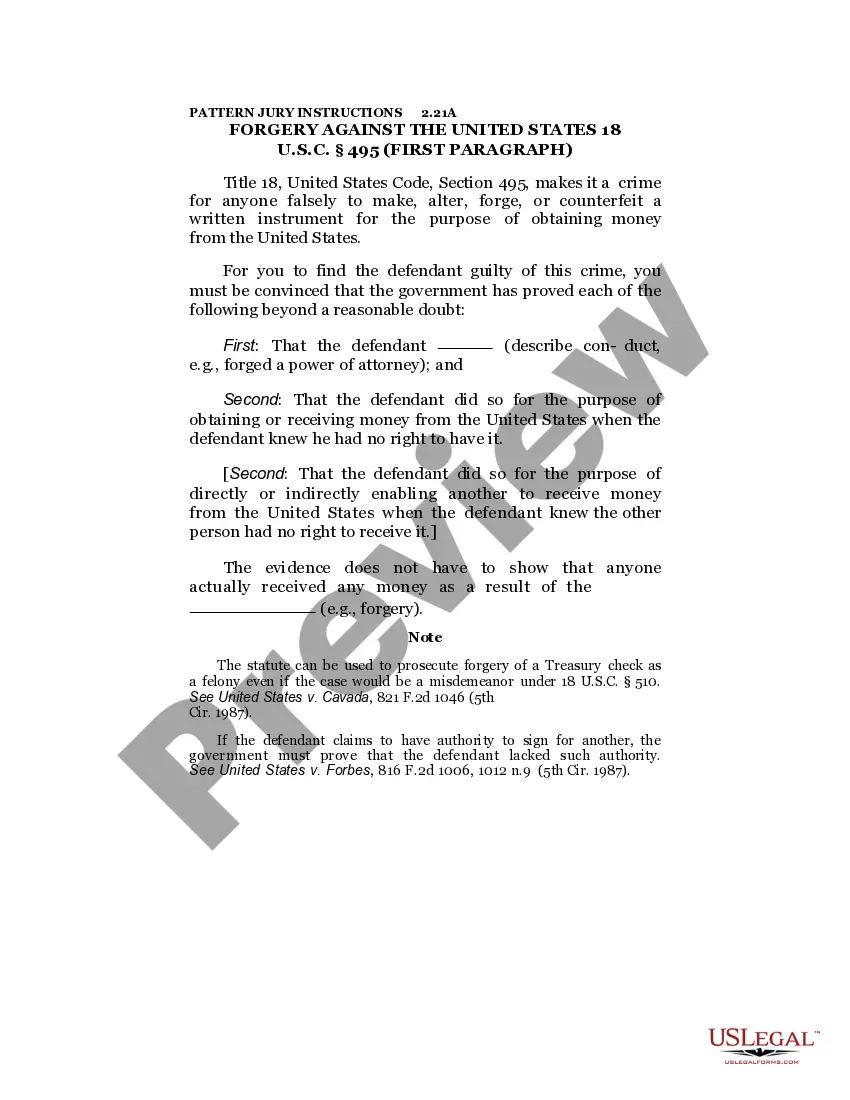

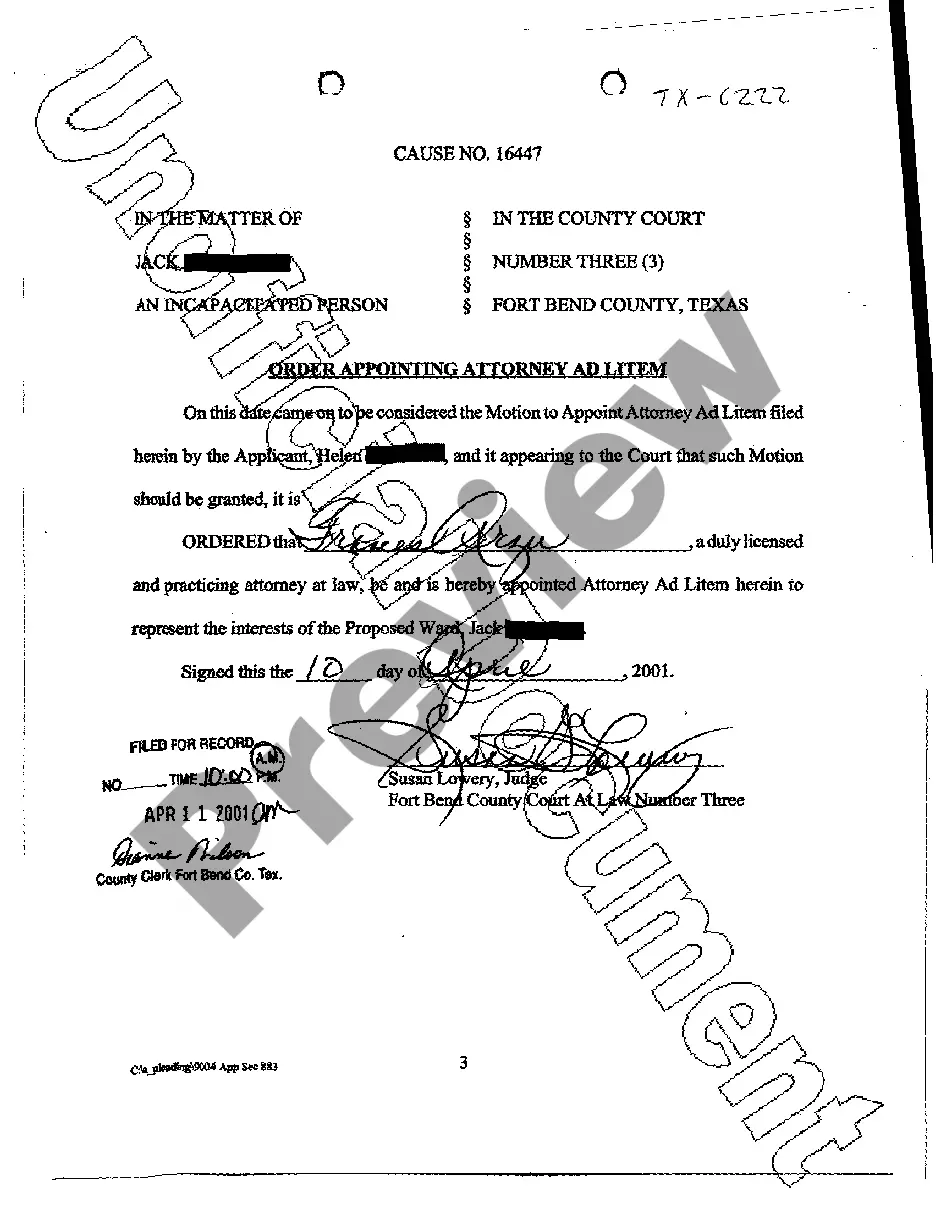

San Antonio Texas Consent to Release of Financial Information is a legal document used to authorize the disclosure of financial information to a specific recipient or organization. This document is commonly used in various financial transactions such as loan applications, mortgage processes, employment background checks, or insurance claims. The purpose of the San Antonio Texas Consent to Release of Financial Information is to provide written consent from the owner of the financial information, granting permission for the release, sharing, and verification of their financial records. This ensures that the confidential information contained within these records can be accessed and reviewed by authorized parties. In San Antonio, Texas, there are several types of Consent to Release of Financial Information documents designed to address specific purposes. Some of these variations include: 1. Mortgage Consent to Release of Financial Information: This form is tailored for mortgage applications and authorizes the lender to verify the applicant's financial status, income, credit score, employment history, and other relevant financial details to assess their eligibility for a home loan. 2. Employment Consent to Release of Financial Information: This type of consent is primarily used by employers during the hiring process. It allows the employer to access the applicant's financial records to assess their financial stability, credibility, and to comply with legal requirements or background check policies. 3. Loan Consent to Release of Financial Information: Used in loan applications, this document permits the lender to verify the applicant's financial capacity, credit history, existing debts, and other relevant financial information to evaluate the risks associated with approving a loan. 4. Insurance Consent to Release of Financial Information: Insurance companies may require this consent form to verify the financial records of the insured party when processing a claim or assessing risk factors. It grants permission for the insurer to access relevant financial data for underwriting or claims settlement purposes. It is important to note that while the purpose of these Consent to Release of Financial Information forms remains consistent, they might differ slightly in content and format depending on the specific requirements of the party requesting the disclosure. To obtain a San Antonio Texas Consent to Release of Financial Information, individuals can typically access these forms online through financial institutions, legal document services, or consult legal professionals to ensure compliance with state and federal laws.

San Antonio Texas Consent to Release of Financial Information

Description

How to fill out San Antonio Texas Consent To Release Of Financial Information?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the San Antonio Consent to Release of Financial Information.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the San Antonio Consent to Release of Financial Information will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the San Antonio Consent to Release of Financial Information:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the San Antonio Consent to Release of Financial Information on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!