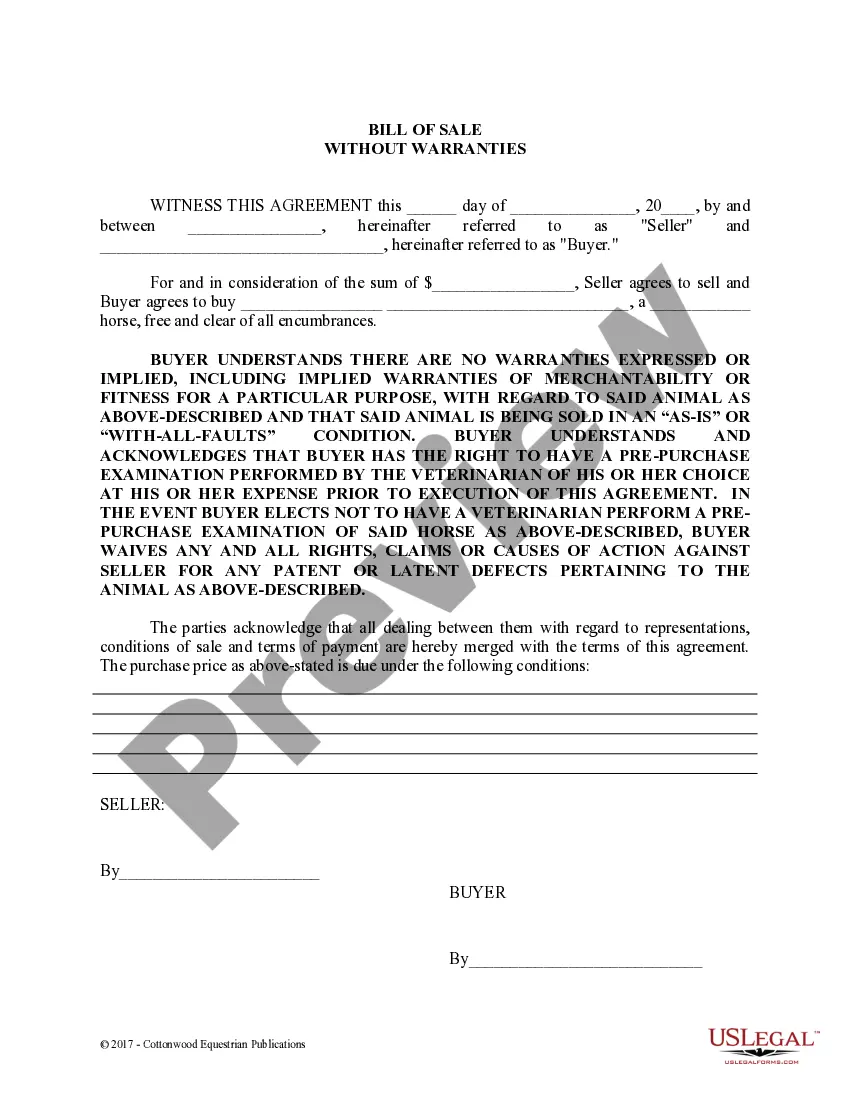

A Phoenix Arizona Buy Sell or Stock Purchase Agreement covering common stock in a closely held corporation with the option to fund the purchase through life insurance is a legally binding document that outlines the terms and conditions surrounding the sale or transfer of common stock within a closely held corporation in the city of Phoenix, Arizona. This agreement provides a framework for shareholders to govern the buying and selling of their stock, as well as a means to fund the transaction through life insurance policies. Keywords: Phoenix Arizona, Buy Sell or Stock Purchase Agreement, Common Stock, Closely Held Corporation, Option, Fund Purchase, Life Insurance. Types of Phoenix Arizona Buy Sell or Stock Purchase Agreements Covering Common Stock in a Closely Held Corporation with an Option to Fund Purchase through Life Insurance: 1. Traditional Buy Sell Agreement: This type of agreement outlines the conditions under which a shareholder can sell their common stock, and the remaining shareholders have the option to purchase the shares at a predetermined price. If the purchase is funded through life insurance, the agreement will specify the policy details, such as the beneficiary and payout amount. 2. Cross-Purchase Buy Sell Agreement: In a closely held corporation with multiple shareholders, this agreement allows individual shareholders to purchase the shares of another shareholder. Life insurance policies can be used to fund these purchases, ensuring that the remaining shareholders have the necessary funds to buy the stock upon the occurrence of a triggering event like death or disability. 3. Stock Redemption Buy Sell Agreement: This type of agreement allows the corporation itself to repurchase the common stock from a shareholder who is leaving the company, retiring, or in the event of their death. Life insurance can be utilized to fund the corporation's purchase, providing liquidity for the transaction. 4. Hybrid Buy Sell Agreement: A hybrid buy sell agreement combines elements of both cross-purchase and stock redemption agreements. It allows individual shareholders to purchase the shares of a departing shareholder or, alternatively, allows the corporation to repurchase the shares. Life insurance can be used to fund either type of purchase, offering flexibility and financial security in the event of an ownership change. In all these types of agreements, the option to fund the purchase through life insurance provides financial stability for the parties involved. The agreements ensure a smooth transition of ownership, protect the interests of the shareholders, and mitigate potential disputes that may arise during the sale or transfer of common stock in a closely held corporation in Phoenix, Arizona.

