Bronx, New York: A Vibrant Borough with Entrepreneurial Opportunities Bronx, New York, known simply as "The Bronx," is one of the five boroughs of New York City. This thriving urban area is recognized for its rich history, diverse culture, and abundant opportunities for businesses to thrive. For entrepreneurs looking to establish a business and take advantage of certain tax benefits, obtaining S Corporation status in The Bronx can be a smart move. To achieve this, entrepreneurs need to complete the necessary paperwork, such as Corporate Resolutions Forms, that enable them to elect S Corporation status for their business. Corporate Resolutions Forms serve as official documents that outline decisions made by a corporation's board of directors or shareholders. These forms are crucial when pursuing S Corporation status in The Bronx, as they record the resolution to be treated as an S Corporation for tax purposes. They typically include details such as the corporation's name, principal location, the date of the resolution, and a statement indicating the shareholders' decision to elect S Corporation status. Bronx, being a bustling economic hub within New York City, offers several types of Corporate Resolutions Forms for obtaining S Corporation status. These may include: 1. Single-Shareholder S Corporation Resolution Form: This form caters to businesses where there is only one shareholder or an individual owning 100% of the corporation's shares. It outlines the shareholder's decision to elect S Corporation status, providing their name, address, and social security number, if applicable. 2. Multiple-Shareholder S Corporation Resolution Form: In cases where there are multiple shareholders, this form becomes essential. It includes details of each shareholder's resolution to obtain S Corporation status, along with their personal information and the number of shares they hold. 3. Annual S Corporation Election Resolution Form: To retain the S Corporation status for another tax year, businesses in The Bronx must complete this form annually. It confirms the shareholders' unanimous decision to continue operating as an S Corporation and lists their personal details. By completing the appropriate Corporate Resolutions Forms, businesses in The Bronx can navigate the process of obtaining S Corporation status seamlessly. This classification entails several advantages, including limited liability protection, potential tax savings, and the ability to distribute income to shareholders without incurring corporate-level taxes. For entrepreneurs considering establishing their businesses in The Bronx, taking advantage of the numerous opportunities in this vibrant borough, and obtaining S Corporation status is a strategic move. The completion of relevant Corporate Resolutions Forms ensures a smooth transition to this advantageous tax status, ultimately benefiting both the businesses and the overall economy of The Bronx.

Bronx New York Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Bronx New York Obtain S Corporation Status - Corporate Resolutions Forms?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Bronx Obtain S Corporation Status - Corporate Resolutions Forms, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Bronx Obtain S Corporation Status - Corporate Resolutions Forms from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Bronx Obtain S Corporation Status - Corporate Resolutions Forms:

