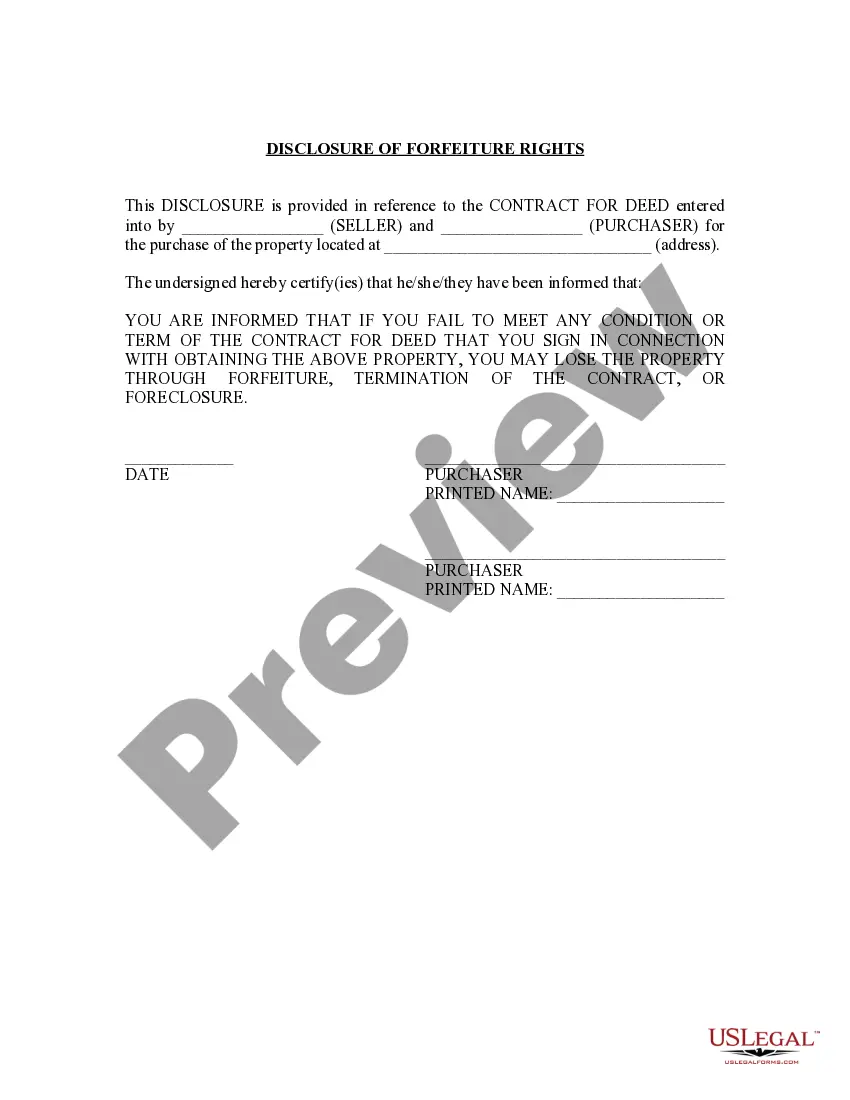

Queens, New York is one of the five boroughs of New York City. It is the most populous borough, offering a diverse mix of neighborhoods, culture, and business opportunities. To operate as an S Corporation in Queens, New York, businesses need to follow the required legal procedures and obtain the necessary corporate resolutions forms. These forms play a crucial role in establishing and maintaining the S Corporation status, ensuring compliance with state regulations. One type of corporate resolution form that businesses in Queens, New York might need is the "Certificate of Incorporation." This form is essential when forming an S Corporation, as it establishes the legal existence of the business entity. It includes information such as the corporation's name, purpose, registered agent, and initial directors. Another important form is the "Election by a Small Business Corporation Form (Form 2553)." This document is required for a corporation to elect S Corporation status with the Internal Revenue Service (IRS). By filing this form, businesses can take advantage of certain tax benefits and pass-through taxation, where profits and losses are reported on the owners' personal tax returns rather than at the corporate level. In addition to the above forms, businesses seeking S Corporation status in Queens, New York may also need to draft specific corporate resolutions. These resolutions can cover various matters, such as authorizing the election of S Corporation status, adopting and amending bylaws, appointing officers, approving financial decisions, or issuing shares of stock to shareholders. It is crucial for businesses to consult with legal professionals or utilize reliable online resources to ensure they complete the correct corporate resolutions forms specific to Queens, New York. By following the necessary steps and submitting the required documents, businesses can successfully obtain S Corporation status, providing them with both legal protection and potential tax advantages.

Queens New York Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Queens New York Obtain S Corporation Status - Corporate Resolutions Forms?

Are you looking to quickly draft a legally-binding Queens Obtain S Corporation Status - Corporate Resolutions Forms or maybe any other document to manage your personal or business matters? You can select one of the two options: contact a professional to draft a legal document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including Queens Obtain S Corporation Status - Corporate Resolutions Forms and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Queens Obtain S Corporation Status - Corporate Resolutions Forms is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Queens Obtain S Corporation Status - Corporate Resolutions Forms template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!