Title: Phoenix Arizona — Obtaining S Corporation Status: A Comprehensive Guide with Corporate Resolutions Forms Introduction: In this article, we will provide a detailed description of what Phoenix, Arizona offers to entrepreneurs seeking to obtain S Corporation status. We will explore the process of becoming an S Corporation, including the necessary steps and legal requirements. Additionally, we will highlight different types of Corporate Resolutions Forms commonly utilized during the incorporation process. Keywords: Phoenix Arizona, S Corporation, corporate resolutions, incorporation process, legal requirements, entrepreneurs, forms. 1. Understanding S Corporation Status: — Definition and Benefits: Explore the advantages of becoming an S Corporation, such as tax benefits, limited liability protection, and ease of transferability. — Eligibility Criteria: Discuss the requirements for qualifying as an S Corporation, such as having less than 100 shareholders, being a domestic corporation, and having only certain types of shareholders. — Tax Considerations: Highlight the key tax advantages of S Corporations, including pass-through taxation, avoidance of double taxation, and potential deductions. 2. Incorporating a Business in Phoenix, Arizona: — Overview of Incorporation: Explain the general process of incorporating a business, including name availability search, filing articles of incorporation, obtaining an Employer Identification Number (EIN), and choosing a registered agent. — Legal Requirements: Discuss the specific legal requirements for incorporating in Phoenix, Arizona, such as paying the necessary fees, submitting the required documents, and fulfilling any state-specific criteria. 3. Corporate Resolutions Forms for Obtaining S Corporation Status: — Certificate of Incorporation: Provide a template and description of the certificate of incorporation form, highlighting the key information required, such as company name, purpose, share structure, and registered agent details. — Bylaws of the Corporation: Explain the importance of bylaws and provide a sample form, detailing the governance rules and procedures for the corporation, such as shareholder meetings, directors, and officer roles. — Shareholder Resolution: Discuss the significance of shareholder resolutions and provide an example form pertaining to the election of S Corporation status, including specific document language and signatures required. 4. Additional Considerations for S Corporations in Phoenix, Arizona: — State Taxes and Reporting: Outline the necessary tax filings and ongoing reporting obligations for S Corporations, including state income taxes, annual reports, and transaction privilege taxes. — CorporatRecorkeepingng: Emphasize the importance of maintaining accurate records, minutes of meetings, and keeping track of all pertinent corporate documents. Conclusion: Obtaining S Corporation status in Phoenix, Arizona offers various benefits to entrepreneurs. By following the detailed incorporation process and utilizing relevant Corporate Resolutions Forms, business owners can enjoy the advantages of S Corporation taxation. Phoenix provides a favorable business environment, making it an excellent choice for entrepreneurs seeking to establish their S Corporations and reap the rewards of running a successful business. Note: It is important to consult with legal and tax professionals to ensure compliance with specific state laws and regulations while obtaining S Corporation status in Phoenix, Arizona.

Phoenix Arizona Obtain S Corporation Status - Corporate Resolutions Forms

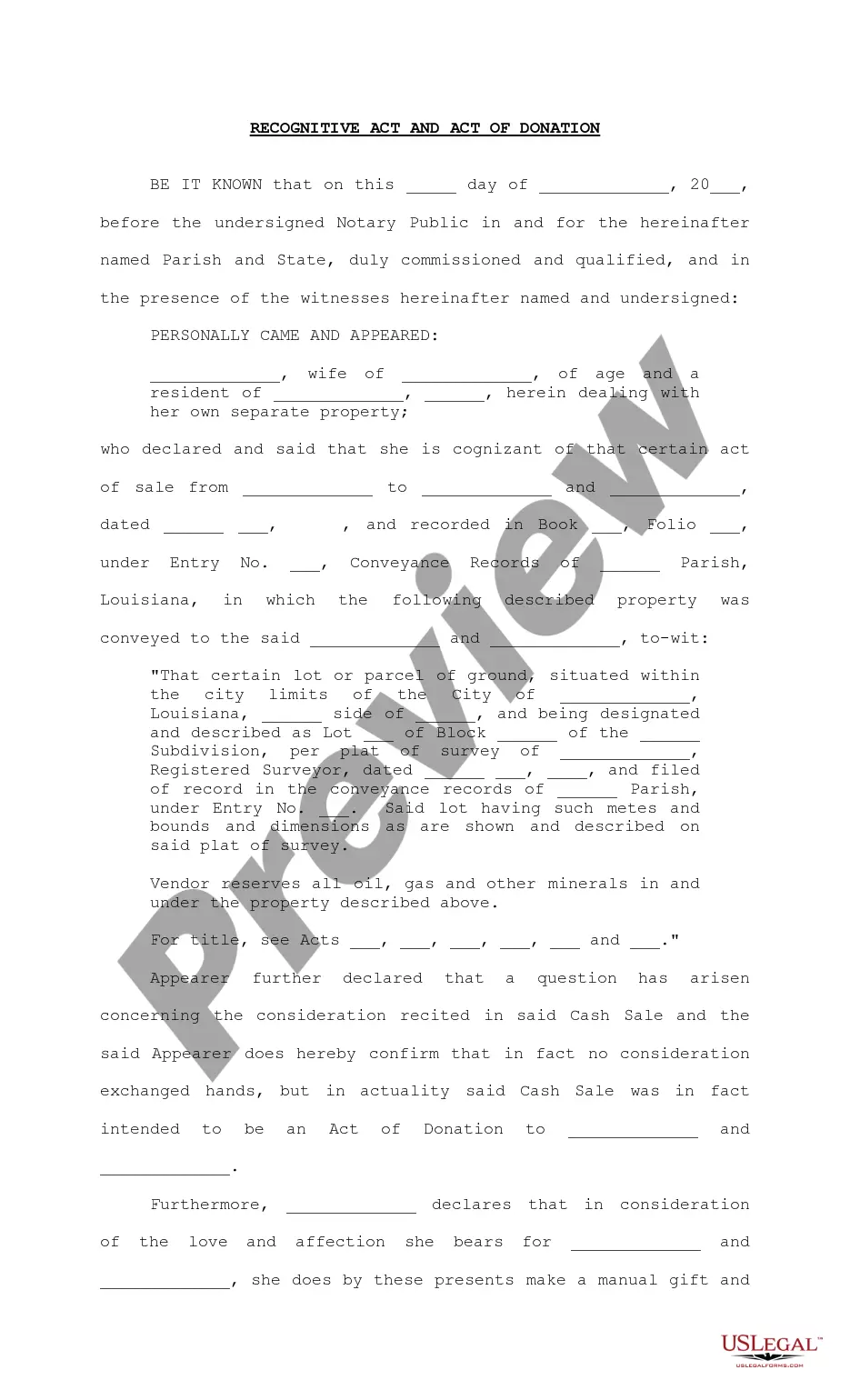

Description

How to fill out Phoenix Arizona Obtain S Corporation Status - Corporate Resolutions Forms?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Phoenix Obtain S Corporation Status - Corporate Resolutions Forms meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Phoenix Obtain S Corporation Status - Corporate Resolutions Forms, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Phoenix Obtain S Corporation Status - Corporate Resolutions Forms:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Phoenix Obtain S Corporation Status - Corporate Resolutions Forms.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!