Phoenix Arizona Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

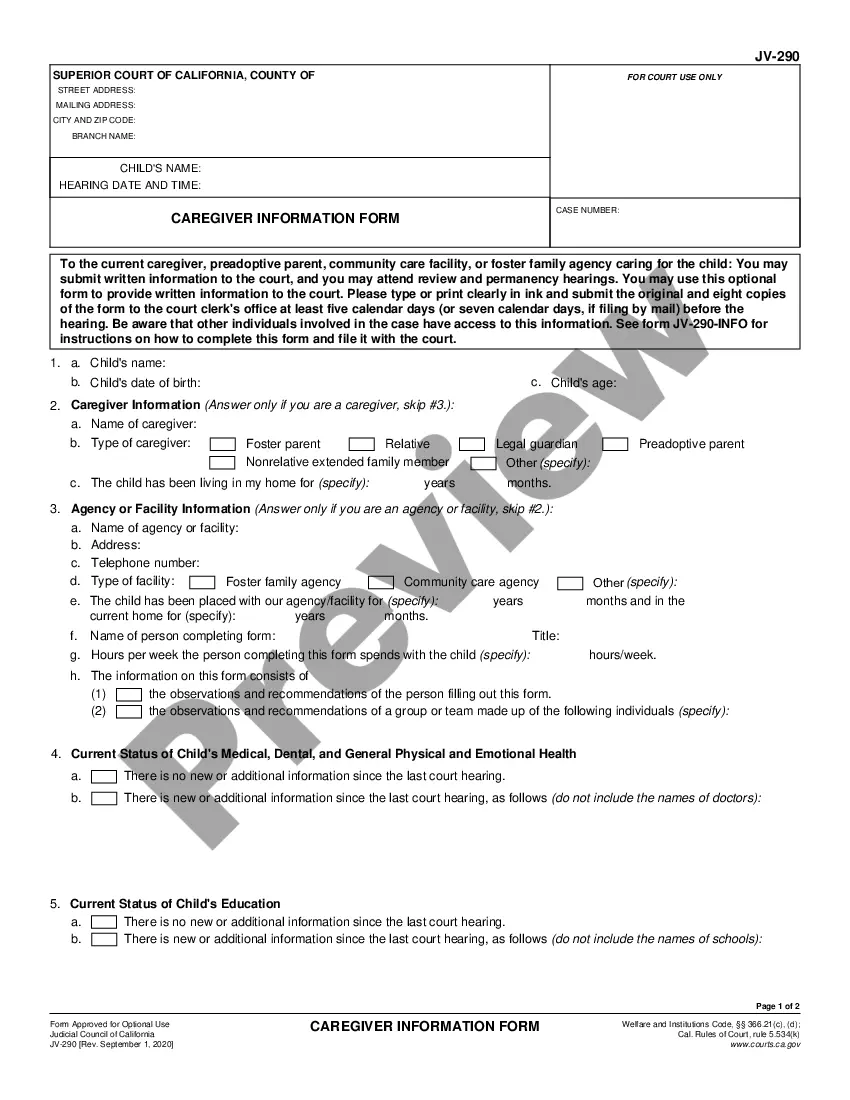

How to fill out Phoenix Arizona Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Phoenix Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Phoenix Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Phoenix Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

In September 2015, Phoenix announced they were being acquired by Nassau Reinsurance Group, a privately held company, for $217.2 million. The acquisition closed on June 20, 2016 and Phoenix became a private company.

Phoenix was acquired by Nassau Financial Group in 2016 and remains headquartered in Hartford, Connecticut, with 650 employees as of 2015. Phoenix remains one of the few insurance companies to keep its headquarters in Hartford.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

We are today pleased to announce that Phoenix Group has acquired ReAssure and is now the UK's largest long-term savings and retirement business. Whilst this announcement does not impact the existing Phoenix customers, we welcome the new customers to the Phoenix Group.

Phoenix Life is a closed life insurance business.

On 31 December 2018, all Abbey Life Assurance Company Limited (Abbey Life) policies transferred to Phoenix Life Limited (Phoenix) following approval by the High Court on 18 December 2018.

Phoenix Life Limited On 30 June 2015, we transferred all the policies of National Provident Life Limited to Phoenix Life Assurance Limited. On 30 September 2013, certain pension annuities transferred from Phoenix Life Limited to another UK life insurance company, Guardian Assurance Limited.

In September 2015, Phoenix announced they were being acquired by Nassau Reinsurance Group, a privately held company, for $217.2 million. The acquisition closed on June 20, 2016 and Phoenix became a private company.

In December 2006, we transferred the life assurance business of six companies into Phoenix Life Limited. The companies were Alba Life Limited, Britannic Assurance plc, Britannic Retirement Solutions Limited, Britannic Unit Linked Assurance Limited, Century Life plc and Phoenix Life & Pensions Limited.

The oldest life company, Phoenix Assurance, dates back to 1786. Abbey Life Assurance Company Limited (Abbey Life) is acquired by Phoenix Group in December 2016. Excess Life, renamed Ambassador Life, merged with Abbey Life. Hill Samuel Life merged with Abbey Life.

Interesting Questions

More info

If you've got it, drink it at this fundraiser. Riverside County is known for many things: its rich history of water-bottling, its beautiful hills and trees. And this year, the county added a new one: beer. The first-of-its-kind Riverside County Beeriest is held on Saturday at the Riverside County Fairgrounds. The event has sold out, but the event is in its sixth year. The tasting portion of the event runs from 3-6 p.m., and food trucks will set up at the fairgrounds. For those who want to drink beer right in Central Garden Park, there's a Beer Garden. The tasting will feature more than 30 different beers from around the world, some local — which means you do have to wait in a line — some international — which means you better bring your A game — and some craft. But there's nothing like sitting by your favorite craft beer. “We take pride in the quality of the beer,” said Chris Lead, manager at Riverside Brewery. “We're not about 'Oh, it was local.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.