Santa Clara, California, is a vibrant city located in the heart of Silicon Valley. Known for its thriving tech industry and world-renowned educational institutions like Santa Clara University, it offers a diverse and dynamic environment for businesses to flourish. Obtaining S Corporation status is an important step for many businesses operating in Santa Clara. S Corporations are a popular choice for small to medium-sized businesses due to their unique tax advantages and limited liability protection. By electing S Corporation status, business owners can avoid double taxation and pass profits and losses directly to shareholders, among other benefits. To obtain S Corporation status in Santa Clara, businesses need to complete and file the necessary paperwork. One essential document is the Corporate Resolutions Form, which outlines the decisions made by the corporation's board of directors or shareholders. This form helps to establish the business as an S Corporation and specifies the shareholders' agreement to be taxed under Subchapter S of the Internal Revenue Code. There are various types of Corporate Resolutions Forms available depending on the specific needs of the business. Some common types include: 1. Initial S Corporation Election Resolution: This form is used when a company decides to become an S Corporation for the first time. It includes important details such as the date of the election, shareholder information, and any necessary amendments to the company's articles of incorporation. 2. Annual Shareholders' Consent Resolution: This form is typically prepared and signed annually by all shareholders to confirm their agreement to be taxed as an S Corporation for the upcoming year. It ensures the ongoing compliance with IRS regulations. 3. Shareholders' Meeting Resolution: This form is used to record decisions made during a shareholders' meeting regarding the S Corporation status. It covers important matters such as changes in shareholders, voting rights, and other corporate governance issues. 4. Bylaws Amendment Resolution: Sometimes, amendments to the bylaws of an S Corporation may be necessary. This form is used to document any changes made to the bylaws and ensure that all shareholders are in agreement. Obtaining S Corporation status in Santa Clara, California, requires careful attention to detail and adherence to legal procedures. These various types of Corporate Resolutions Forms help businesses navigate the process smoothly, ensuring compliance with both state and federal guidelines. By understanding the significance of S Corporation status and utilizing the appropriate Corporate Resolutions Forms, businesses in Santa Clara can benefit from tax advantages, limited liability protection, and the continued growth opportunities within the vibrant Silicon Valley ecosystem.

Santa Clara California Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Santa Clara California Obtain S Corporation Status - Corporate Resolutions Forms?

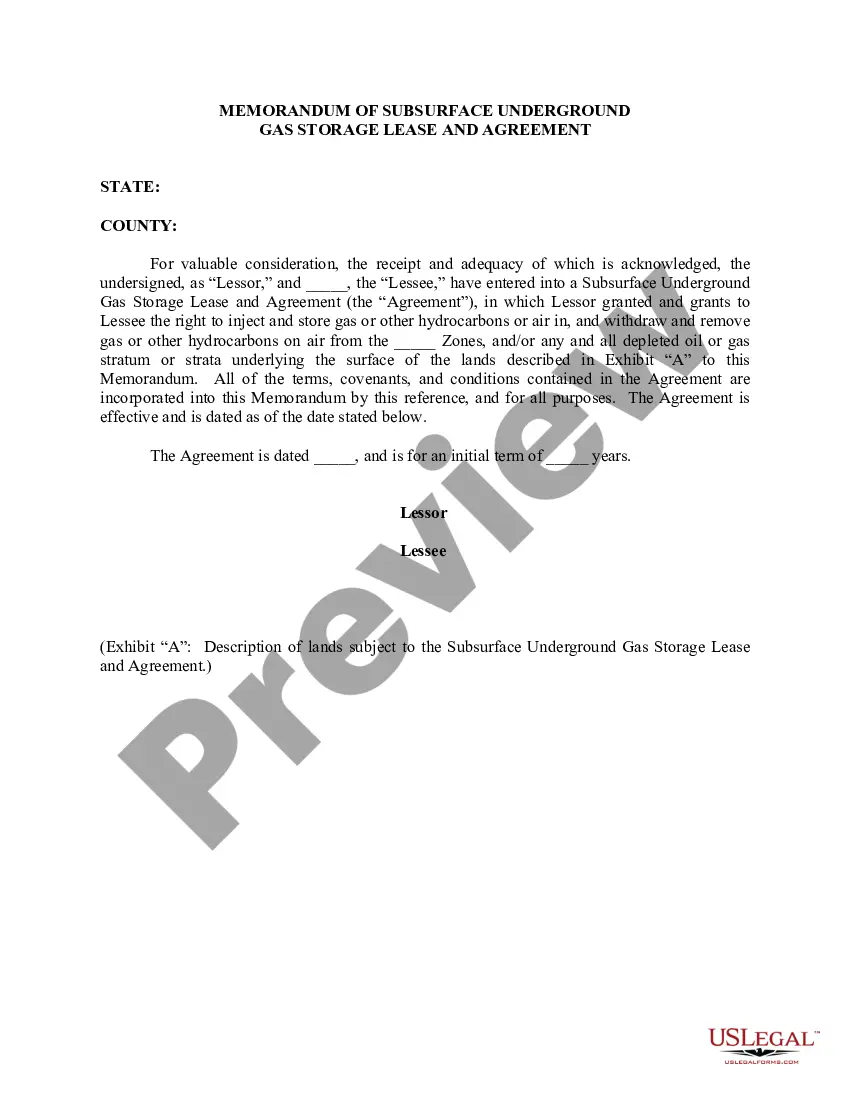

Are you looking to quickly create a legally-binding Santa Clara Obtain S Corporation Status - Corporate Resolutions Forms or maybe any other form to manage your personal or corporate affairs? You can go with two options: hire a professional to draft a valid document for you or draft it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant form templates, including Santa Clara Obtain S Corporation Status - Corporate Resolutions Forms and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Santa Clara Obtain S Corporation Status - Corporate Resolutions Forms is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Santa Clara Obtain S Corporation Status - Corporate Resolutions Forms template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the templates we provide are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!