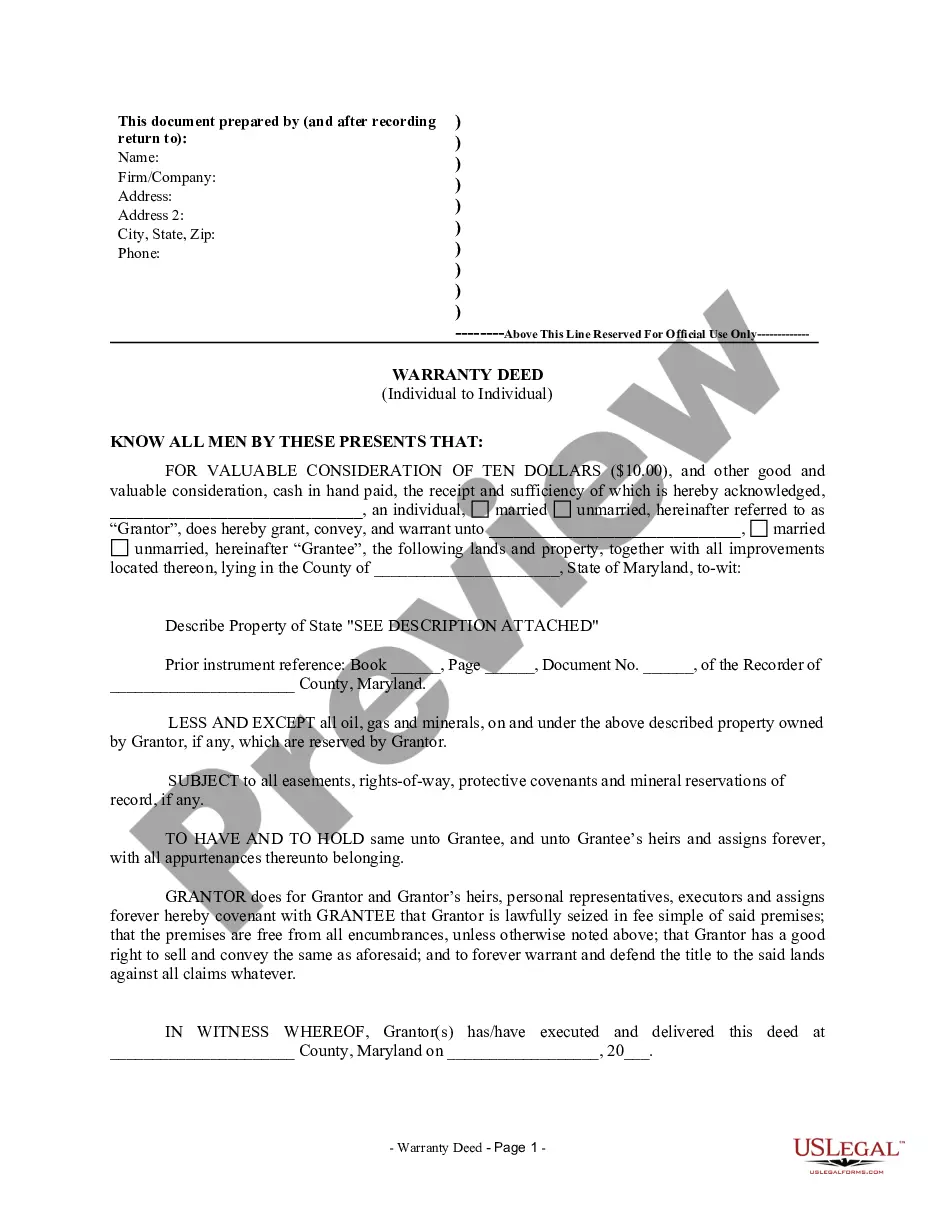

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

You can check your S corp status relatively easily by contacting the IRS. If you have properly submitted your S corporation form to the IRS and have not heard back, you can call the IRS at (800) 829-4933 and they will inform you of your application status.

Use Form 4506, Request for Copy of Tax Return, to request copies of tax returns. Automated transcript request. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on Get a Tax Transcript... under Tools or call 1-800-908-9946.

To request an S corp verification letter, contact the IRS' Business & Specialty Tax Line at 1-800-829-4933. It's open from Monday through Friday from a.m. to p.m. taxpayer local time.

The process for electing S corporation status begins with an IRS application, on IRS Form 2553. Form 2553- Election by a Small Business Corporation. This form gives the IRS detailed information about the corporation requesting S Corp status and about the corporation's eligibility for electing this status.

Call the Internal Revenue Service's Business and Specialty Tax Line. This is the department a corporation calls to obtain a copy of almost any letter from the IRS regarding business matters, including Subchapter S elections and Employer Identification Number assignments. The phone number is 800-829-4933.

If you have submitted Form 2553 to the IRS and are confident that it was completed correctly, you can call the department at any time to check on your current status. The phone number is (800) 829-4933. If your S-corp application is approved, the IRS will send you a letter confirming this status.

The IRS will mail a copy; you can request a faxed copy in addition to the mailed letter. You can't check S corp status online.

Call the Internal Revenue Service's Business and Specialty Tax Line. This is the department a corporation calls to obtain a copy of almost any letter from the IRS regarding business matters, including Subchapter S elections and Employer Identification Number assignments. The phone number is 800-829-4933.