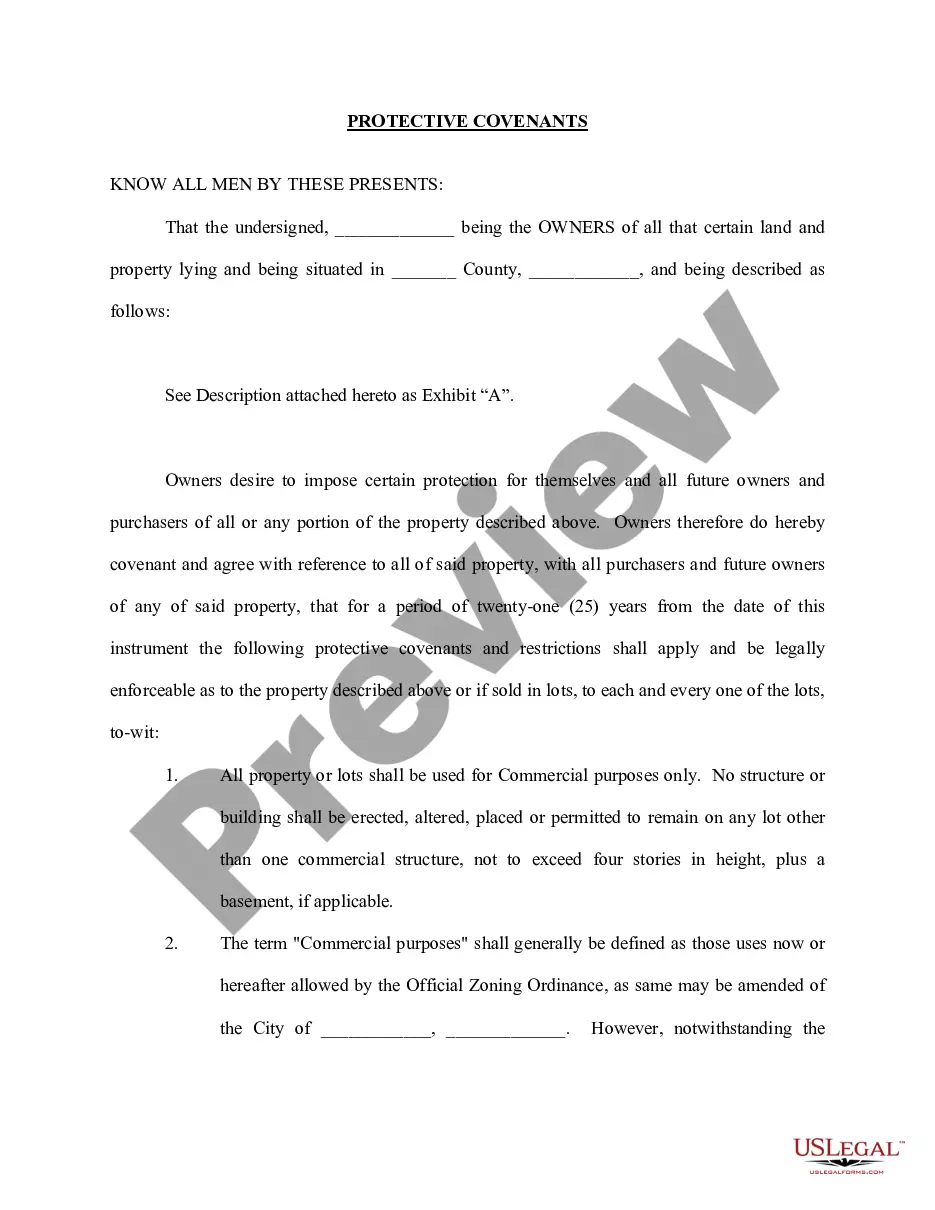

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!