Fulton Georgia Consulting Agreement — Assist Company Obtain Loan: A detailed overview In Fulton, Georgia, a Consulting Agreement specifically tailored to assist companies in procuring loans is a valuable tool for businesses looking to secure financial support. This agreement is designed to provide expert guidance and consulting services to businesses seeking loans from various financial institutions in Fulton, Georgia. By engaging in such a consulting agreement, companies can access specialized knowledge, insights, and strategies to increase their chances of obtaining loans successfully. Keywords: Fulton Georgia, consulting agreement, assist company, obtain loan, financial support, business, loans, consulting services, expert guidance, specialized knowledge, insights, strategies. Different types of Fulton Georgia Consulting Agreement — Assist Company Obtain Loan: 1. General Consulting Agreement for Loan Procurement: This type of consulting agreement encompasses a broad range of services aimed at assisting companies in obtaining loans. It involves analyzing the financial health and requirements of the company, identifying suitable lenders, guiding the application process, and providing recommendations to enhance the loan application's chances of success. 2. Financial Analysis and Strategy Consulting Agreement: This consulting agreement focuses on providing in-depth financial analysis and developing strategic plans to maximize the company's viability and credibility in the eyes of potential lenders. Consultants specializing in this type of agreement assess the company's financial statements, develop accurate financial forecasts, and strategize ways to mitigate risk and increase loan approval chances. 3. Lender Relationship and Negotiation Consulting Agreement: This agreement centers around building and maintaining effective relationships between companies and lenders. Consultants help companies establish contacts with lenders, understand their requirements, and negotiate loan terms, interest rates, and collateral arrangements. They assist in presenting the company's financial position and business plans in a compelling manner, ultimately enabling successful loan acquisitions. 4. Loan Application Documentation Consulting Agreement: This agreement involves specialized assistance in preparing the necessary documentation required for loan applications. Consultants collaborate with companies to gather all essential financial records, develop persuasive business plans, and compile comprehensive loan application packages. They ensure that the documentation accurately represents the company's strengths and potential, increasing the likelihood of loan approval. 5. Compliance and Regulation Consulting Agreement: This consulting agreement focuses on ensuring businesses adhere to all relevant legal and regulatory requirements during the loan procurement process. Consultants provide guidance on compliance matters, review loan contracts, and advise companies on potential risks and liabilities associated with various loan options. Their expertise ensures that businesses operate within the bounds of the law, safeguarding their interests. In conclusion, the Fulton Georgia Consulting Agreement — Assist Company Obtain Loan is a comprehensive and specialized arrangement that supports businesses in their quest for financial support. By utilizing the relevant consulting services, companies can enhance their loan procurement process, optimize their financial strategies, and increase their chances of obtaining the necessary funds for growth and expansion.

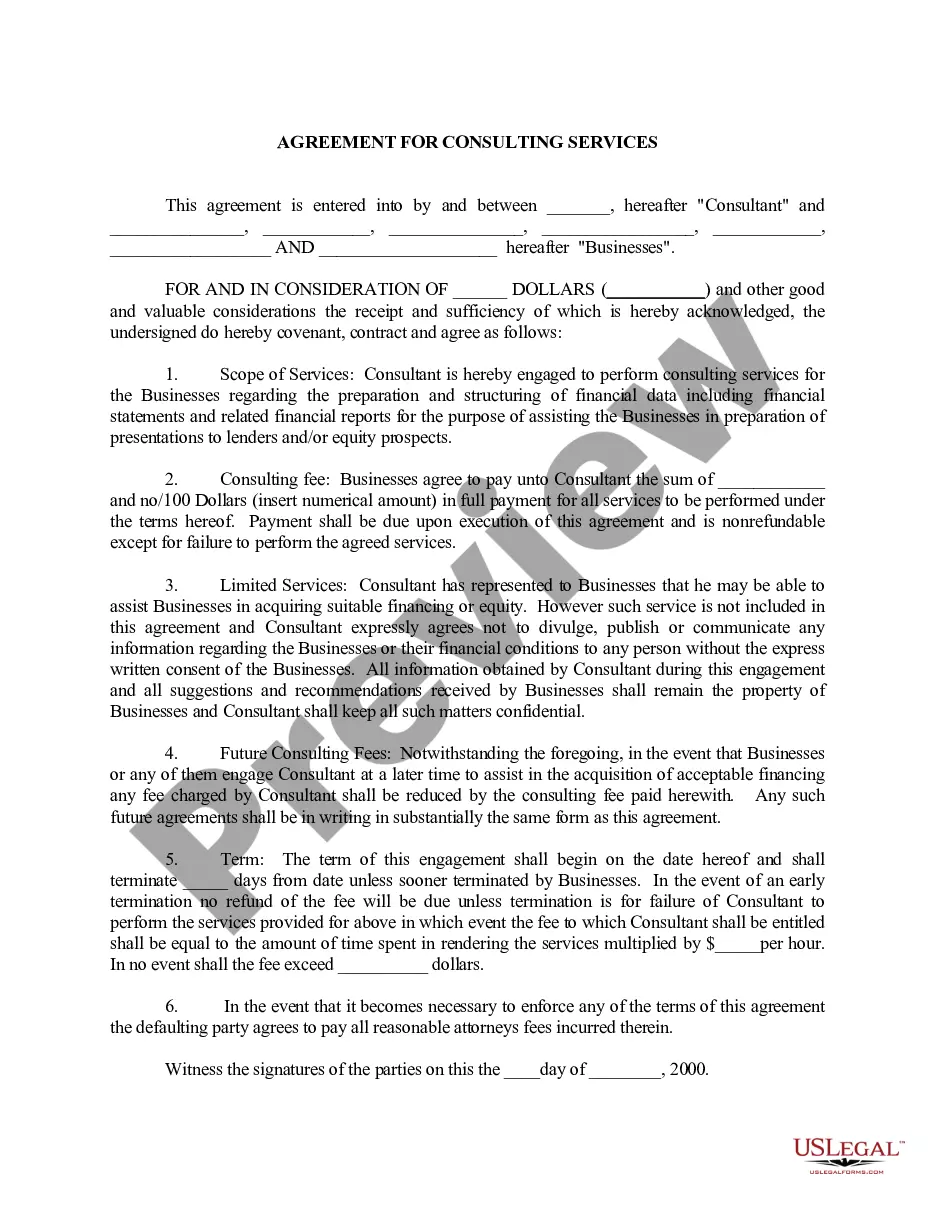

Fulton Georgia Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Fulton Georgia Consulting Agreement - Assist Company Obtain Loan?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Fulton Consulting Agreement - Assist Company Obtain Loan.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Fulton Consulting Agreement - Assist Company Obtain Loan will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Fulton Consulting Agreement - Assist Company Obtain Loan:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Fulton Consulting Agreement - Assist Company Obtain Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!